Harbor Custom Development Investor Presentation Deck

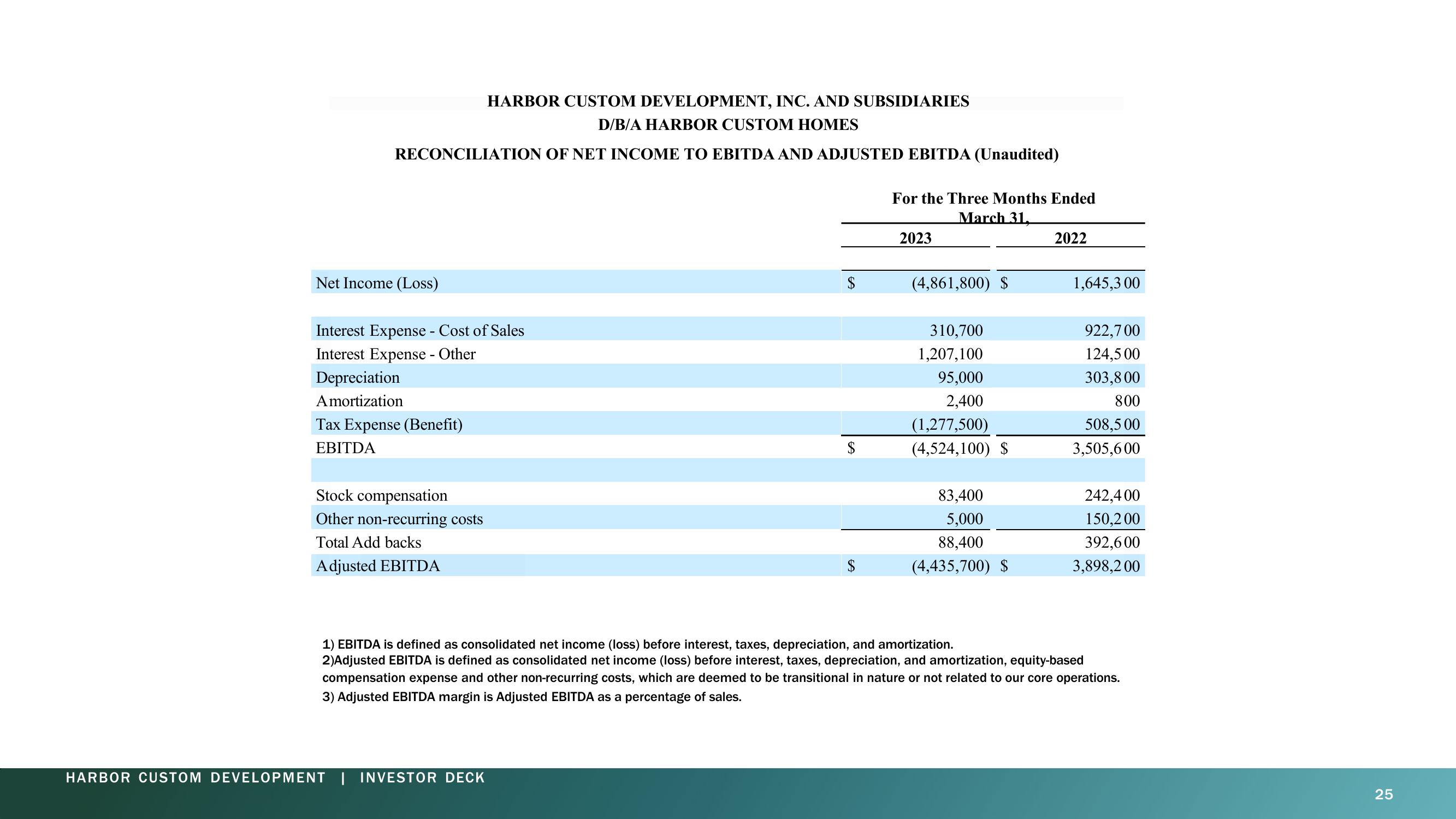

HARBOR CUSTOM DEVELOPMENT, INC. AND SUBSIDIARIES

D/B/A HARBOR CUSTOM HOMES

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA (Unaudited)

Net Income (Loss)

Interest Expense - Cost of Sales

Interest Expense - Other

Depreciation

Amortization

Tax Expense (Benefit)

EBITDA

Stock compensation

Other non-recurring costs

Total Add backs

Adjusted EBITDA

$

HARBOR CUSTOM DEVELOPMENT | INVESTOR DECK

For the Three Months Ended

March 31,

2023

(4,861,800) $

310,700

1,207,100

95,000

2,400

(1,277,500)

(4,524,100) $

83,400

5,000

88,400

(4,435,700) $

2022

1,645,3 00

922,700

124,500

303,800

800

508,500

3,505,600

242,400

150,200

392,600

3,898,2 00

1) EBITDA is defined as consolidated net income (loss) before interest, taxes, depreciation, and amortization.

2)Adjusted EBITDA is defined as consolidated net income (loss) before interest, taxes, depreciation, and amortization, equity-based

compensation expense and other non-recurring costs, which are deemed to be transitional in nature or not related to our core operations.

3) Adjusted EBITDA margin is Adjusted EBITDA as a percentage of sales.

25View entire presentation