Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

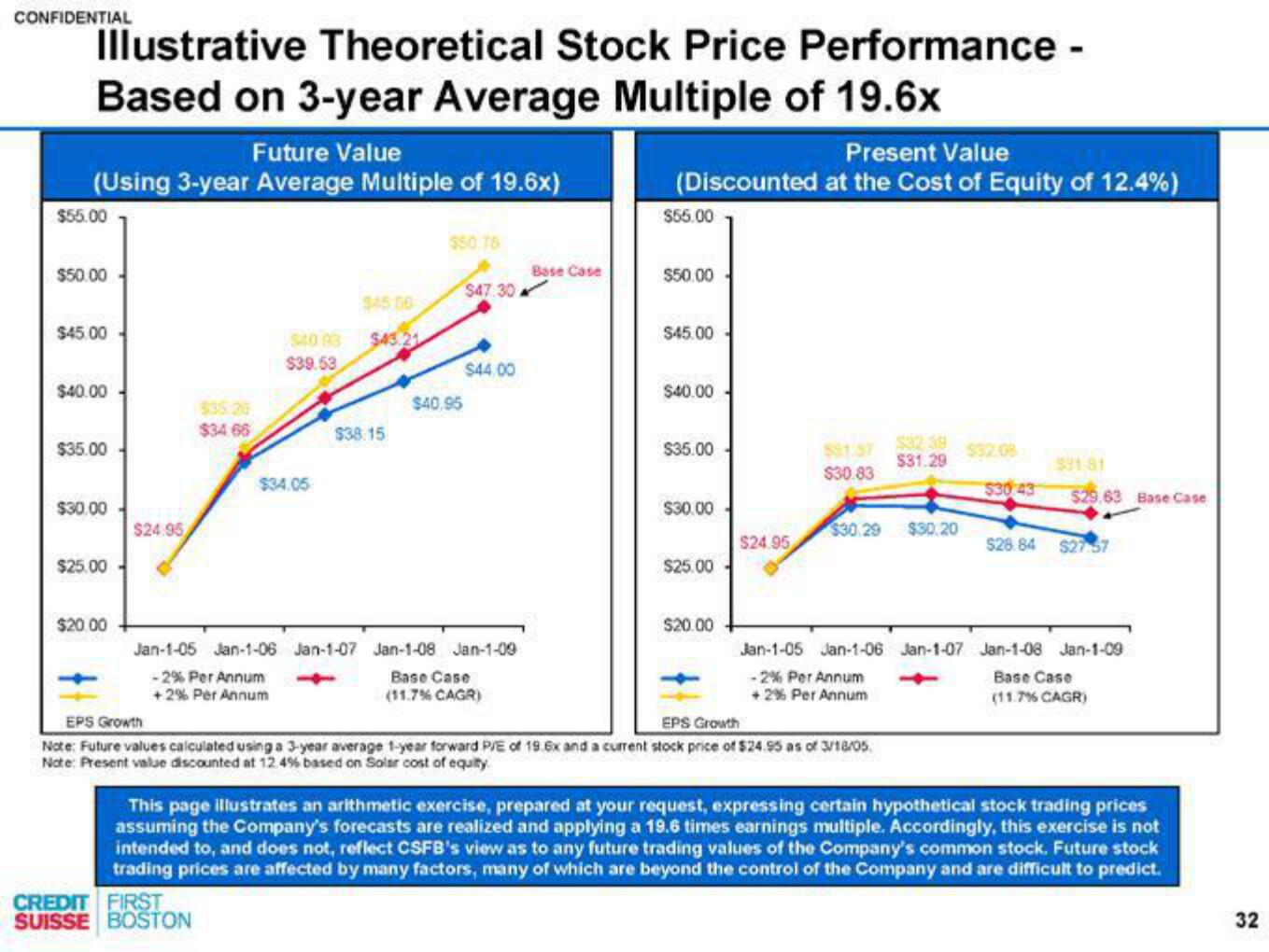

Illustrative Theoretical Stock Price Performance -

Based on 3-year Average Multiple of 19.6x

Future Value

Present Value

(Using 3-year Average Multiple of 19.6x)

(Discounted at the Cost of Equity of 12.4%)

$55.00

$50.00

$45.00

$40.00

$35.00

$30.00

$25.00

$20.00

$24.95

$35.26

$34.66

$40 93

$39.53

$34.05

$45.50

$43.21

$38.15

$50,78

$40.95

$47.30

$44.00

Jan-1-05 Jan-1-06 Jan-1-07 Jan-1-08 Jan-1-09

-2% Per Annum

Base Case

(11.7% CAGR)

+2% Per Annum

Base Case

$55.00

$50,00

$45.00

$40.00

$35.00

$30.00

$25.00

$20.00

$24.95

$91.37

$30.83

$32 39

$31.29

$30.29 $30.20

EPS Growth

EPS Growth

Note: Future values calculated using a 3-year average 1-year forward P/E of 19.6x and a current stock price of $24.95 as of 3/18/05.

Note: Present value discounted at 12.4% based on Solar cost of equity.

$32.08

$30 43

391 81

$29.63 Base Case

$28.84 $27.57

Jan-1-05 Jan-1-06 Jan-1-07 Jan-1-08 Jan-1-09

-2% Per Annum

+2% Per Annum

Base Case

(11.7% CAGR)

This page illustrates an arithmetic exercise, prepared at your request, expressing certain hypothetical stock trading prices

assuming the Company's forecasts are realized and applying a 19.6 times earnings multiple. Accordingly, this exercise is not

intended to, and does not, reflect CSFB's view as to any future trading values of the Company's common stock. Future stock

trading prices are affected by many factors, many of which are beyond the control of the Company and are difficult to predict.

CREDIT FIRST

SUISSE BOSTON

32View entire presentation