NewFortress Energy 2Q23 Results

(in thousands of $)

Appendix

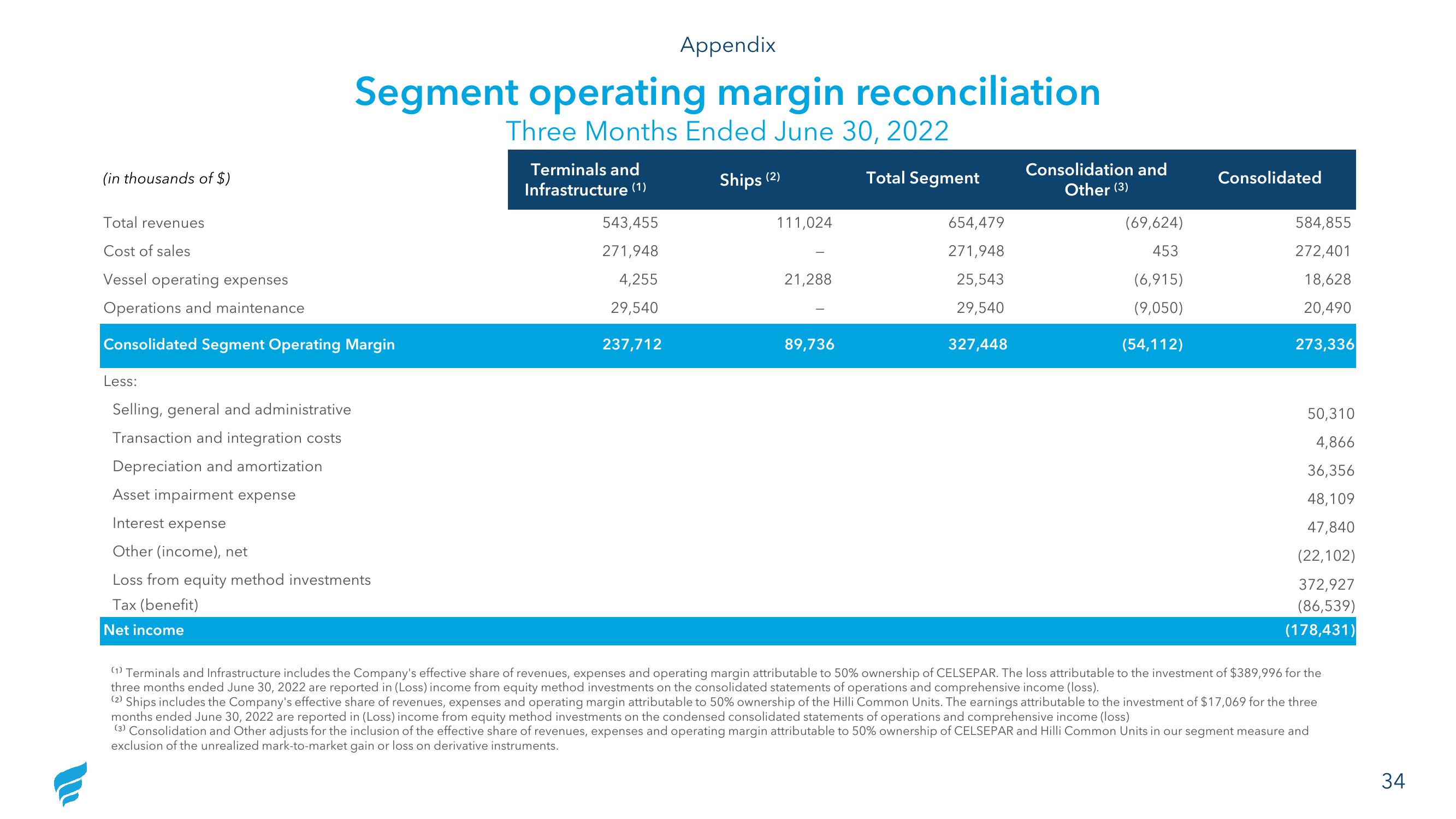

Segment operating margin reconciliation

Three Months Ended June 30, 2022

Total revenues

Cost of sales

Vessel operating expenses

Operations and maintenance

Consolidated Segment Operating Margin

Less:

Selling, general and administrative

Transaction and integration costs

Depreciation and amortization

Asset impairment expense

Interest expense

Other (income), net

Loss from equity method investments

Tax (benefit)

Net income

Terminals and

Infrastructure (1)

543,455

271,948

4,255

29,540

237,712

Ships

(2)

111,024

21,288

89,736

Total Segment

654,479

271,948

25,543

29,540

327,448

Consolidation and

Other (3)

(69,624)

453

(6,915)

(9,050)

(54,112)

Consolidated

584,855

272,401

18,628

20,490

273,336

50,310

4,866

36,356

48,109

47,840

(22,102)

372,927

(86,539)

(178,431)

(1) Terminals and Infrastructure includes the Company's effective share of revenues, expenses and operating margin attributable to 50% ownership of CELSEPAR. The loss attributable to the investment of $389,996 for the

three months ended June 30, 2022 are reported in (Loss) income from equity method investments on the consolidated statements of operations and comprehensive income (loss).

(2) Ships includes the Company's effective share of revenues, expenses and operating margin attributable to 50% ownership of the Hilli Common Units. The earnings attributable to the investment of $17,069 for the three

months ended June 30, 2022 are reported in (Loss) income from equity method investments on the condensed consolidated statements of operations and comprehensive income (loss)

(3) Consolidation and Other adjusts for the inclusion of the effective share of revenues, expenses and operating margin attributable to 50% ownership of CELSEPAR and Hilli Common Units in our segment measure and

exclusion of the unrealized mark-to-market gain or loss on derivative instruments.

34View entire presentation