Dave Investor Presentation Deck

Improving delinquency

performance

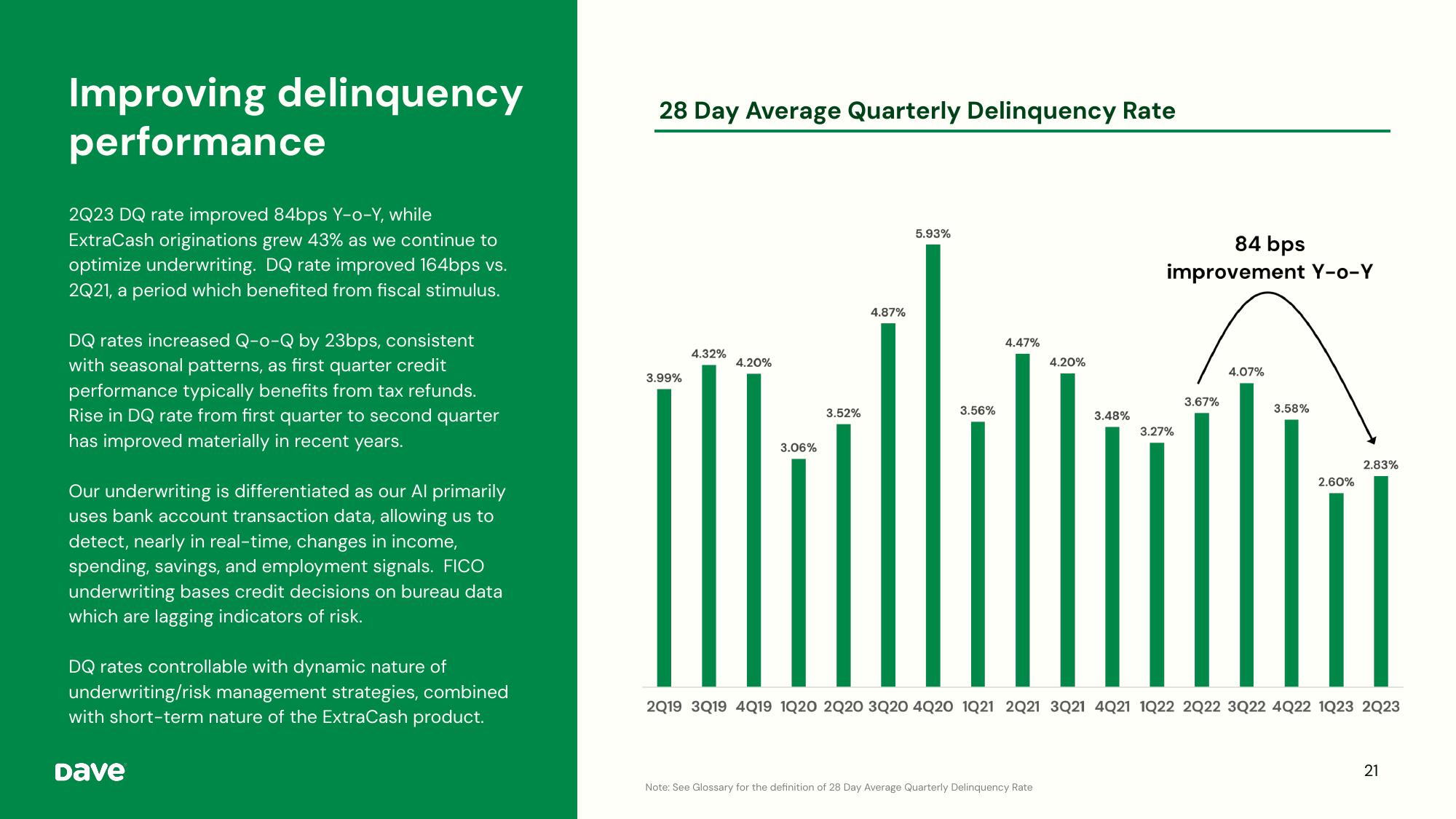

2Q23 DQ rate improved 84bps Y-o-Y, while

ExtraCash originations grew 43% as we continue to

optimize underwriting. DQ rate improved 164bps vs.

2Q21, a period which benefited from fiscal stimulus.

DQ rates increased Q-o-Q by 23bps, consistent

with seasonal patterns, as first quarter credit

performance typically benefits from tax refunds.

Rise in DQ rate from first quarter to second quarter

has improved materially in recent years.

Our underwriting is differentiated as our Al primarily

uses bank account transaction data, allowing us to

detect, nearly in real-time, changes in income,

spending, savings, and employment signals. FICO

underwriting bases credit decisions on bureau data

which are lagging indicators of risk.

DQ rates controllable with dynamic nature of

underwriting/risk management strategies, combined

with short-term nature of the ExtraCash product.

Dave

28 Day Average Quarterly Delinquency Rate

3.99%

4.32%

4.20%

3.06%

3.52%

4.87%

5.93%

3.56%

4.47%

4.20%

Note: See Glossary for the definition of 28 Day Average Quarterly Delinquency Rate

3.48%

84 bps

improvement Y-o-Y

3.27%

3.67%

4.07%

3.58%

2.60%

2.83%

|||||||

11

2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23

21View entire presentation