Silicon Valley Bank Results Presentation Deck

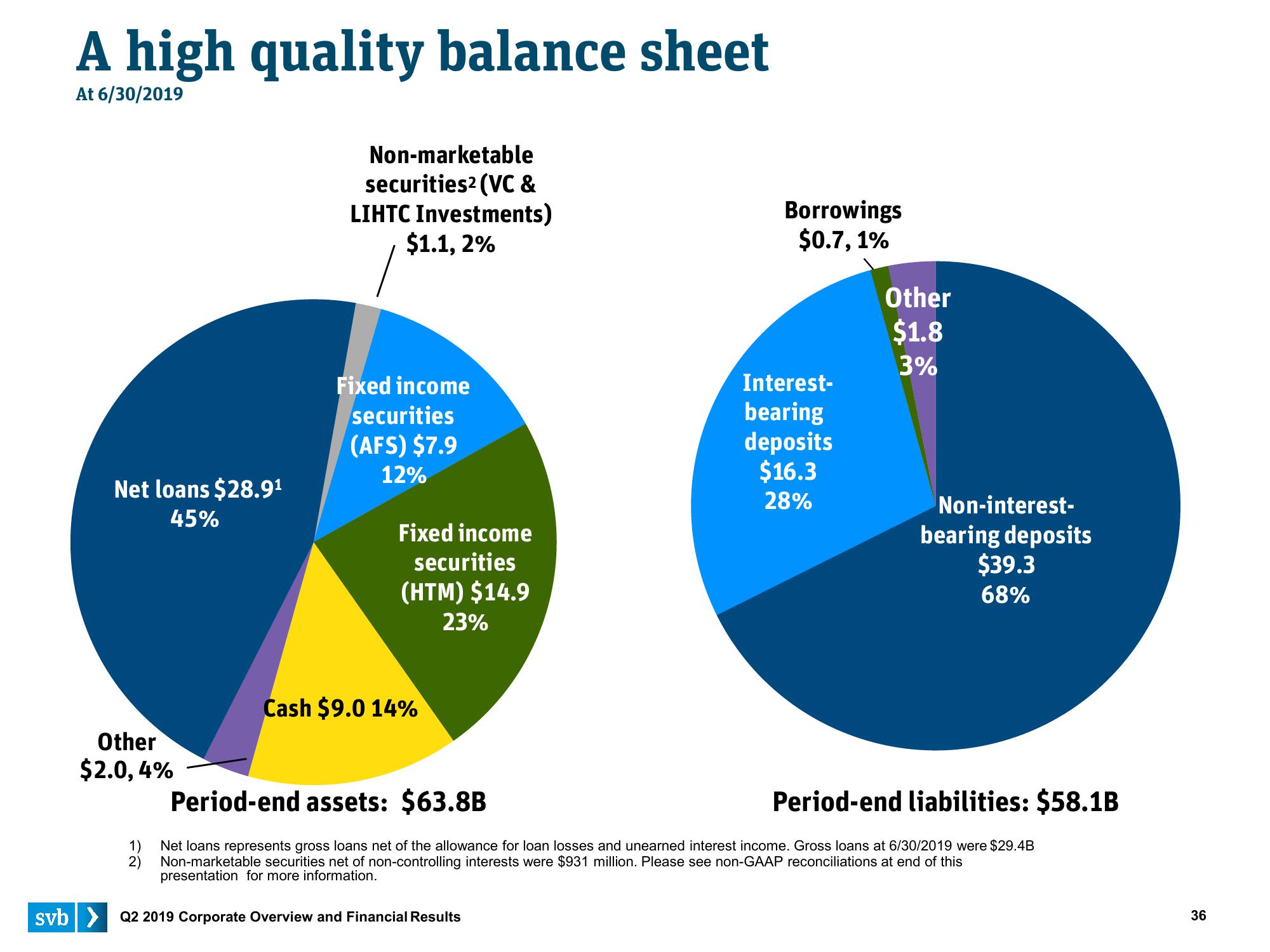

A high quality balance sheet

At 6/30/2019

Net loans $28.9¹

45%

Other

$2.0, 4%

1)

2)

Non-marketable

securities² (VC &

LIHTC Investments)

$1.1, 2%

Fixed income

securities

(AFS) $7.9

12%

Fixed income

securities

(HTM) $14.9

23%

Cash $9.0 14%

Borrowings

$0.7, 1%

svb> Q2 2019 Corporate Overview and Financial Results

Interest-

bearing

deposits

$16.3

28%

Other

$1.8

3%

Non-interest-

bearing deposits

$39.3

68%

Period-end assets: $63.8B

Period-end liabilities: $58.1B

Net loans represents gross loans net of the allowance for loan losses and unearned interest income. Gross loans at 6/30/2019 were $29.4B

Non-marketable securities net of non-controlling interests were $931 million. Please see non-GAAP reconciliations at end of this

presentation for more information.

36View entire presentation