Allwyn Results Presentation Deck

Consolidated P&L (excluding acquisitions)

●

●

15

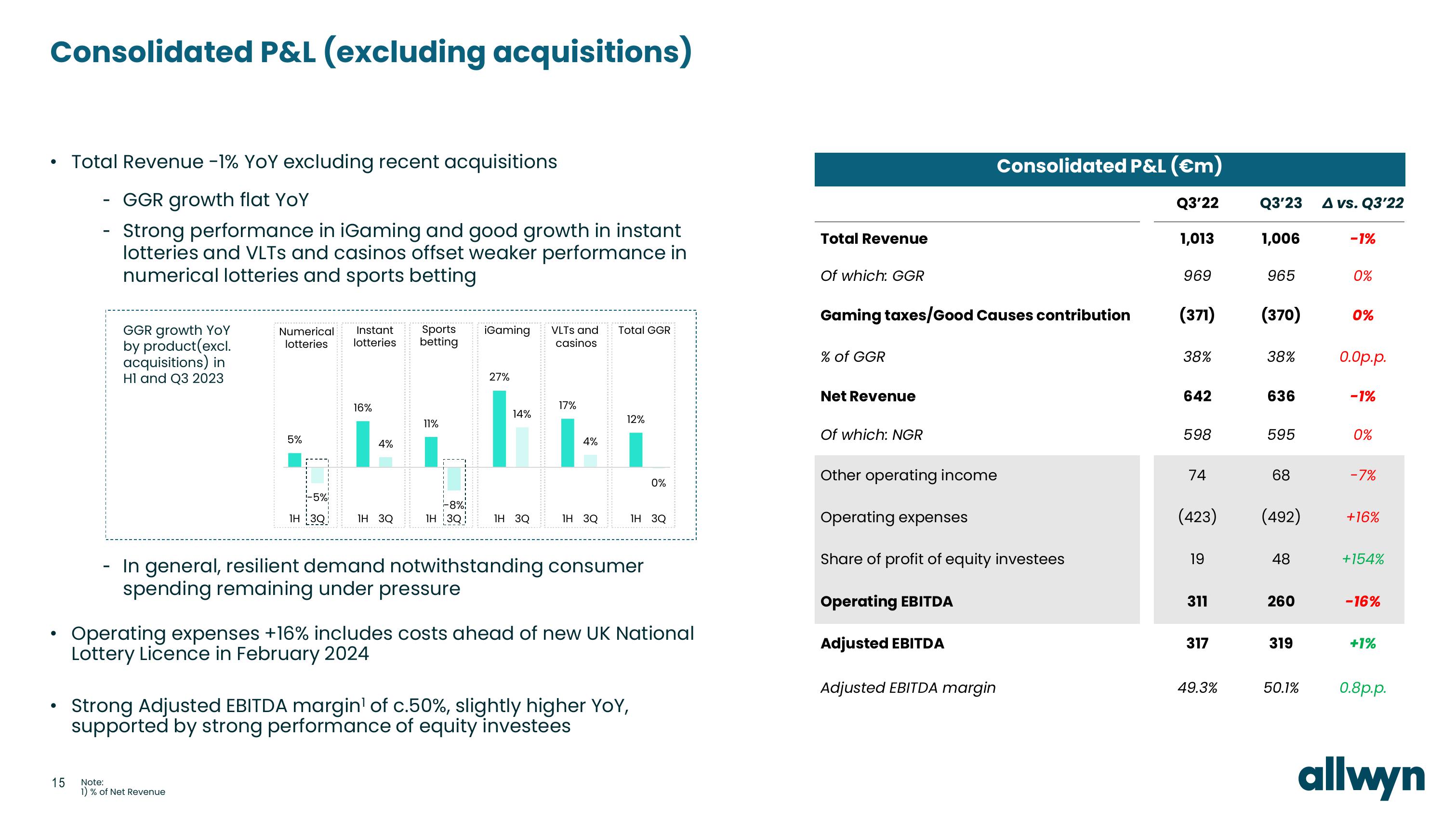

Total Revenue -1% YoY excluding recent acquisitions

GGR growth flat YoY

Strong performance in iGaming and good growth in instant

lotteries and VLTS and casinos offset weaker performance in

numerical lotteries and sports betting

-

GGR growth YoY

by product (excl.

acquisitions) in

HI and Q3 2023

Numerical Instant

lotteries lotteries

5%

-5%

Note:

1) % of Net Revenue

1H3Q

16%

4%

1H 3Q

********

Sports iGaming VLTS and

betting

casinos

11%

-8%

1H3Q

27%

14%

1H 3Q

17%

4%

1H 3Q

Total GGR

12%

In general, resilient demand notwithstanding consumer

spending remaining under pressure

1H 3Q

0%

Operating expenses +16% includes costs ahead of new UK National

Lottery Licence in February 2024

Strong Adjusted EBITDA margin¹ of c.50%, slightly higher YoY,

supported by strong performance of equity investees

Total Revenue

Of which: GGR

Gaming taxes/Good Causes contribution

% of GGR

Net Revenue

Of which: NGR

Other operating income

Consolidated P&L (€m)

Q3'22

1,013

Operating expenses

Share of profit of equity investees

Operating EBITDA

Adjusted EBITDA

Adjusted EBITDA margin

969

(371)

38%

642

598

74

(423)

19

311

317

49.3%

Q3'23

1,006

965

(370)

38%

636

595

68

(492)

48

260

319

50.1%

A vs. Q3'22

-1%

0%

0%

0.0p.p.

-1%

0%

-7%

+16%

+154%

-16%

+1%

0.8p.p.

allwynView entire presentation