Plastiq SPAC Presentation Deck

●

●

●

●

IQ

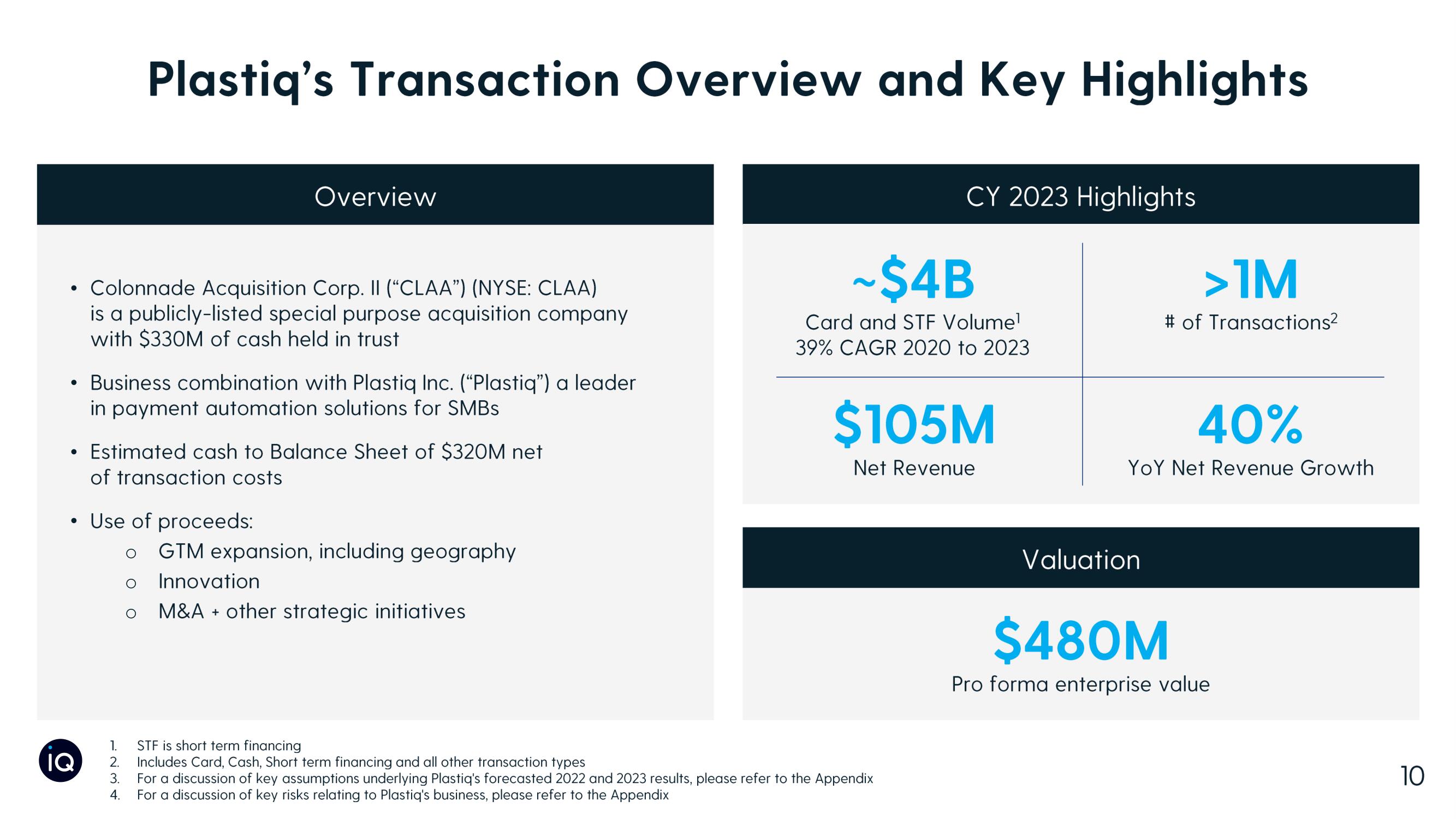

Plastiq's Transaction Overview and Key Highlights

Colonnade Acquisition Corp. II (“CLAA”) (NYSE: CLAA)

is a publicly-listed special purpose acquisition company

with $330M of cash held in trust

Overview

Business combination with Plastiq Inc. ("Plastiq") a leader

in payment automation solutions for SMBs

Estimated cash to Balance Sheet of $320M net

of transaction costs

Use of proceeds:

o GTM expansion, including geography

O

234

3.

Innovation

O M&A + other strategic initiatives

1. STF is short term financing

2. Includes Card, Cash, Short term financing and all other transaction types

For a discussion of key assumptions underlying Plastiq's forecasted 2022 and 2023 results, please refer to the Appendix

4. For a discussion of key risks relating to Plastiq's business, please refer to the Appendix

CY 2023 Highlights

~$4B

Card and STF Volume¹

39% CAGR 2020 to 2023

$105M

Net Revenue

>IM

# of Transactions²

40%

YOY Net Revenue Growth

Valuation

$480M

Pro forma enterprise value

10View entire presentation