Baird Investment Banking Pitch Book

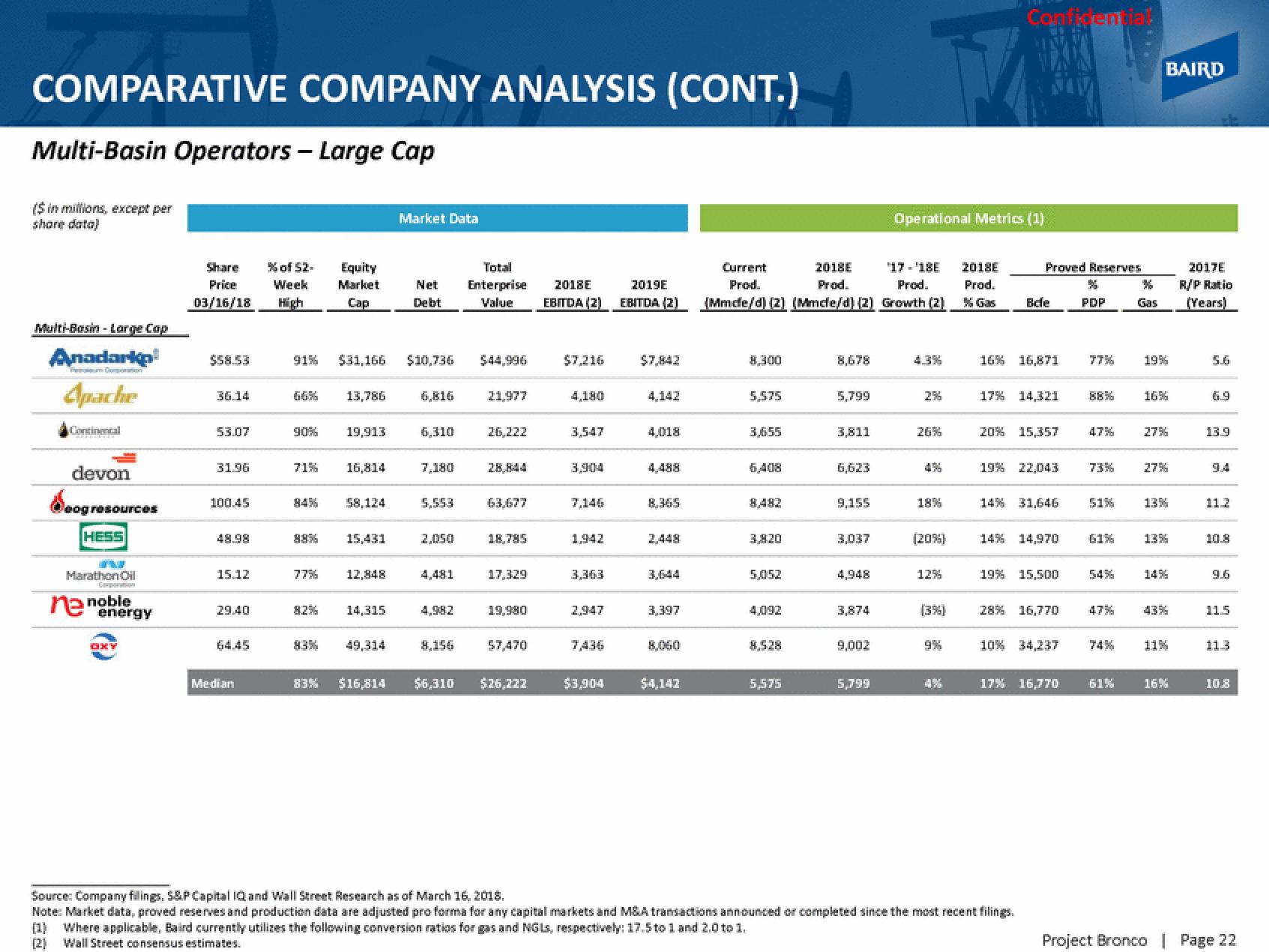

COMPARATIVE COMPANY ANALYSIS (CONT.)

Multi-Basin Operators - Large Cap

($ in millions, except per

share data)

Multi-Basin - Large Cop

Anadarko

Apache

Corporation

Continental

devon

Soogr

og resources

HESS

Marathon Oil

ne noble

energy

OX

% of 52-

Week

03/16/18 High

Share

Price

$58.53

36.14

53.07

31.96

100.45

48.98

15.12

29.40

Median

66% 13,786

90%

71%

91% $31,166 $10,736 $44,996

84%

Equity

Market

Cap

77%

82%

19,913

16,814

58,124

15,431

12,848

14,315

Market Data

83% 49,314

Net

Debt

6,816

6,310

7,180

5,553

2,050

4,481

4,982

Total

Enterprise

Value

8,156

21,977

26,222

28,844

63,677

18,785

17,329

19,980

57,470

83% $16,814 $6,310 $26,222

2018E

EBITDA (2)

$7,216

4,180

3,547

3,904

7,146

1,942

3,363

2,947

7,436

$3,904

2019E

EBITDA (2)

$7,842

4,142

4,018

4,488

8,365

2,448

3,397

8,060

$4,142

Current

2018E '17-'18E

Prod.

Prod.

Prod.

(Mmde/d) (2) (Mmde/d) (2) Growth (2)

8,300

5,575

3,655

6,408

3,820

5,052

4,092

8,528

5,575

8,678

5,799

3,811

6,623

9,155

3,037

4,948

3,874

9,002

5,799

Operational Metrics (1)

4.3%

26%

18%

(20%)

12%

(3%)

9%

2018E

Prod.

% Gas

Confidential

Proved Reserves

Bele

16% 16,871

17% 14,321

20% 15,357

19% 22,043

14% 31,646

14% 14,970

19% 15,500

28% 16,770

Source: Company filings, S&P Capital IQ and Wall Street Research as of March 16, 2018.

Note: Market data, proved reserves and production data are adjusted pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Where applicable, Baird currently utilizes the following conversion ratios for gas and NGLs, respectively: 17.5 to 1 and 2.0 to 1.

(2)

Wall Street consensus estimates.

10% 34,237

17% 16,770

%

PDP

77%

47%

73%

51%

61%

54%

74%

61%

%

Gas

BAIRD

19%

16%

27%

27%

13%

13%

14%

43%

11%

16%

2017E

R/P Ratio

(Years)

5.6

6.9

13.9

112

10.8

9.6

11.5

11.3

10.8

Project Bronco | Page 22View entire presentation