Procore IPO Presentation Deck

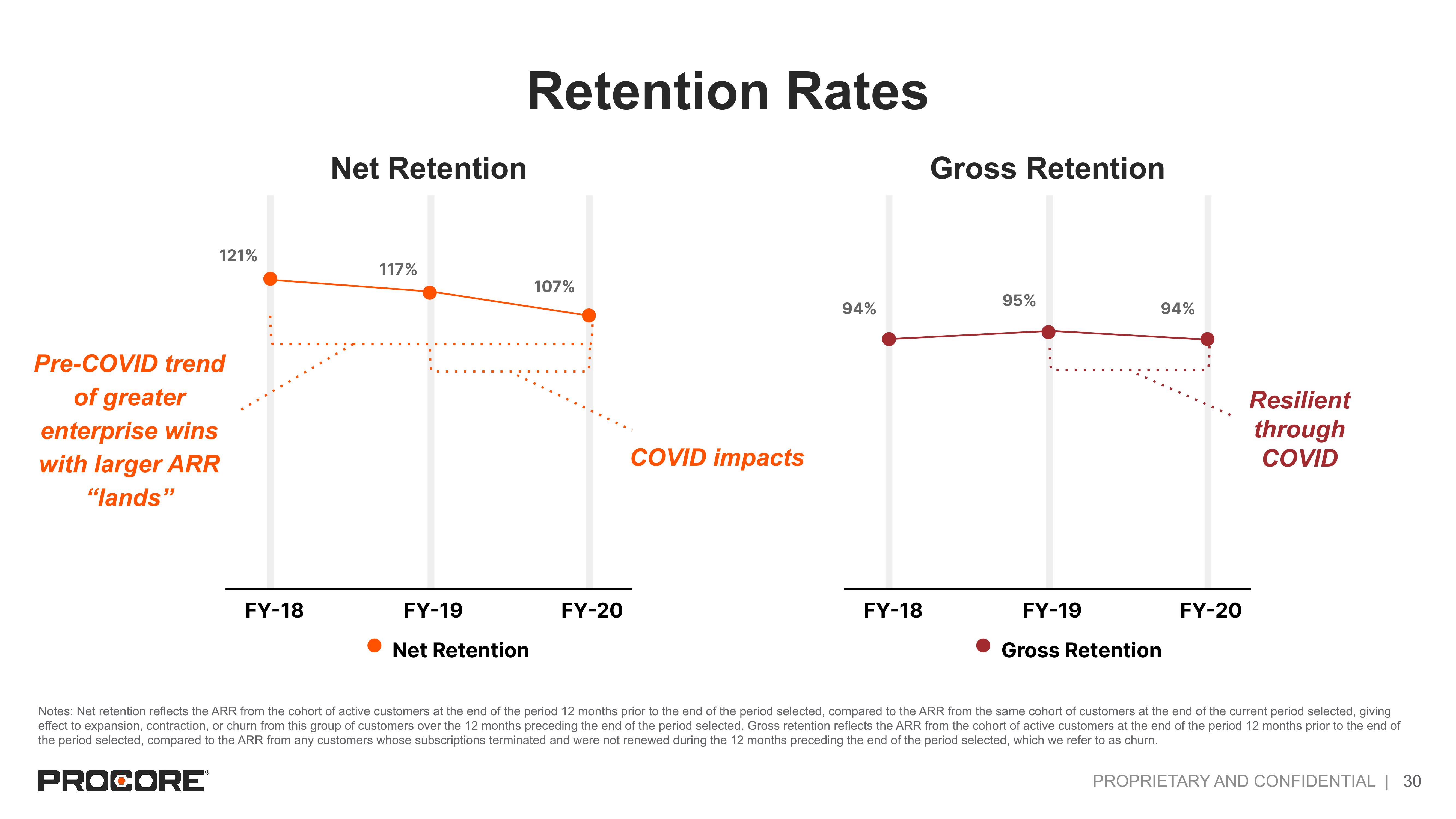

121%

Pre-COVID trend

of greater

enterprise wins

with larger ARR

"lands"

FY-18

Net Retention

117%

Retention Rates

FY-19

Net Retention

107%

FY-20

COVID impacts

94%

FY-18

Gross Retention

95%

94%

FY-19

Gross Retention

FY-20

Resilient

through

COVID

Notes: Net retention reflects the ARR from the cohort of active customers at the end of the period 12 months prior to the end of the period selected, compared to the ARR from the same cohort of customers at the end of the current period selected, giving

effect to expansion, contraction, or churn from this group of customers over the 12 months preceding the end of the period selected. Gross retention reflects the ARR from the cohort of active customers at the end of the period 12 months prior to the end of

the period selected, compared to the ARR from any customers whose subscriptions terminated and were not renewed during the 12 months preceding the end of the period selected, which we refer to as churn.

PROCORE®

PROPRIETARY AND CONFIDENTIAL | 30View entire presentation