Maersk Investor Presentation Deck

Key statements

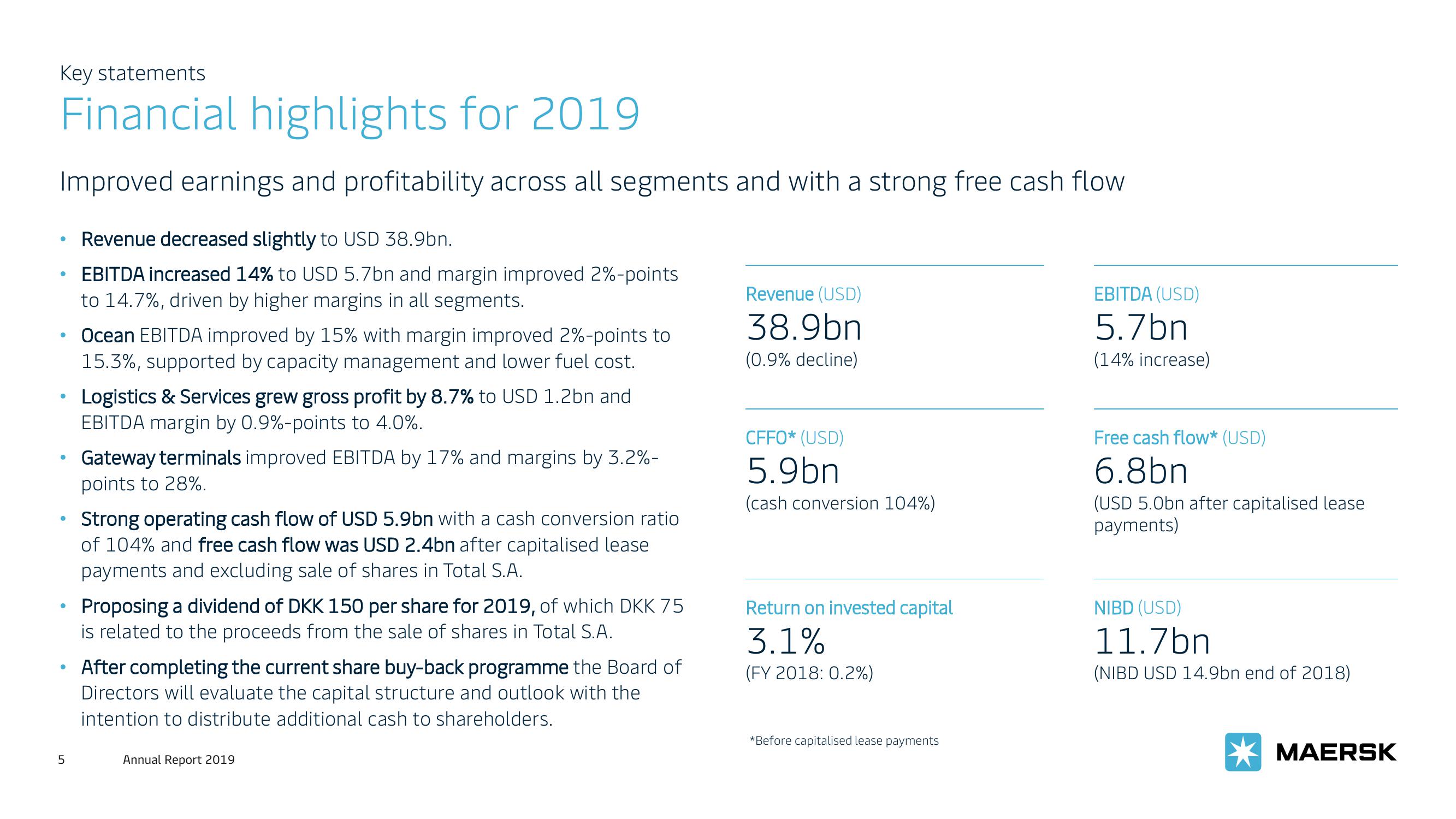

Financial highlights for 2019

Improved earnings and profitability across all segments and with a strong free cash flow

Revenue decreased slightly to USD 38.9bn.

EBITDA increased 14% to USD 5.7bn and margin improved 2%-points

to 14.7%, driven by higher margins in all segments.

●

●

●

●

●

●

Ocean EBITDA improved by 15% with margin improved 2%-points to

15.3%, supported by capacity management and lower fuel cost.

5

Logistics & Services grew gross profit by 8.7% to USD 1.2bn and

EBITDA margin by 0.9%-points to 4.0%.

Gateway terminals improved EBITDA by 17% and margins by 3.2%-

points to 28%.

Strong operating cash flow of USD 5.9bn with a cash conversion ratio

of 104% and free cash flow was USD 2.4bn after capitalised lease

payments and excluding sale of shares in Total S.A.

Proposing a dividend of DKK 150 per share for 2019, of which DKK 75

is related to the proceeds from the sale of shares in Total S.A.

• After completing the current share buy-back programme the Board of

Directors will evaluate the capital structure and outlook with the

intention to distribute additional cash to shareholders.

Annual Report 2019

Revenue (USD)

38.9bn

(0.9% decline)

CFFO* (USD)

5.9bn

(cash conversion 104%)

Return on invested capital

3.1%

(FY 2018: 0.2%)

*Before capitalised lease payments

EBITDA (USD)

5.7bn

(14% increase)

Free cash flow* (USD)

6.8bn

(USD 5.0bn after capitalised lease

payments)

NIBD (USD)

11.7bn

(NIBD USD 14.9bn end of 2018)

MAERSKView entire presentation