Netstreit IPO Presentation Deck

Market Opportunity: Why Now?

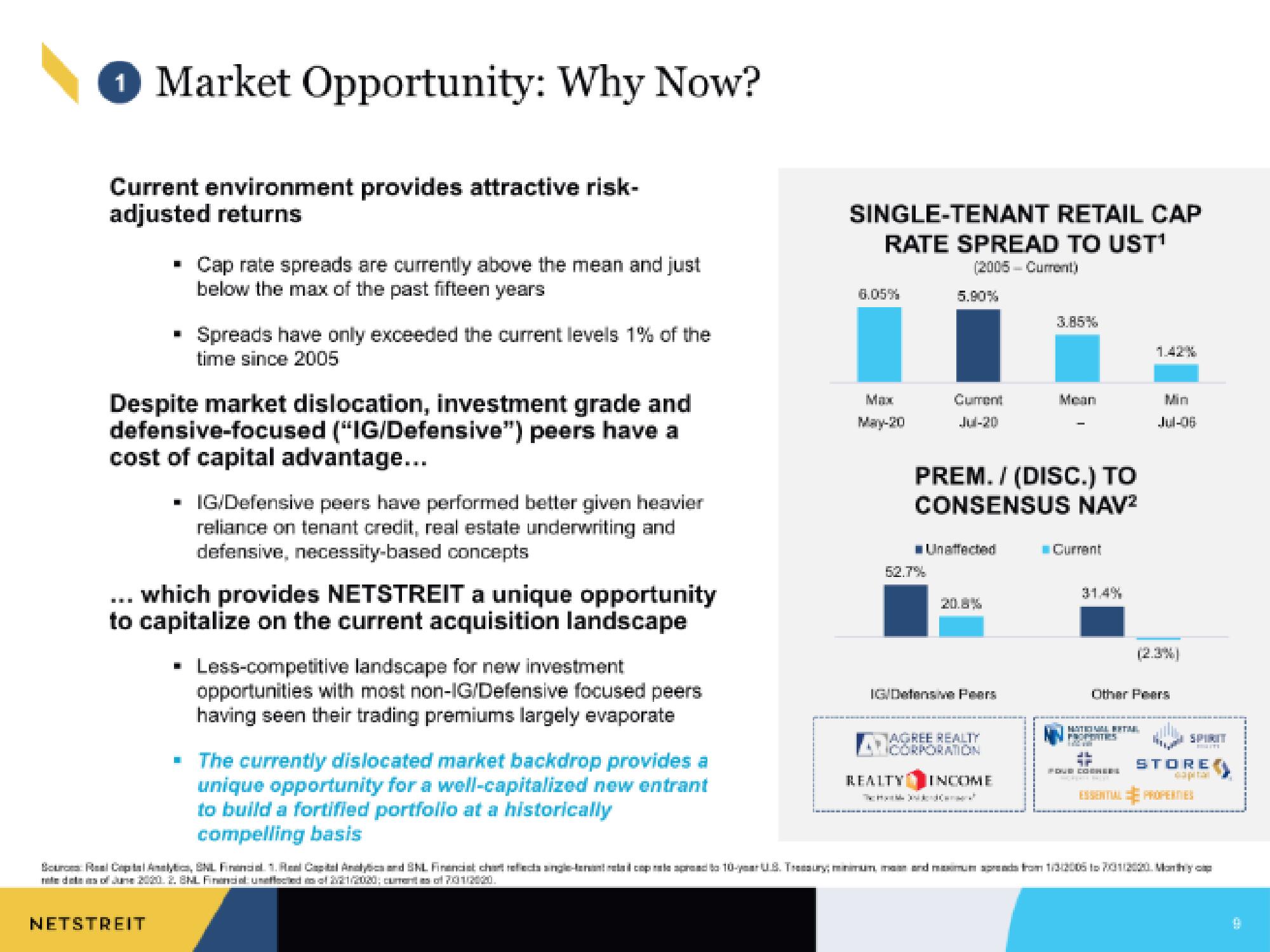

Current environment provides attractive risk-

adjusted returns

Cap rate spreads are currently above the mean and just

below the max of the past fifteen years

Spreads have only exceeded the current levels 1% of the

time since 2005

Despite market dislocation, investment grade and

defensive-focused ("IG/Defensive") peers have a

cost of capital advantage...

NETSTREIT

▪ IG/Defensive peers have performed better given heavier

reliance on tenant credit, real estate underwriting and

defensive, necessity-based concepts

.….

which provides NETSTREIT a unique opportunity

to capitalize on the current acquisition landscape

▪ Less-competitive landscape for new investment

opportunities with most non-IG/Defensive focused peers

having seen their trading premiums largely evaporate

▪ The currently dislocated market backdrop provides a

unique opportunity for a well-capitalized new entrant

to build a fortified portfolio at a historically

compelling basis

SINGLE-TENANT RETAIL CAP

RATE SPREAD TO UST¹

(2005- Current)

6.05%

Max

5.90%

52.7%

Cument

Jul-20

PREM. / (DISC.) TO

CONSENSUS NAV²

Unaffected

20.8%

IG/Defensive Peers

AGREE REALTY

CORPORATION

3.85%

REALTY INCOME

Mean

Current

31.4%

T

HATINAL ENTAIL

PROPERTIES

1.42%

Other Pears

JL

SP

FOUR COEREEL

Min

Jul-06

SPIRIT

STORE

ESSENTIAL PROPERTIES

Sources Real Copy, SNL Financ. 1. Real Capital Andly and SNL Finendist chean refeca single-te copprend to 10-year U.S. Tressury; minimun, main and makmum sprends from 1/3/2006 to 70112000 Monthy

des of June 2020. 2. BNL Firende unaffected in of 22:112020; current es of 70157420.View entire presentation