Evercore Investment Banking Pitch Book

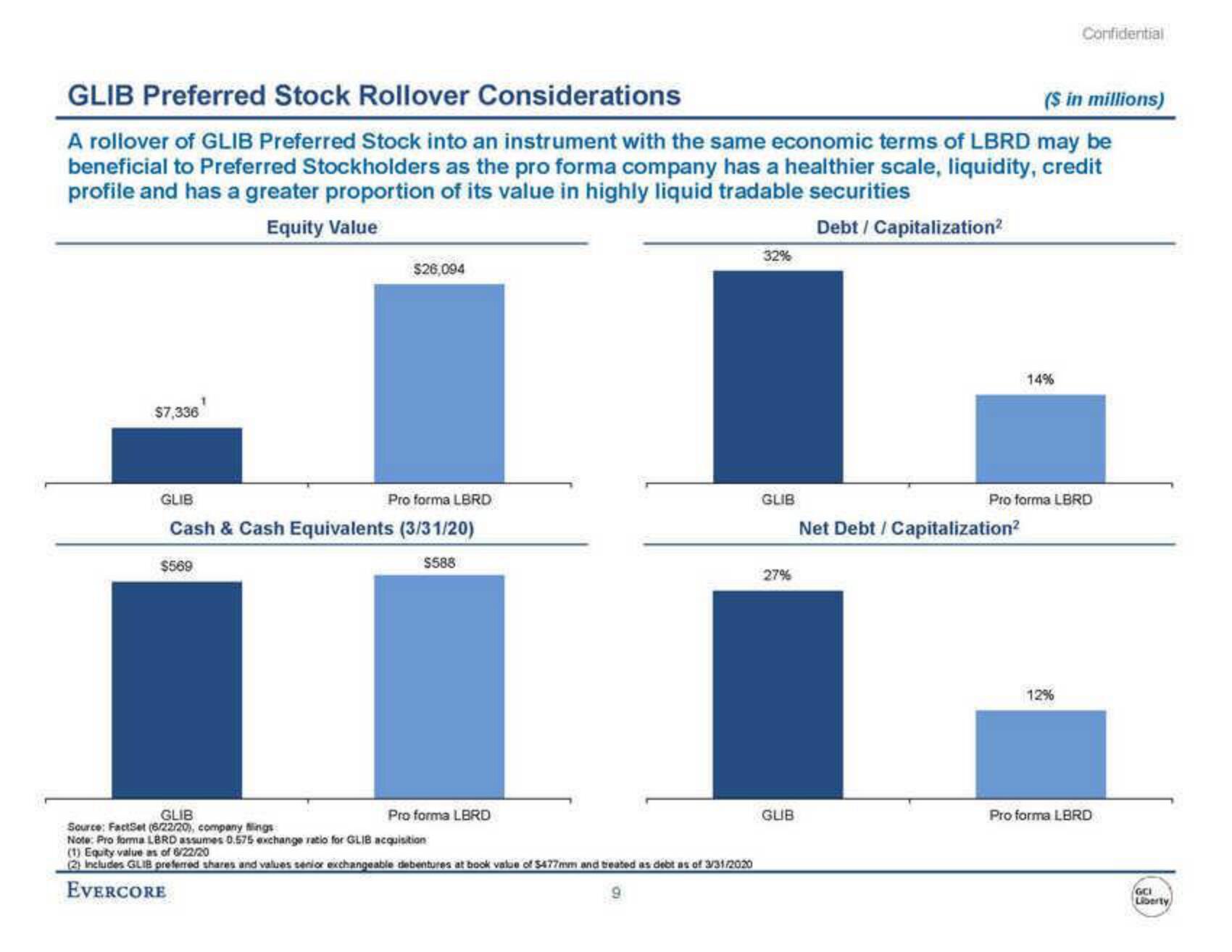

GLIB Preferred Stock Rollover Considerations

($ in millions)

A rollover of GLIB Preferred Stock into an instrument with the same economic terms of LBRD may be

beneficial to Preferred Stockholders as the pro forma company has a healthier scale, liquidity, credit

profile and has a greater proportion of its value in highly liquid tradable securities

Equity Value

Debt / Capitalization²

$7,336

1

$569

GLIB

Pro forma LBRD

Cash & Cash Equivalents (3/31/20)

$588

$26,094

GLIB

Source: FactSet (6/22/20), company fings

Pro forma LBRD

Note: Pro forma LBRD assumes 0.575 exchange ratio for GLIB acquisition

(1) Equity value as of 6/22/20

(2) Includes GLIB preferred shares and values senior exchangeable debentures at book value of $477mm and treated as debt as of 3/31/2020

EVERCORE

9

32%

GLIB

27%

GLIB

14%

Net Debt / Capitalization²

Confidential

Pro forma LBRD

12%

Pro forma LBRD

GCI

LibertyView entire presentation