Pathward Financial Results Presentation Deck

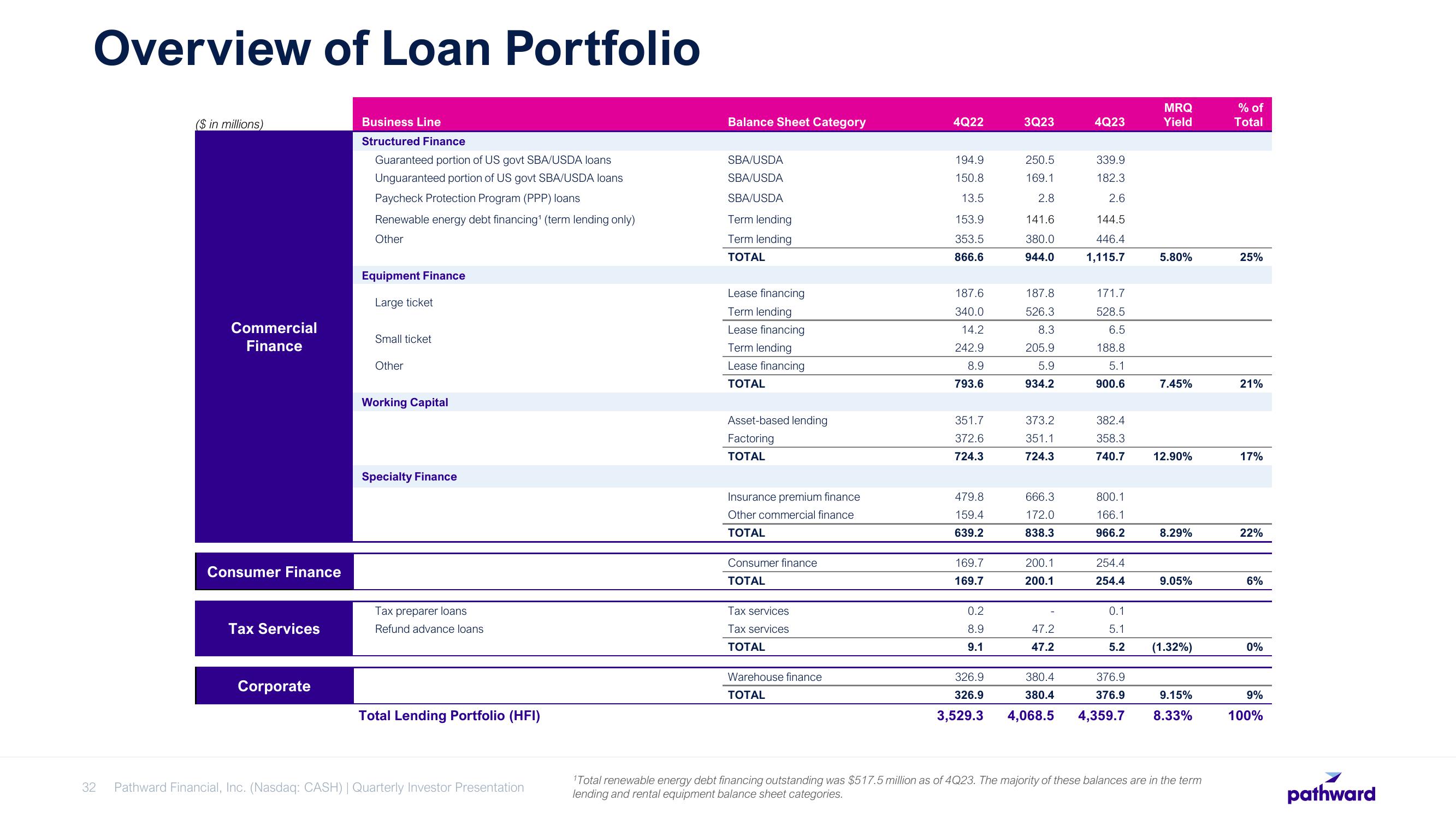

Overview of Loan Portfolio

Business Line

Structured Finance

32

($ in millions)

Commercial

Finance

Consumer Finance

Tax Services

Corporate

Guaranteed portion of US govt SBA/USDA loans

Unguaranteed portion of US govt SBA/USDA loans

Paycheck Protection Program (PPP) loans

Renewable energy debt financing¹ (term lending only)

Other

Equipment Finance

Large ticket

Small ticket

Other

Working Capital

Specialty Finance

Tax preparer loans

Refund advance loans

Total Lending Portfolio (HFI)

Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

Balance Sheet Category

SBA/USDA

SBA/USDA

SBA/USDA

Term lending

Term lending

TOTAL

Lease financing

Term lending

Lease financing

Term lending

Lease financing

TOTAL

Asset-based lending

Factoring

TOTAL

Insurance premium finance

Other commercial finance

TOTAL

Consumer finance

TOTAL

Tax services

Tax services

TOTAL

Warehouse finance

TOTAL

4Q22

194.9

150.8

13.5

153.9

353.5

866.6

187.6

340.0

14.2

242.9

8.9

793.6

351.7

372.6

724.3

479.8

159.4

639.2

169.7

169.7

0.2

8.9

9.1

326.9

326.9

3,529.3

3Q23

250.5

169.1

2.8

141.6

380.0

944.0

187.8

526.3

8.3

205.9

5.9

934.2

373.2

351.1

724.3

666.3

172.0

838.3

200.1

200.1

47.2

47.2

380.4

380.4

4,068.5

4Q23

339.9

182.3

2.6

144.5

446.4

1,115.7

171.7

528.5

6.5

188.8

5.1

900.6

382.4

358.3

740.7

800.1

166.1

966.2

254.4

254.4

0.1

5.1

5.2

MRQ

Yield

5.80%

7.45%

12.90%

8.29%

9.05%

(1.32%)

376.9

376.9

9.15%

4,359.7 8.33%

¹Total renewable energy debt financing outstanding was $517.5 million as of 4Q23. The majority of these balances are in the term

lending and rental equipment balance sheet categories.

% of

Total

25%

21%

17%

22%

6%

0%

9%

100%

pathwardView entire presentation