Hanmi Financial Results Presentation Deck

Securities Portfolio

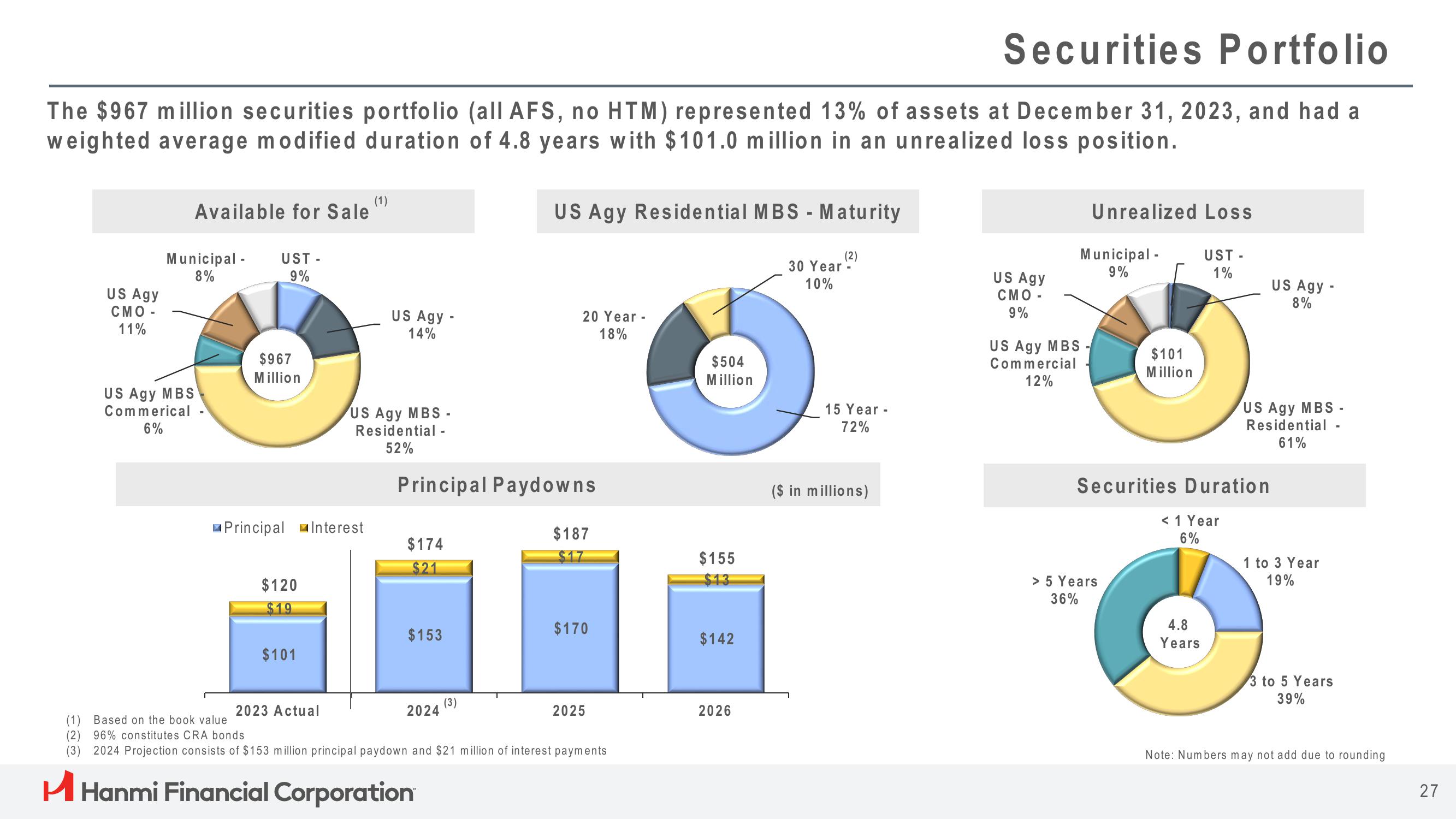

The $967 million securities portfolio (all AFS, no HTM) represented 13% of assets at December 31, 2023, and had a

weighted average modified duration of 4.8 years with $101.0 million in an unrealized loss position.

US Agy

CMO -

11%

Available for Sale

Municipal -

8%

US Agy MBS

Commerical

6%

UST -

9%

$967

Million

Principal Interest

$120

$19

$101

2023 Actual

(1)

US Agy -

14%

US Agy MBS -

Residential -

52%

$174

$21

Principal Paydowns

$153

2024

US Agy Residential MBS - Maturity

(3)

20 Year -

18%

$187

$170

2025

(1) Based on the book value

(2) 96% constitutes CRA bonds

(3) 2024 Projection consists of $153 million principal paydown and $21 million of interest payments

H Hanmi Financial Corporation

$504

Million

$155

$13

$142

2026

(2)

30 Year -

10%

15 Year -

72%

($ in millions)

US Agy

CMO -

9%

US Agy MBS

Commercial

12%

Unrealized Loss

Municipal -

9%

UST-

1%

$101

Million

> 5 Years

36%

Securities Duration

< 1 Year

6%

4.8

Years

US Agy -

8%

US Agy MBS -

Residential

61%

1 to 3 Year

19%

3 to 5 Years

39%

Note: Numbers may not add due to rounding

27View entire presentation