Lanvin Results Presentation Deck

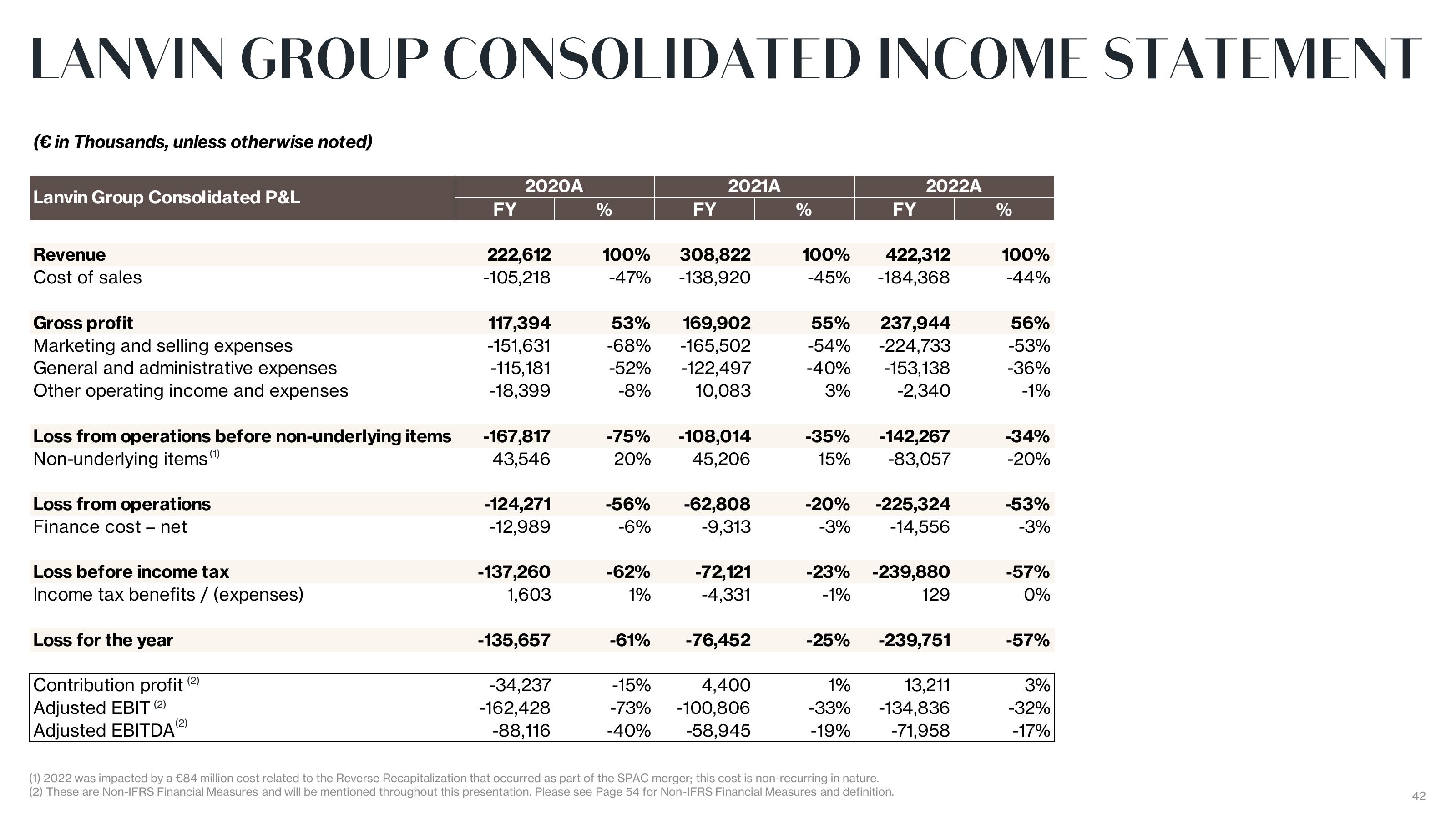

LANVIN GROUP CONSOLIDATED INCOME STATEMENT

(€ in Thousands, unless otherwise noted)

Lanvin Group Consolidated P&L

Revenue

Cost of sales

Gross profit

Marketing and selling expenses

General and administrative expenses

Other operating income and expenses

Loss from operations before non-underlying items

Non-underlying items (¹)

Loss from operations

Finance cost - net

Loss before income tax

Income tax benefits/(expenses)

Loss for the year

Contribution profit (2)

Adjusted EBIT (2)

Adjusted EBITDA

FY

2020A

222,612

-105,218

117,394

-151,631

-115,181

-18,399

-167,817

43,546

-124,271

-12,989

-137,260

1,603

-135,657

-34,237

-162,428

-88,116

%

100%

-47%

-75%

20%

-56%

-6%

53% 169,902

-68% -165,502

-52% -122,497

-8% 10,083

-62%

1%

FY

-61%

2021A

308,822

-138,920

-108,014

45,206

-62,808

-9,313

-72,121

-4,331

-76,452

-15%

4,400

-73% -100,806

-58,945

-40%

%

FY

100% 422,312

-45% -184,368

-35%

15%

55% 237,944

-54% -224,733

-40% -153,138

3% -2,340

2022A

-25%

-142,267

-83,057

-20% -225,324

-3% -14,556

-23% -239,880

-1%

129

-239,751

13,211

1%

-33% -134,836

-19%

-71,958

(1) 2022 was impacted by a €84 million cost related to the Reverse Recapitalization that occurred as part of the SPAC merger; this cost is non-recurring in nature.

(2) These are Non-IFRS Financial Measures and will be mentioned throughout this presentation. Please see Page 54 for Non-IFRS Financial Measures and definition.

%

100%

-44%

56%

-53%

-36%

-1%

-34%

-20%

-53%

-3%

-57%

0%

-57%

3%

-32%

-17%

42View entire presentation