Vale Results Presentation Deck

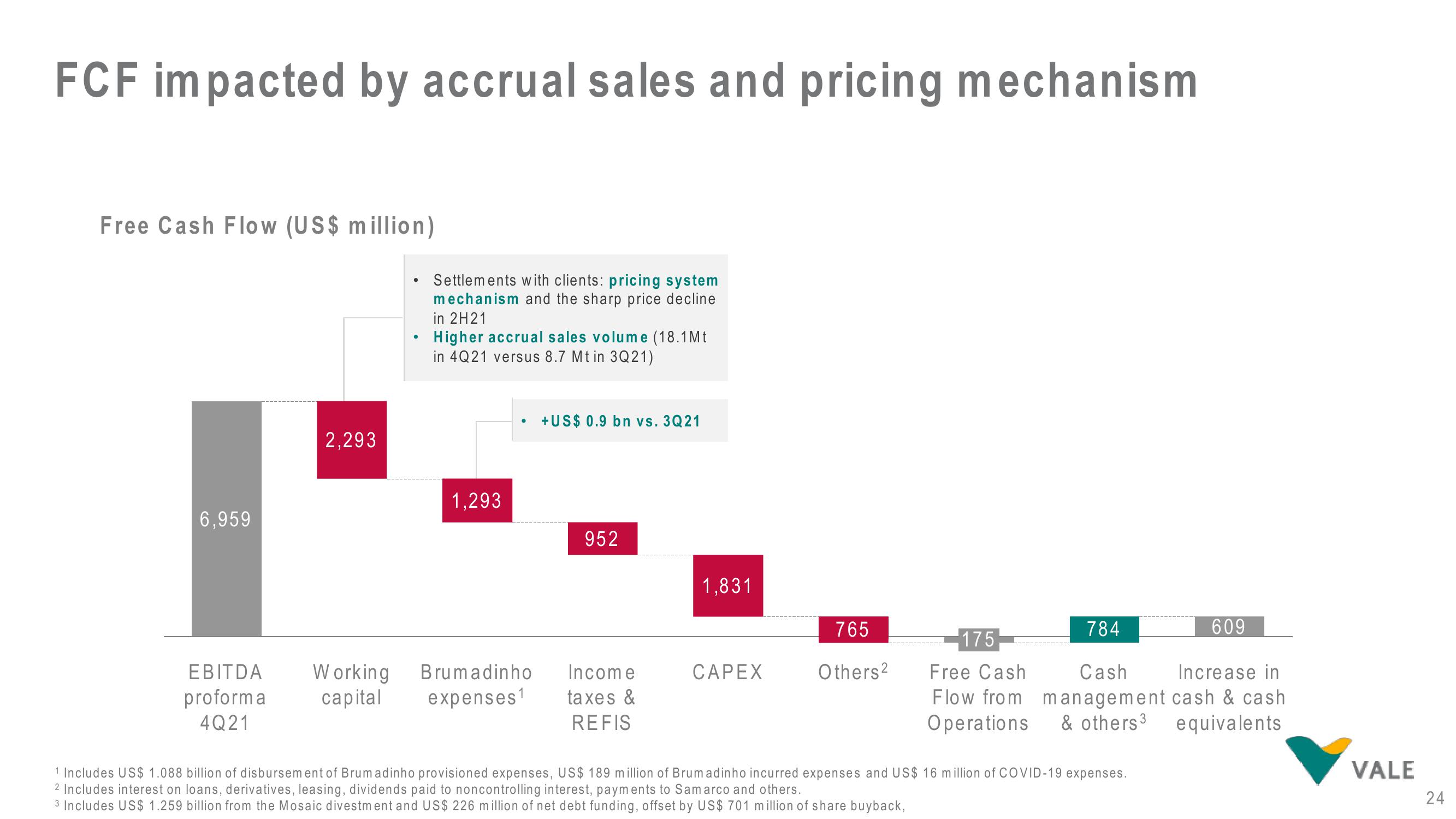

FCF impacted by accrual sales and pricing mechanism

Free Cash Flow (US$ million)

6,959

2,293

●

Settlements with clients: pricing system

mechanism and the sharp price decline

in 2H21

Higher accrual sales volume (18.1Mt

in 4Q21 versus 8.7 Mt in 3Q21)

1,293

EBITDA Working Brumadinho

proforma capital expenses¹

4Q21

+US$ 0.9 bn vs. 3Q21

952

Income

taxes &

REFIS

1,831

CAPEX

765

Others²

784

175

Free Cash Cash Increase in

Flow from management cash & cash

Operations & others 3 equivalents

609

1 Includes US$ 1.088 billion of disbursement of Brumadinho provisioned expenses, US$ 189 million of Brumadinho incurred expenses and US$ 16 million of COVID-19 expenses.

2 Includes interest on loans, derivatives, leasing, dividends paid to noncontrolling interest, payments to Samarco and others.

3 Includes US$ 1.259 billion from the Mosaic divestment and US$ 226 million of net debt funding, offset by US$ 701 million of share buyback,

VALE

24View entire presentation