Mondee SPAC

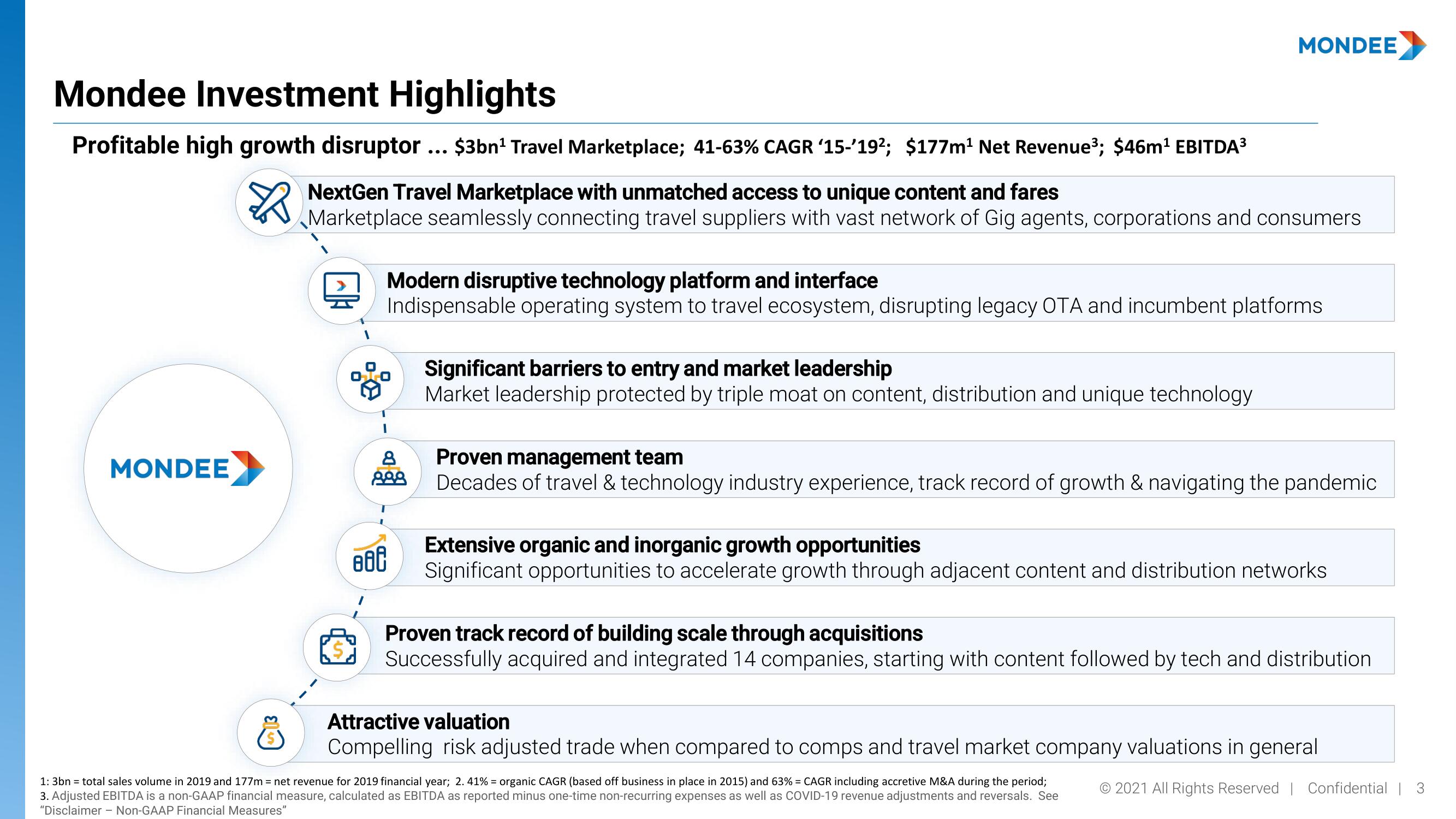

Mondee Investment Highlights

Profitable high growth disruptor ... $3bn¹ Travel Marketplace; 41-63% CAGR '15-'19²; $177m¹ Net Revenue³; $46m¹ EBITDA³

NextGen Travel Marketplace with unmatched access to unique content and fares

Marketplace seamlessly connecting travel suppliers with vast network of Gig agents, corporations and consumers

MONDEE

Modern disruptive technology platform and interface

Indispensable operating system to travel ecosystem, disrupting legacy OTA and incumbent platforms

OTO

8

888

880

MONDEE

Significant barriers to entry and market leadership

Market leadership protected by triple moat on content, distribution and unique technology

Proven management team

Decades of travel & technology industry experience, track record of growth & navigating the pandemic

Extensive organic and inorganic growth opportunities

Significant opportunities to accelerate growth through adjacent content and distribution networks

Proven track record of building scale through acquisitions

Successfully acquired and integrated 14 companies, starting with content followed by tech and distribution

Attractive valuation

Compelling risk adjusted trade when compared to comps and travel market company valuations in general

Ỗ

1:3bn = total sales volume in 2019 and 177m = net revenue for 2019 financial year; 2.41% = organic CAGR (based off business in place in 2015) and 63% = CAGR including accretive M&A during the period;

3. Adjusted EBITDA is a non-GAAP financial measure, calculated as EBITDA as reported minus one-time non-recurring expenses as well as COVID-19 revenue adjustments and reversals. See

"Disclaimer - Non-GAAP Financial Measures"

© 2021 All Rights Reserved | Confidential | 3View entire presentation