LSE Mergers and Acquisitions Presentation Deck

3 Post Trade

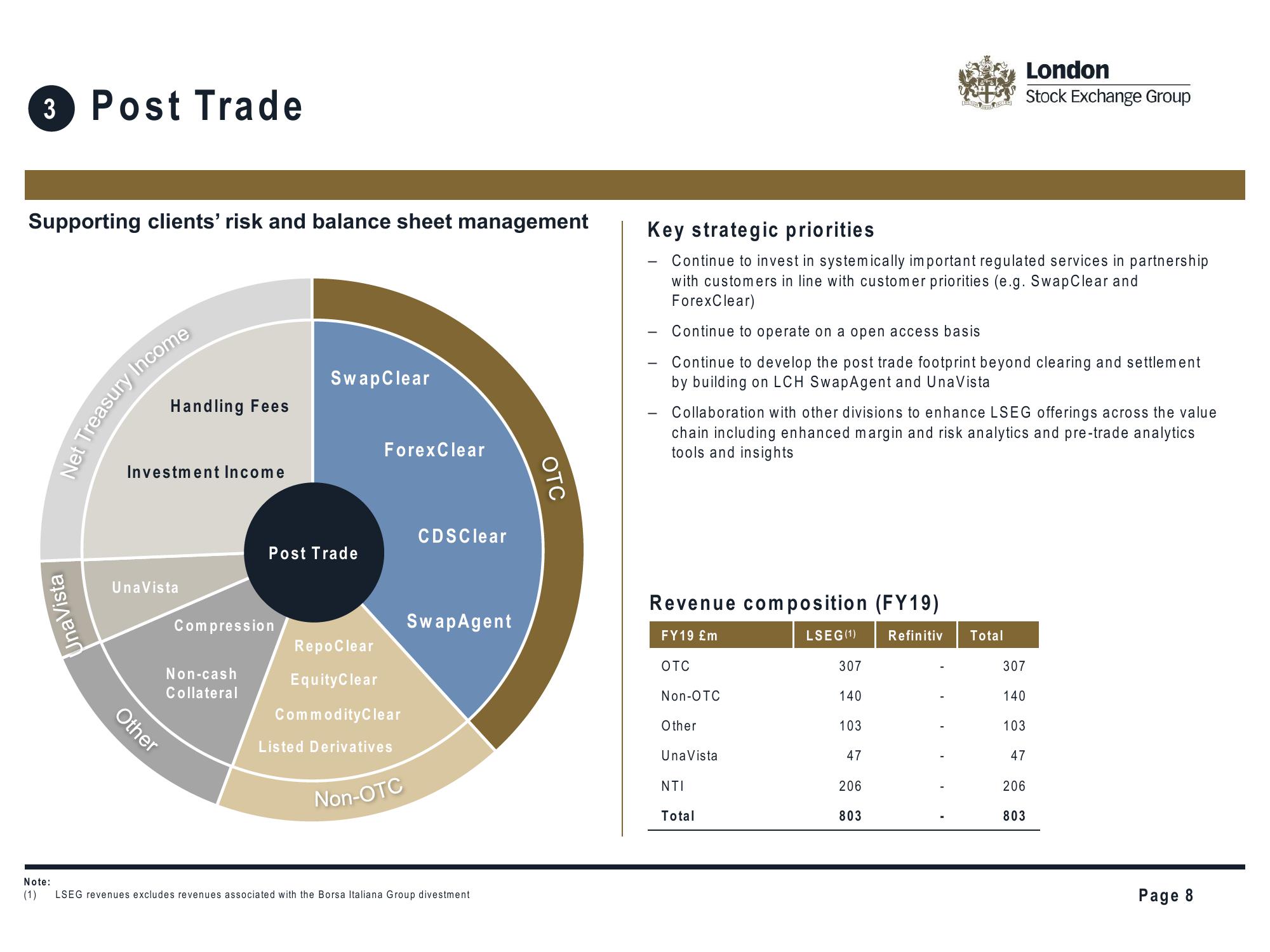

Supporting clients' risk and balance sheet management

UnaVista

Treasury Income

Handling Fees

Investment Income

Other

Una Vista

Compression

Non-cash

Collateral

SwapClear

Post Trade

ForexClear

RepoClear

Equity Clear

Commodity Clear

Listed Derivatives

Non-OTC

CDSClear

SwapAgent

Note:

(1) LSEG revenues excludes revenues associated with the Borsa Italiana Group divestment

OTC

Key strategic priorities

Continue to invest in systemically important regulated services in partnership

with customers in line with customer priorities (e.g. SwapClear and

ForexClear)

Continue to operate on a open access basis

Continue to develop the post trade footprint beyond clearing and settlement

by building on LCH SwapAgent and Una Vista

Collaboration with other divisions to enhance LSEG offerings across the value

chain including enhanced margin and risk analytics and pre-trade analytics

tools and insights

Revenue composition (FY19)

FY19 £m

Refinitiv

OTC

Non-OTC

Other

Una Vista

NTI

Total

LSEG (1)

307

140

103

47

206

803

London

Stock Exchange Group

Total

307

140

103

47

206

803

Page 8View entire presentation