Bank of America Investment Banking Pitch Book

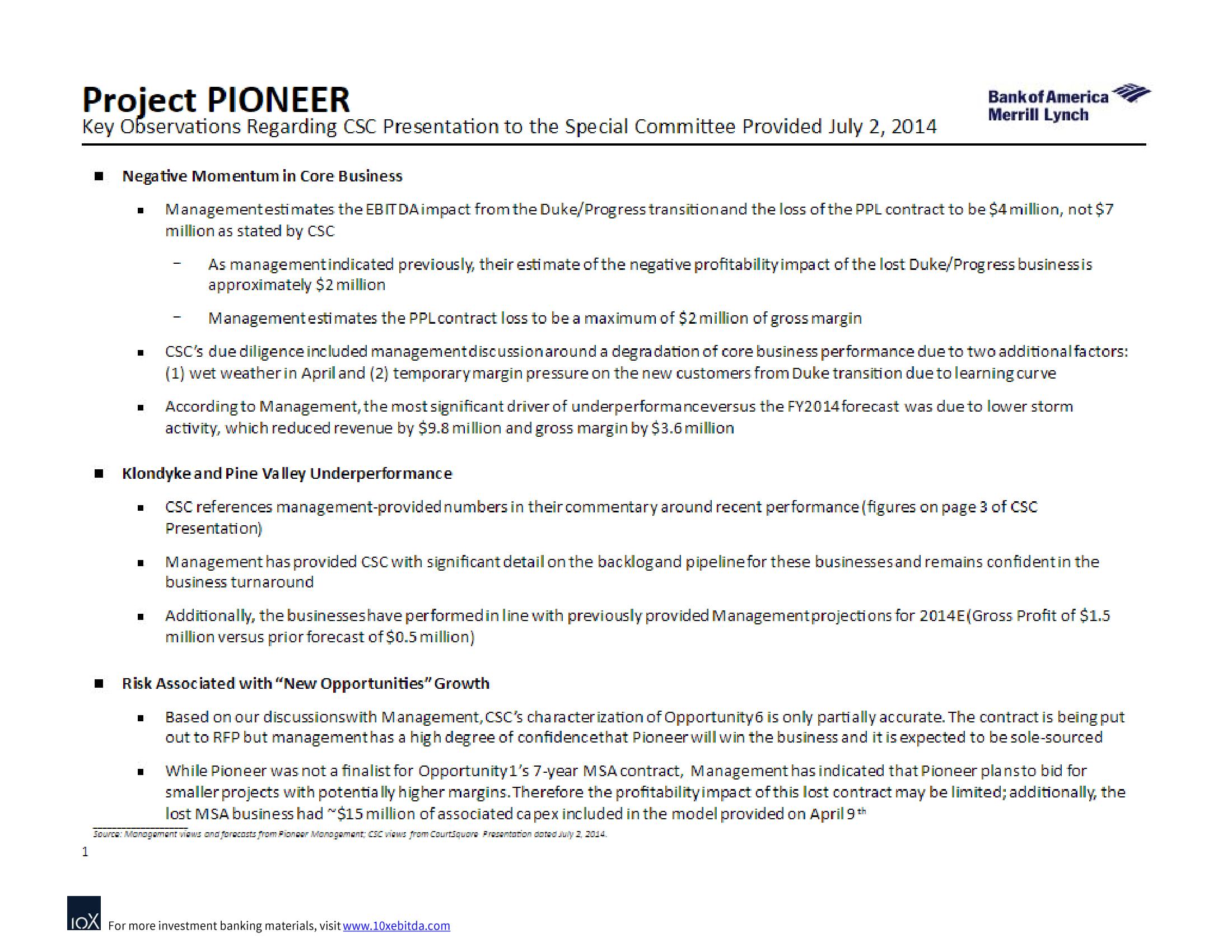

Project PIONEER

Key Observations Regarding CSC Presentation to the Special Committee Provided July 2, 2014

1

■ Negative Momentum in Core Business

Management estimates the EBITDA impact from the Duke/Progress transition and the loss of the PPL contract to be $4 million, not $7

million as stated by CSC

7

■

■

Bank of America

Merrill Lynch

■

As management indicated previously, their estimate of the negative profitability impact of the lost Duke/Progress business is

approximately $2 million

Management estimates the PPL contract loss to be a maximum of $2 million of gross margin

CSC's due diligence included management discussion around a degradation of core business performance due to two additional factors:

(1) wet weather in April and (2) temporary margin pressure on the new customers from Duke transition due to learning curve

■ Klondyke and Pine Valley Underperformance

CSC references management-provided numbers in their commentary around recent performance (figures on page 3 of CSC

Presentation)

According to Management, the most significant driver of underperformanceversus the FY2014 forecast was due to lower storm

activity, which reduced revenue by $9.8 million and gross margin by $3.6 million

Management has provided CSC with significant detail on the backlogand pipeline for these businesses and remains confident in the

business turnaround

Additionally, the businesses have performed in line with previously provided Management projections for 2014E(Gross Profit of $1.5

million versus prior forecast of $0.5 million)

Risk Associated with "New Opportunities" Growth

Based on our discussionswith Management, CSC's characterization of Opportunity6 is only partially accurate. The contract is being put

out to RFP but management has a high degree of confidencethat Pioneer will win the business and it is expected to be sole-sourced

While Pioneer was not a finalist for Opportunity1's 7-year MSA contract, Management has indicated that Pioneer plans to bid for

smaller projects with potentially higher margins. Therefore the profitability impact of this lost contract may be limited; additionally, the

lost MSA business had ~$15 million of associated ca pex included in the model provided on April 9th

Source: Monogement views and forecasts from Pionoor Monogamant; CSC views from CourtSquare Presentation dated July 2, 2014.

LOX For more investment banking materials, visit www.10xebitda.comView entire presentation