Microsoft Mergers and Acquisitions Presentation Deck

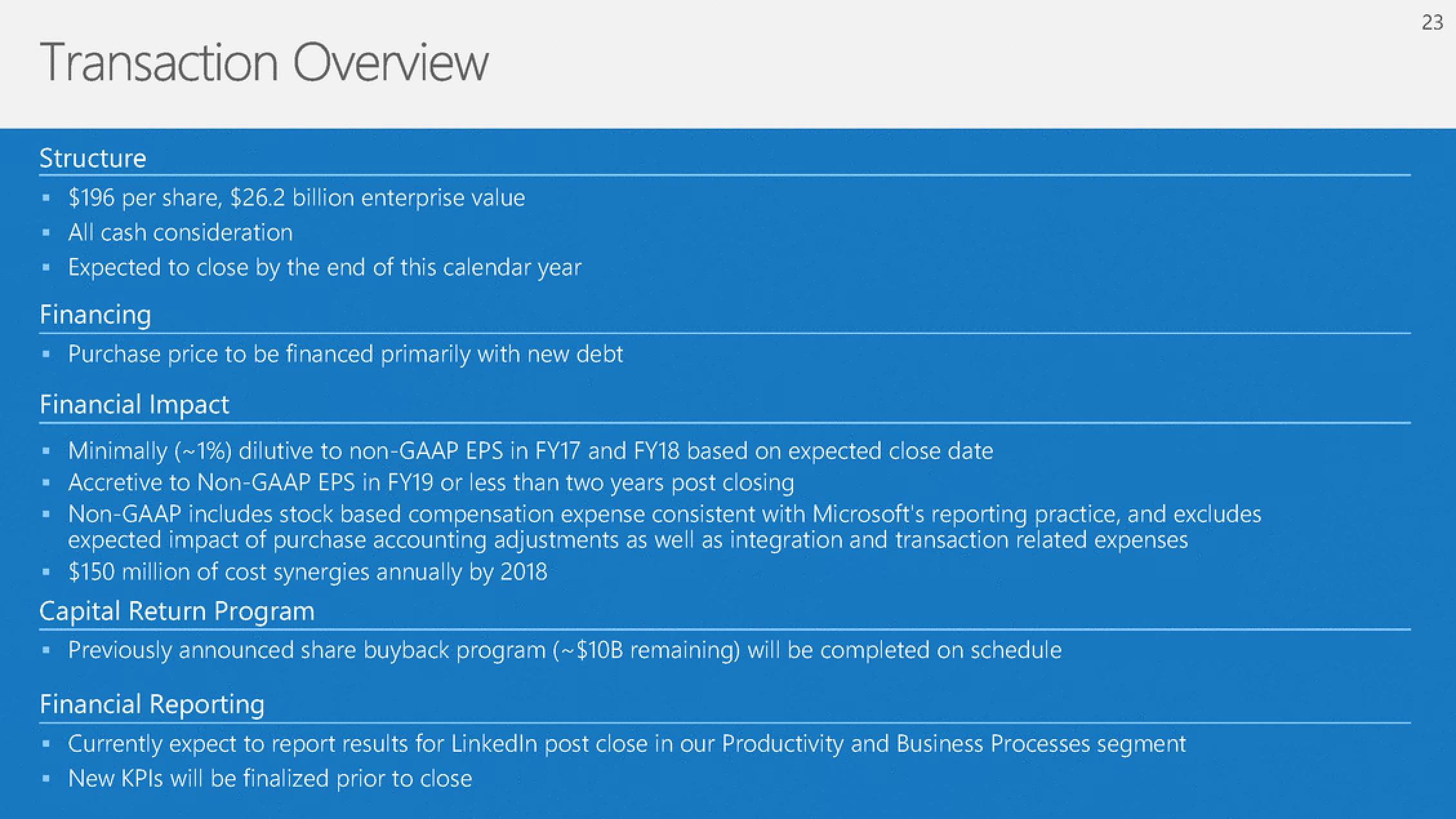

Transaction Overview

Structure

$196 per share, $26.2 billion enterprise value

▪ All cash consideration

Expected to close by the end of this calendar year

■

=

Financing

▪ Purchase price to be financed primarily with new debt

Financial Impact

Minimally (~1%) dilutive to non-GAAP EPS in FY17 and FY18 based on expected close date

Accretive to Non-GAAP EPS in FY19 or less than two years post closing

Non-GAAP includes stock based compensation expense consistent with Microsoft's reporting practice, and excludes

expected impact of purchase accounting adjustments as well as integration and transaction related expenses

■ $150 million of cost synergies annually by 2018

Capital Return Program

▪ Previously announced share buyback program (~$10B remaining) will be completed on schedule

Financial Reporting

Currently expect to report results for LinkedIn post close in our Productivity and Business Processes segment

New KPIs will be finalized prior to close

■

23View entire presentation