Deutsche Bank Results Presentation Deck

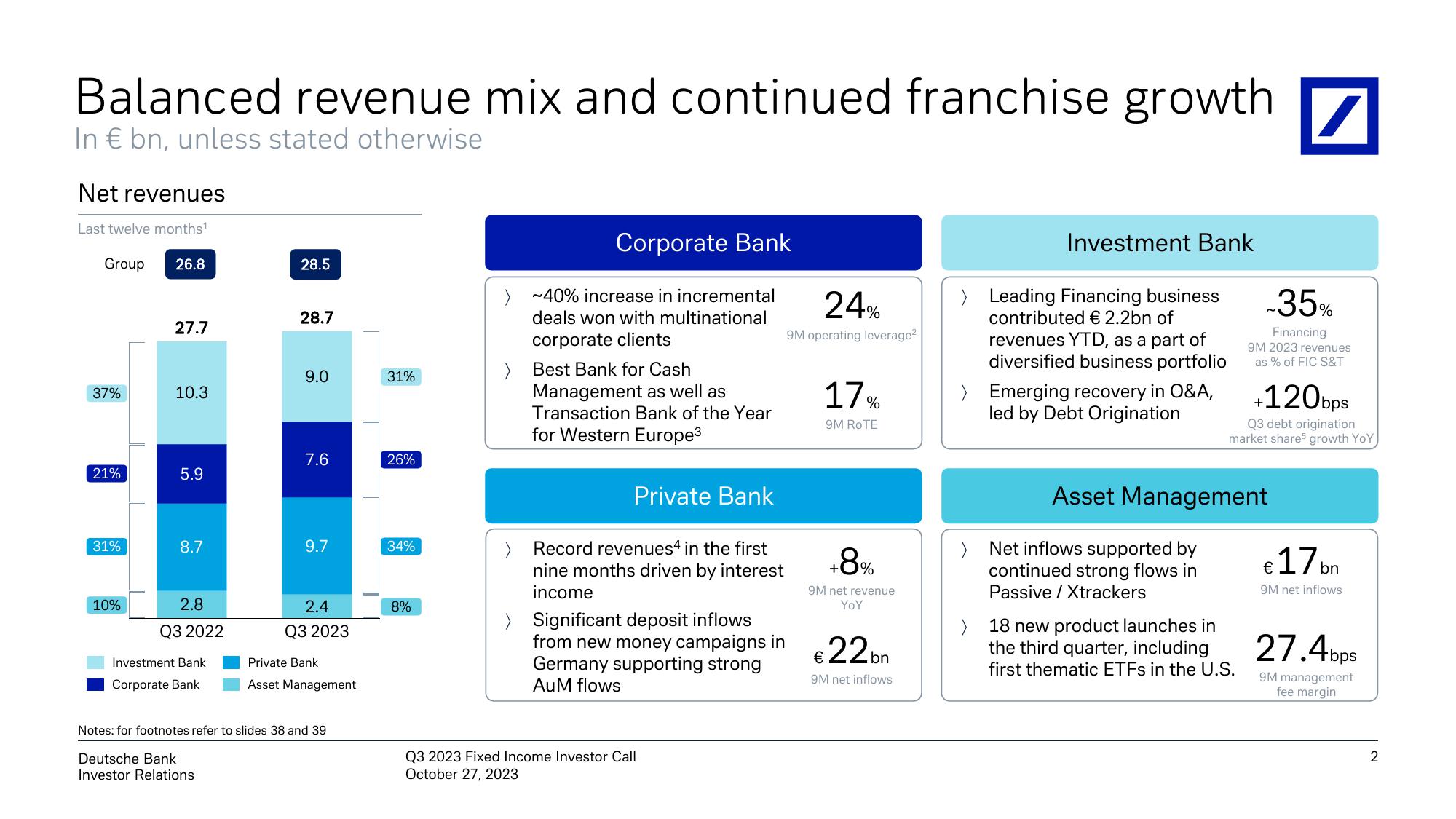

Balanced revenue mix and continued franchise growth

In € bn, unless stated otherwise

Net revenues

Last twelve months¹

Group

37%

21%

31%

10%

26.8

27.7

10.3

5.9

8.7

2.8

Q3 2022

Investment Bank

Corporate Bank

28.5

28.7

9.0

7.6

9.7

2.4

Q3 2023

Private Bank

Asset Management

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

31%

26%

34%

8%

Corporate Bank

~40% increase in incremental

deals won with multinational

corporate clients

> Best Bank for Cash

Management as well as

Transaction Bank of the Year

for Western Europe³

Private Bank

Record revenues4 in the first

nine months driven by interest

income

24%

9M operating leverage²

Q3 2023 Fixed Income Investor Call

October 27, 2023

17%

9M ROTE

+8%

9M net revenue

YoY

> Significant deposit inflows

from new money campaigns in €22bn

Germany supporting strong

AuM flows

9M net inflows

Investment Bank

>

Leading Financing business

contributed € 2.2bn of

revenues YTD, as a part of

diversified business portfolio

> Emerging recovery in O&A,

led by Debt Origination

Net inflows supported by

continued strong flows in

Passive / Xtrackers

/

-35%

Financing

Asset Management

18 new product launches in

the third quarter, including

first thematic ETFs in the U.S.

9M 2023 revenues

as % of FIC S&T

+120bps

Q3 debt origination

market share growth YoY

€17bn

9M net inflows

27.4bps

9M management

fee margin

2View entire presentation