Affirm Results Presentation Deck

Interest Income and Loans Held for Investment Composition

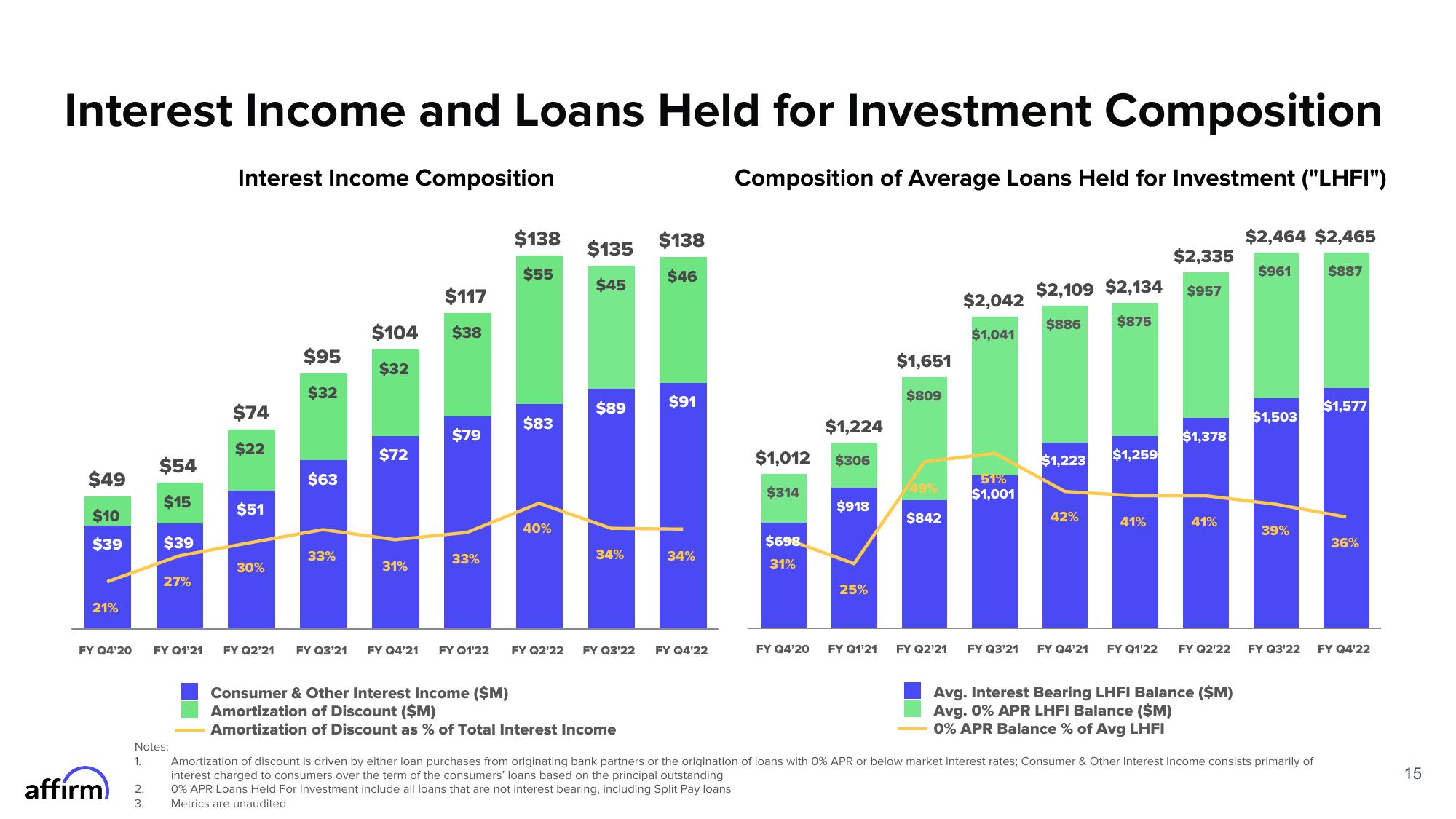

Interest Income Composition

Composition of Average Loans Held for Investment ("LHFI")

$2,464 $2,465

$961

$887

$49

$10

$39

21%

FY Q4'20

affirm

$54

$15

2.

3.

$39

27%

FY Q1'21

Notes:

1.

$74

$22

$51

30%

$95

$32

$63

33%

$117

$104 $38

$32

$72

31%

$79

33%

$138

$55

$83

40%

$135

$45

$89

34%

$138

$46

Consumer & Other Interest Income ($M)

Amortization of Discount ($M)

Amortization of Discount as % of Total Interest Income

$91

34%

FY Q2'21 FY Q3'21 FY Q4'21 FY Q1'22 FY Q2'22 FY Q3'22 FY Q4'22

$1,012

$314

$698

31%

FY Q4'20

$1,224

$306

$918

25%

FY Q1'21

$1,651

$809

49%

$842

FY Q2'21

$2,042

$1,041

51%

$1,001

FY Q3'21

$2,109 $2,134

$886 $875

$1,223

42%

$1,259

41%

$2,335

$957

$1,378

41%

FY Q4'21 FY Q1'22 FY Q2'22

Avg. Interest Bearing LHFI Balance ($M)

Avg. 0% APR LHFI Balance ($M)

0% APR Balance % of Avg LHFI

$1,503

39%

FY Q3'22

Amortization of discount is driven by either loan purchases from originating bank partners or the origination of loans with 0% APR or below market interest rates; Consumer & Other Interest Income consists primarily of

interest charged to consumers over the term of the consumers' loans based on the principal outstanding

0% APR Loans Held For Investment include all loans that are not interest bearing, including Split Pay loans

Metrics are unaudited

$1,577

36%

FY Q4'22

15View entire presentation