Tradeweb Results Presentation Deck

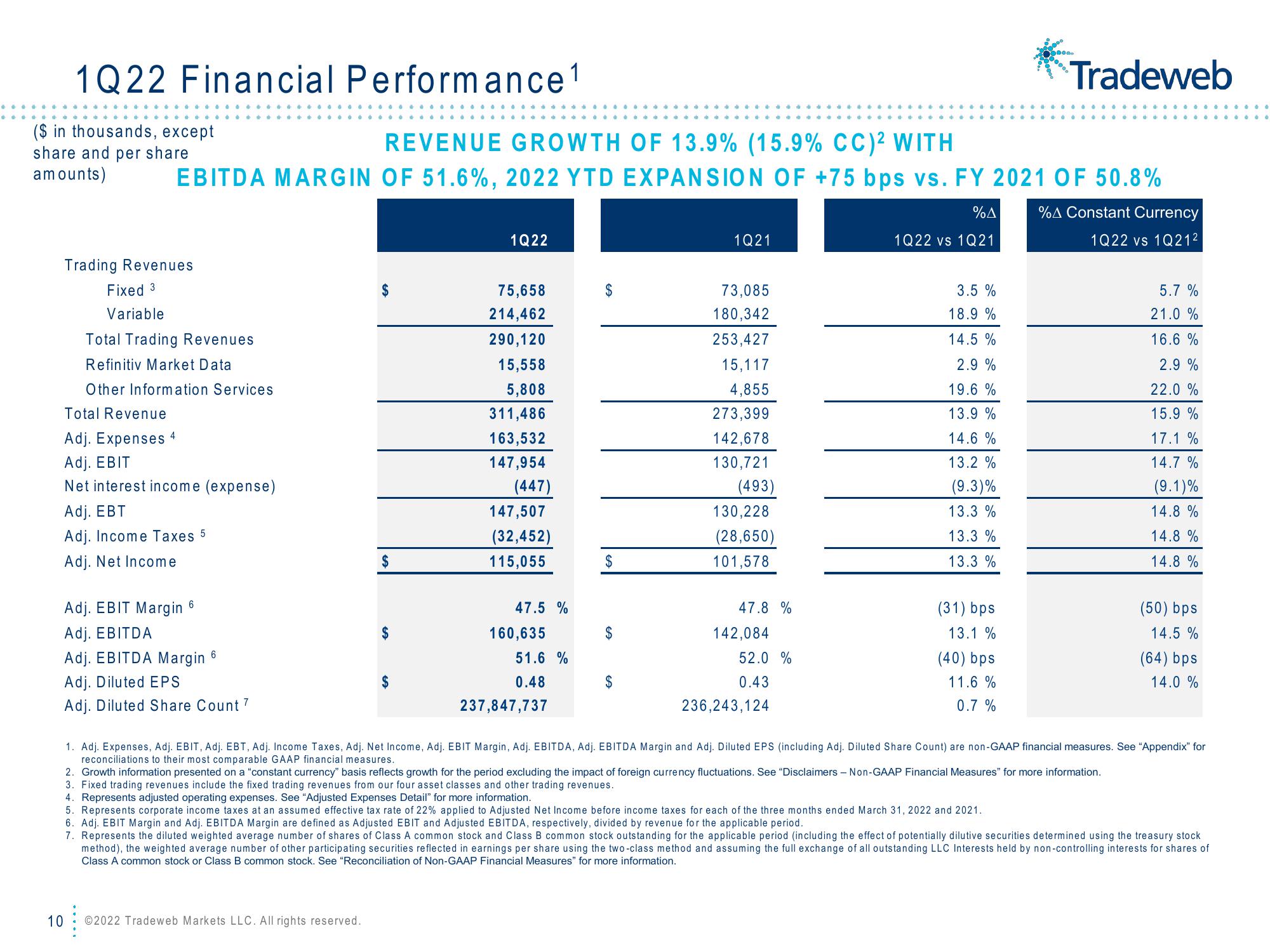

1Q22 Financial Performance ¹

($ in thousands, except

share and per share

amounts)

Trading Revenues

Fixed 3

Variable

10

REVENUE GROWTH OF 13.9% (15.9% CC) ² WITH

EBITDA MARGIN OF 51.6%, 2022 YTD EXPANSION OF +75 bps vs. FY 2021 OF 50.8%

Total Trading Revenues

Refinitiv Market Data

Other Information Services

Total Revenue

Adj. Expenses 4

Adj. EBIT

Net interest income (expense)

Adj. EBT

Adj. Income Taxes 5

Adj. Net Income

Adj. EBIT Margin 6

Adj. EBITDA

Adj. EBITDA Margin 6

Adj. Diluted EPS

Adj. Diluted Share Count 7

$

$

$

$

©2022 Tradeweb Markets LLC. All rights reserved.

1Q22

75,658

214,462

290,120

15,558

5,808

311,486

163,532

147,954

(447)

147,507

(32,452)

115,055

47.5 %

160,635

51.6 %

0.48

237,847,737

$

$

$

1Q21

73,085

180,342

253,427

15,117

4,855

273,399

142,678

130,721

(493)

130,228

(28,650)

101,578

47.8%

142,084

52.0 %

0.43

236,243,124

1Q22 vs 1Q21

%A %A Constant Currency

1Q22 vs 1Q21²

3.5 %

18.9%

14.5%

2.9%

19.6 %

13.9%

14.6%

13.2 %

(9.3)%

13.3%

13.3 %

13.3%

(31) bps

13.1 %

0000

(40) bps

11.6 %

0.7%

Tradeweb

4. Represents adjusted operating expenses. See "Adjusted Expenses Detail" for more information.

5. Represents corporate income taxes at an assumed effective tax rate of 22% applied to Adjusted Net Income before income taxes for each of the three months ended March 31, 2022 and 2021.

2. Growth information presented on a "constant currency" basis reflects growth for the period excluding the impact of foreign currency fluctuations. See "Disclaimers - Non-GAAP Financial Measures" for more information.

3. Fixed trading revenues include the fixed trading revenues from our four asset classes and other trading revenues.

5.7 %

21.0%

16.6%

2.9 %

22.0%

15.9 %

17.1 %

14.7%

(9.1)%

14.8 %

14.8 %

14.8 %

1. Adj. Expenses, Adj. EBIT, Adj. EBT, Adj. Income Taxes, Adj. Net Income, Adj. EBIT Margin, Adj. EBITDA, Adj. EBITDA Margin and Adj. Diluted EPS (including Adj. Diluted Share Count) are non-GAAP financial measures. See "Appendix" for

reconciliations to their most comparable GAAP financial measures.

(50) bps

14.5%

(64) bps

14.0 %

6. Adj. EBIT Margin and Adj. EBITDA Margin are defined as Adjusted EBIT and Adjusted EBITDA, respectively, divided by revenue for the applicable period.

7. Represents the diluted weighted average number of shares of Class A common stock and Class B common stock outstanding for the applicable period (including the effect of potentially dilutive securities determined using the treasury stock

method), the weighted average number of other participating securities reflected in earnings per share using the two-class method and assuming the full exchange of all outstanding LLC Interests held by non-controlling interests for shares of

Class A common stock or Class B common stock. See "Reconciliation of Non-GAAP Financial Measures" for more information.View entire presentation