LionTree Investment Banking Pitch Book

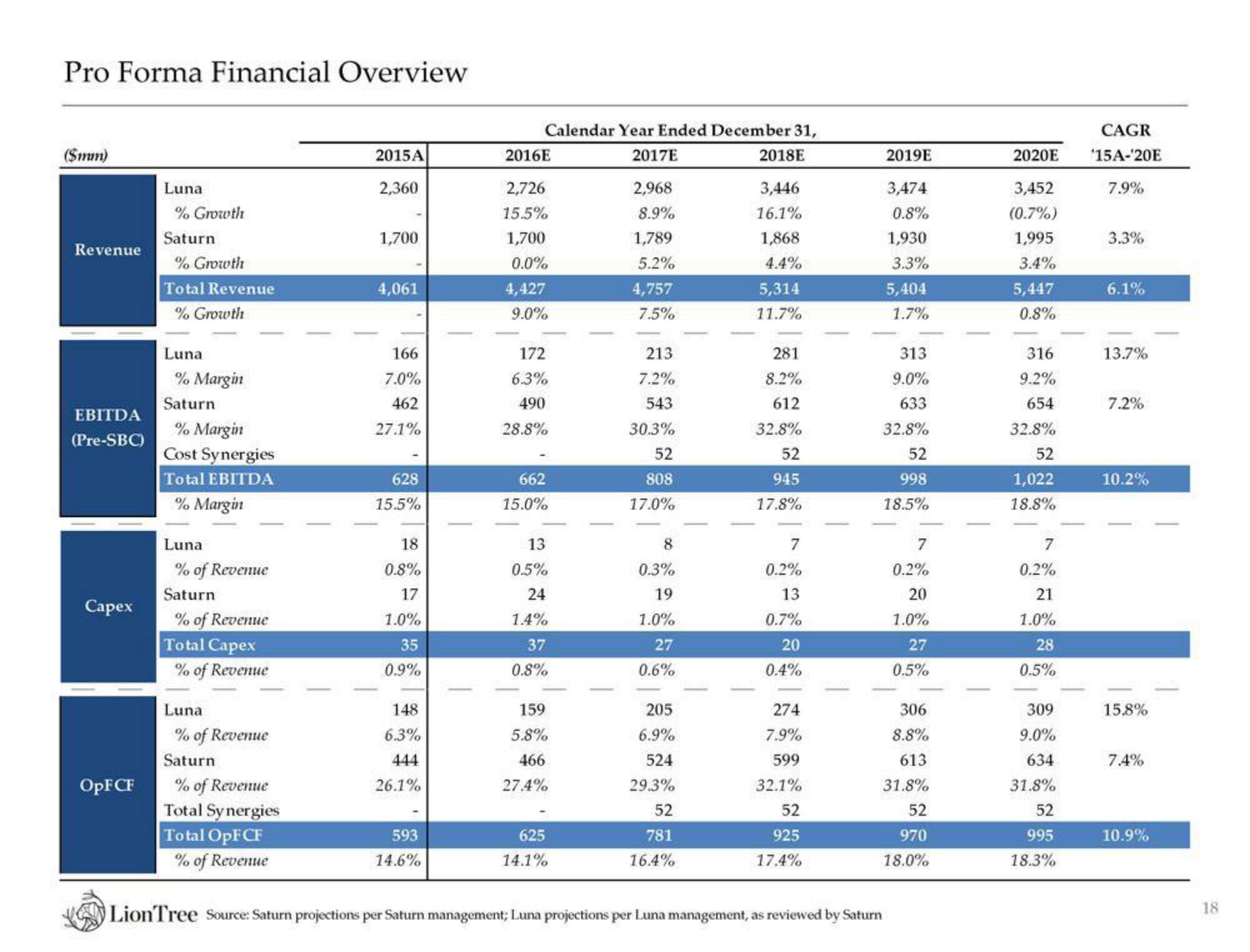

Pro Forma Financial Overview

($mm)

Revenue

EBITDA

(Pre-SBC)

Capex

OpFCF

Luna

% Growth

Saturn

% Growth

Total Revenue

% Growth

Luna

% Margin

Saturn

% Margin

Cost Synergies

Total EBITDA

% Margin

Luna

% of Revenue

Saturn

% of Revenue

Total Capex

% of Revenue

Luna

% of Revenue

Saturn

% of Revenue

Total Synergies

Total OpFCF

% of Revenue

2015A

2,360

1,700

4,061

166

7.0%

462

27.1%

628

15.5%

18

0.8%

17

1.0%

35

0.9%

148

6.3%

444

26.1%

593

14.6%

Calendar Year Ended December 31,

2017E

2018E

3,446

16.1%

2016E

2,726

15.5%

1,700

0.0%

4,427

9.0%

172

6.3%

490

28.8%

662

15.0%

13

0.5%

24

1.4%

37

0.8%

159

5.8%

466

27.4%

625

14.1%

2,968

8.9%

1,789

5.2%

4,757

7.5%

213

7.2%

543

30.3%

52

808

17.0%

8

0.3%

19

1.0%

27

0.6%

205

6.9%

524

29.3%

52

781

16.4%

1,868

4.4%

5,314

11.7%

281

8.2%

612

32.8%

52

945

17.8%

7

0.2%

13

0.7%

20

0.4%

274

7.9%

599

32.1%

52

925

17.4%

2019E

3,474

0.8%

1,930

3.3%

5,404

1.7%

313

9.0%

633

32.8%

LionTree Source: Saturn projections per Saturn management; Luna projections per Luna management, as reviewed by Saturn

52

998

18.5%

7

0.2%

20

1.0%

27

0.5%

306

8.8%

613

31.8%

52

970

18.0%

2020E

3,452

(0.7%)

1,995

3.4%

5,447

0.8%

316

9.2%

654

32.8%

52

1,022

18.8%

7

0.2%

21

1.0%

28

0.5%

309

9.0%

634

31.8%

52

995

18.3%

CAGR

'15A-¹20E

7.9%

3.3%

6.1%

13.7%

7.2%

10.2%

15.8%

7.4%

10.9%

18View entire presentation