Antofagasta Investor Day

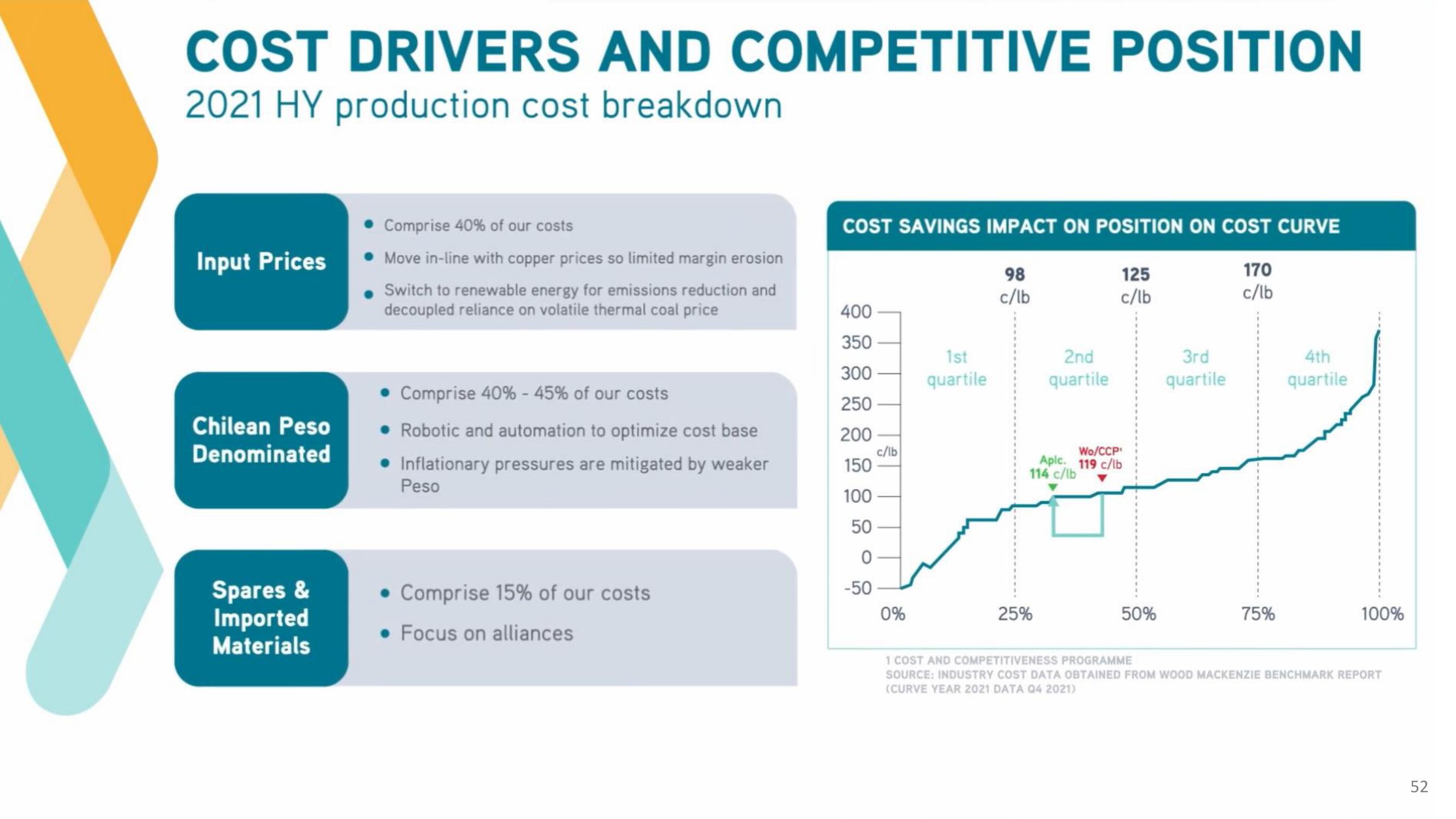

COST DRIVERS AND COMPETITIVE POSITION

2021 HY production cost breakdown

Input Prices

Chilean Peso

Denominated

Spares &

Imported

Materials

Comprise 40% of our costs

Move in-line with copper prices so limited margin erosion

Switch to renewable energy for emissions reduction and

decoupled reliance on volatile thermal coal price

Comprise 40% -45% of our costs

• Robotic and automation to optimize cost base

• Inflationary pressures are mitigated by weaker

Peso

• Comprise 15% of our costs

• Focus on alliances

COST SAVINGS IMPACT ON POSITION ON COST CURVE

400

350

300

250

200

150

100

50

0

-50

c/lb

0%

1st

quartile

98

c/lb

2nd

quartile

25%

125

c/lb

Wo/CCP¹

Apic. 119 c/lb

114 c/lb

50%

3rd

quartile

170

c/lb

75%

4th

quartile

100%

1 COST AND COMPETITIVENESS PROGRAMME

SOURCE: INDUSTRY COST DATA OBTAINED FROM WOOD MACKENZIE BENCHMARK REPORT

(CURVE YEAR 2021 DATA Q4 2021)

52View entire presentation