Liberty Global Results Presentation Deck

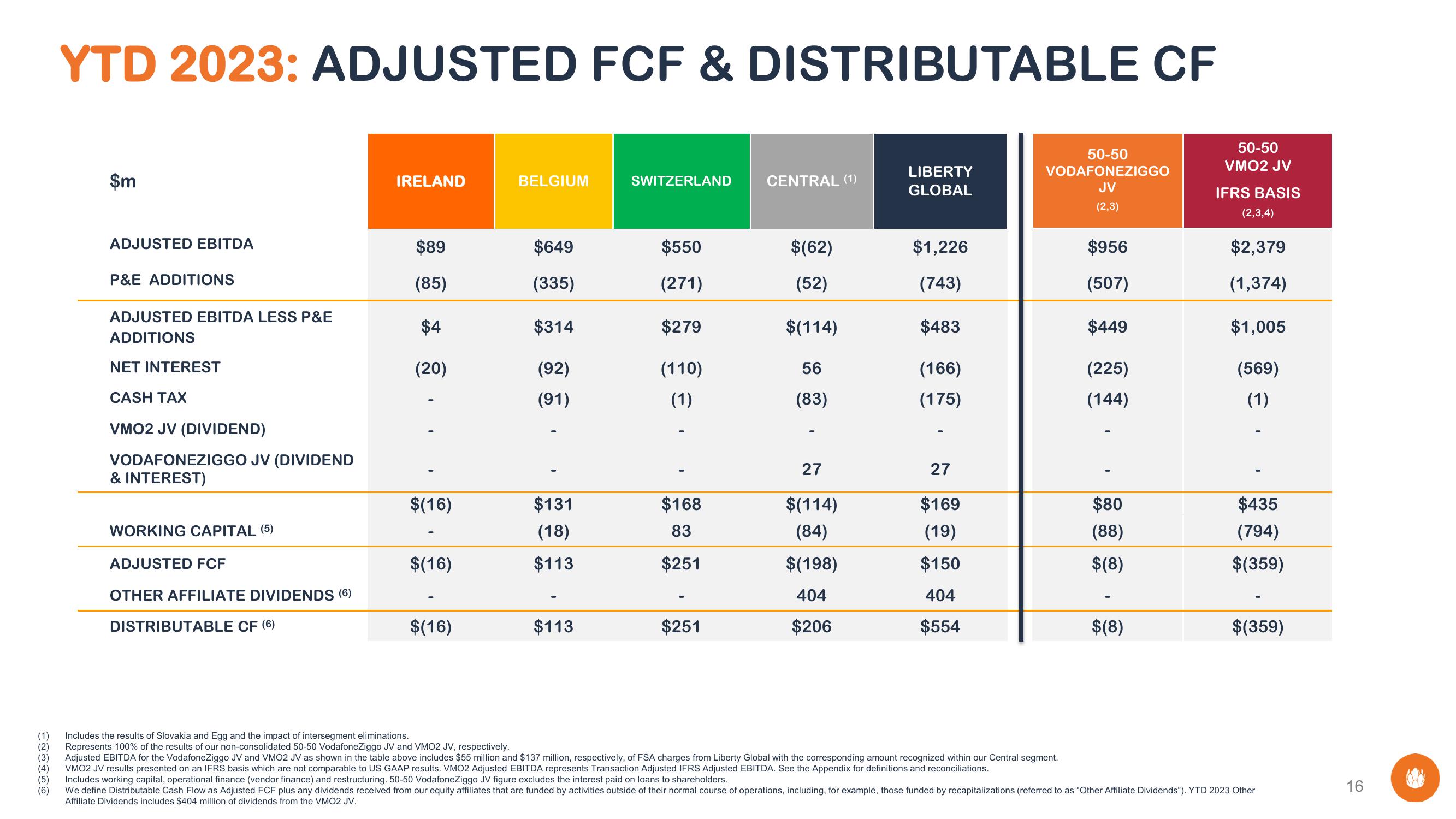

YTD 2023: ADJUSTED FCF & DISTRIBUTABLE CF

$m

ADJUSTED EBITDA

P&E ADDITIONS

ADJUSTED EBITDA LESS P&E

ADDITIONS

NET INTEREST

CASH TAX

VMO2 JV (DIVIDEND)

VODAFONEZIGGO JV (DIVIDEND

& INTEREST)

WORKING CAPITAL (5)

ADJUSTED FCF

OTHER AFFILIATE DIVIDENDS (6)

DISTRIBUTABLE CF (6)

IRELAND

$89

(85)

$4

(20)

$(16)

$(16)

$(16)

BELGIUM

$649

(335)

$314

(92)

(91)

$131

(18)

$113

$113

SWITZERLAND

$550

(271)

$279

(110)

(1)

$168

83

$251

$251

CENTRAL (1)

$(62)

(52)

$(114)

56

(83)

27

$(114)

(84)

$(198)

404

$206

LIBERTY

GLOBAL

$1,226

(743)

$483

(166)

(175)

27

$169

(19)

$150

404

$554

50-50

VODAFONEZIGGO

JV

(2,3)

$956

(507)

$449

(225)

(144)

$80

(88)

$(8)

$(8)

50-50

VMO2 JV

IFRS BASIS

(2,3,4)

$2,379

(1,374)

$1,005

(569)

(1)

$435

(794)

$(359)

$(359)

Includes the results of Slovakia and Egg and the impact of intersegment eliminations.

(2)

Represents 100% of the results of our non-consolidated 50-50 VodafoneZiggo JV and VMO2 JV, respectively.

(3)

Adjusted EBITDA for the VodafoneZiggo JV and VMO2 JV as shown in the table above includes $55 million and $137 million, respectively, of FSA charges from Liberty Global with the corresponding amount recognized within our Central segment.

(4) VMO2 JV results presented on an IFRS basis which are not comparable to US GAAP results. VMO2 Adjusted EBITDA represents Transaction Adjusted IFRS Adjusted EBITDA. See the Appendix for definitions and reconciliations.

Includes working capital, operational finance (vendor finance) and restructuring. 50-50 VodafoneZiggo JV figure excludes the interest paid on loans to shareholders.

(6)

We define Distributable Cash Flow as Adjusted FCF plus any dividends received from our equity affiliates that are funded by activities outside of their normal course of operations, including, for example, those funded by recapitalizations (referred to as "Other Affiliate Dividends"). YTD 2023 Other

Affiliate Dividends includes $404 million of dividends from the VMO2 JV.

16

(View entire presentation