Pershing Square Activist Presentation Deck

B. PF McDonald's Financial Analysis

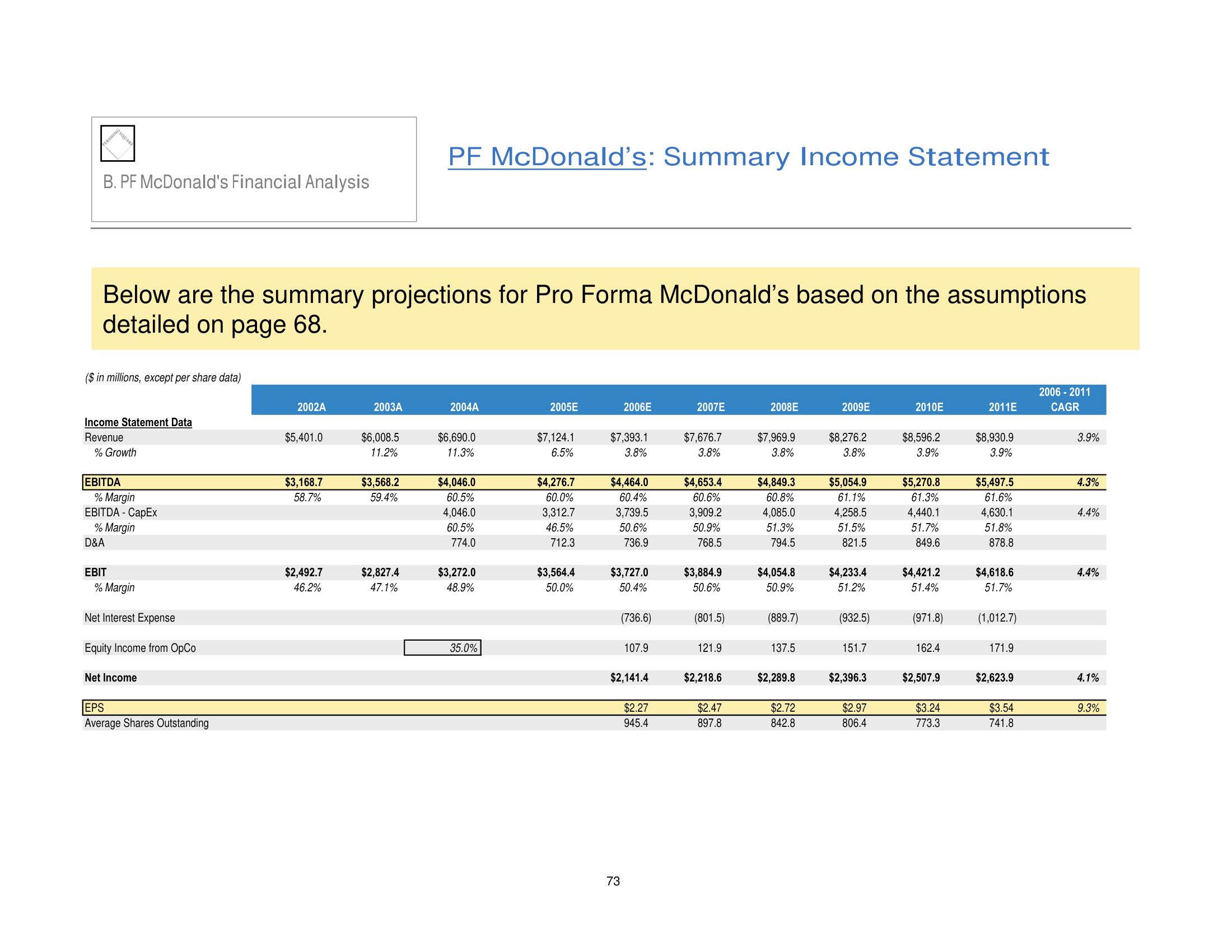

Below are the summary projections for Pro Forma McDonald's based on the assumptions

detailed on page 68.

($ in millions, except per share data)

Income Statement Data

Revenue

% Growth

EBITDA

% Margin

EBITDA - CapEx

% Margin

D&A

EBIT

% Margin

Net Interest Expense

Equity Income from OpCo

Net Income

EPS

Average Shares Outstanding

2002A

$5,401.0

$3,168.7

58.7%

$2,492.7

46.2%

2003A

$6,008.5

11.2%

$3,568.2

59.4%

PF McDonald's: Summary Income Statement

$2,827.4

47.1%

2004A

$6,690.0

11.3%

$4,046.0

60.5%

4,046.0

60.5%

774.0

$3,272.0

48.9%

35.0%

2005E

$7,124.1

6.5%

$4,276.7

60.0%

3,312.7

46.5%

712.3

$3,564.4

50.0%

2006E

$7,393.1

3.8%

$4,464.0

60.4%

3,739.5

50.6%

736.9

$3,727.0

50.4%

73

(736.6)

107.9

$2,141.4

$2.27

945.4

2007E

$7,676.7

3.8%

$4,653.4

60.6%

3,909.2

50.9%

768.5

$3,884.9

50.6%

(801.5)

121.9

$2,218.6

$2.47

897.8

2008E

$7,969.9

3.8%

$4,849.3

60.8%

4,085.0

51.3%

794.5

$4,054.8

50.9%

(889.7)

137.5

$2,289.8

$2.72

842.8

2009E

$8,276.2

3.8%

$5,054.9

61.1%

4,258.5

51.5%

821.5

$4,233.4

51.2%

(932.5)

151.7

$2,396.3

$2.97

806.4

2010E

$8,596.2

3.9%

$5,270.8

61.3%

4,440.1

51.7%

849.6

$4,421.2

51.4%

(971.8)

162.4

$2,507.9

$3.24

773.3

2011E

$8,930.9

3.9%

$5,497.5

61.6%

4,630.1

51.8%

878.8

$4,618.6

51.7%

(1,012.7)

171.9

$2,623.9

$3.54

741.8

2006 - 2011

CAGR

3.9%

4.3%

4.4%

4.4%

4.1%

9.3%View entire presentation