WeWork SPAC Presentation Deck

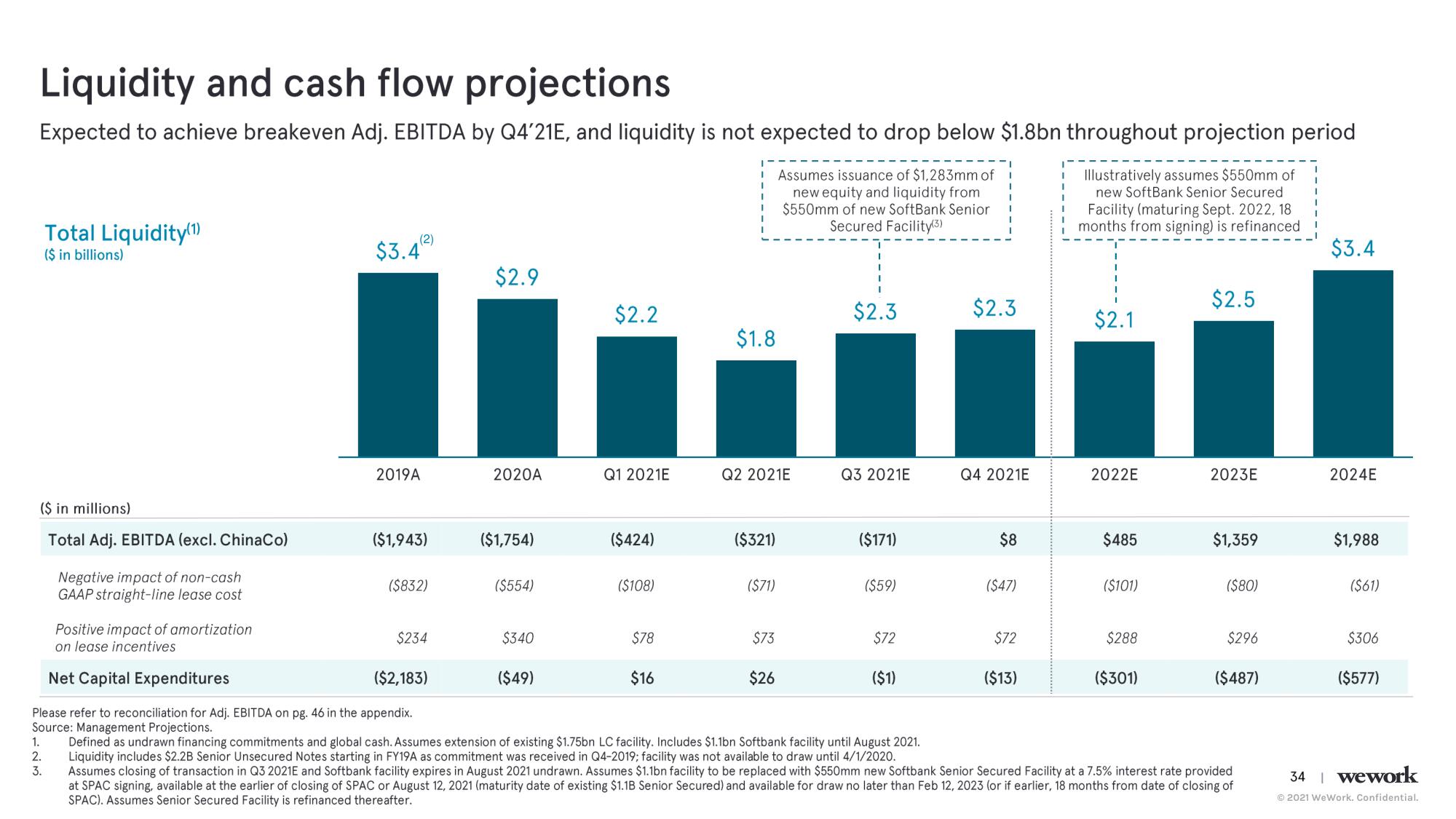

Liquidity and cash flow projections

Expected to achieve breakeven Adj. EBITDA by Q4′21E, and liquidity is not expected to drop below $1.8bn throughout projection period

Total Liquidity (1)

($ in billions)

($ in millions)

Total Adj. EBITDA (excl. ChinaCo)

1.

2.

3.

Negative impact of non-cash

GAAP straight-line lease cost

$3.42)

2019A

($1,943)

($832)

$2.9

$234

2020A

($1,754)

($554)

$340

$2.2

($49)

Q1 2021E

($424)

($108)

$78

$1.8

$16

Q2 2021E

($321)

($71)

Assumes issuance of $1,283mm of

new equity and liquidity from

$550mm of new SoftBank Senior

Secured Facility(3)

$73

$26

$2.3

Q3 2021E

($171)

($59)

$72

$2.3

($1)

Q4 2021E

$8

($47)

Positive impact of amortization

on lease incentives

Net Capital Expenditures

($2,183)

Please refer to reconciliation for Adj. EBITDA on pg. 46 in the appendix.

Source: Management Projections.

Defined as undrawn financing commitments and global cash. Assumes extension of existing $1.75bn LC facility. Includes $1.1bn Softbank facility until August 2021.

Liquidity includes $2.2B Senior Unsecured Notes starting in FY19A as commitment was received in Q4-2019; facility was not available to draw until 4/1/2020.

Assumes closing of transaction in Q3 2021E and Softbank facility expires in August 2021 undrawn. Assumes $1.1bn facility to be replaced with $550mm new Softbank Senior Secured Facility at a 7.5% interest rate provided

at SPAC signing, available at the earlier of closing of SPAC or August 12, 2021 (maturity date of existing $1.1B Senior Secured) and available for draw no later than Feb 12, 2023 (or if earlier, 18 months from date of closing of

SPAC). Assumes Senior Secured Facility is refinanced thereafter.

$72

Illustratively assumes $550mm of

new SoftBank Senior Secured

Facility (maturing Sept. 2022, 18

months from signing) is refinanced

($13)

$2.1

2022E

$485

($101)

$288

$2.5

($301)

2023E

$1,359

($80)

$296

($487)

$3.4

2024E

$1,988

($61)

$306

($577)

34 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation