Spirit Mergers and Acquisitions Presentation Deck

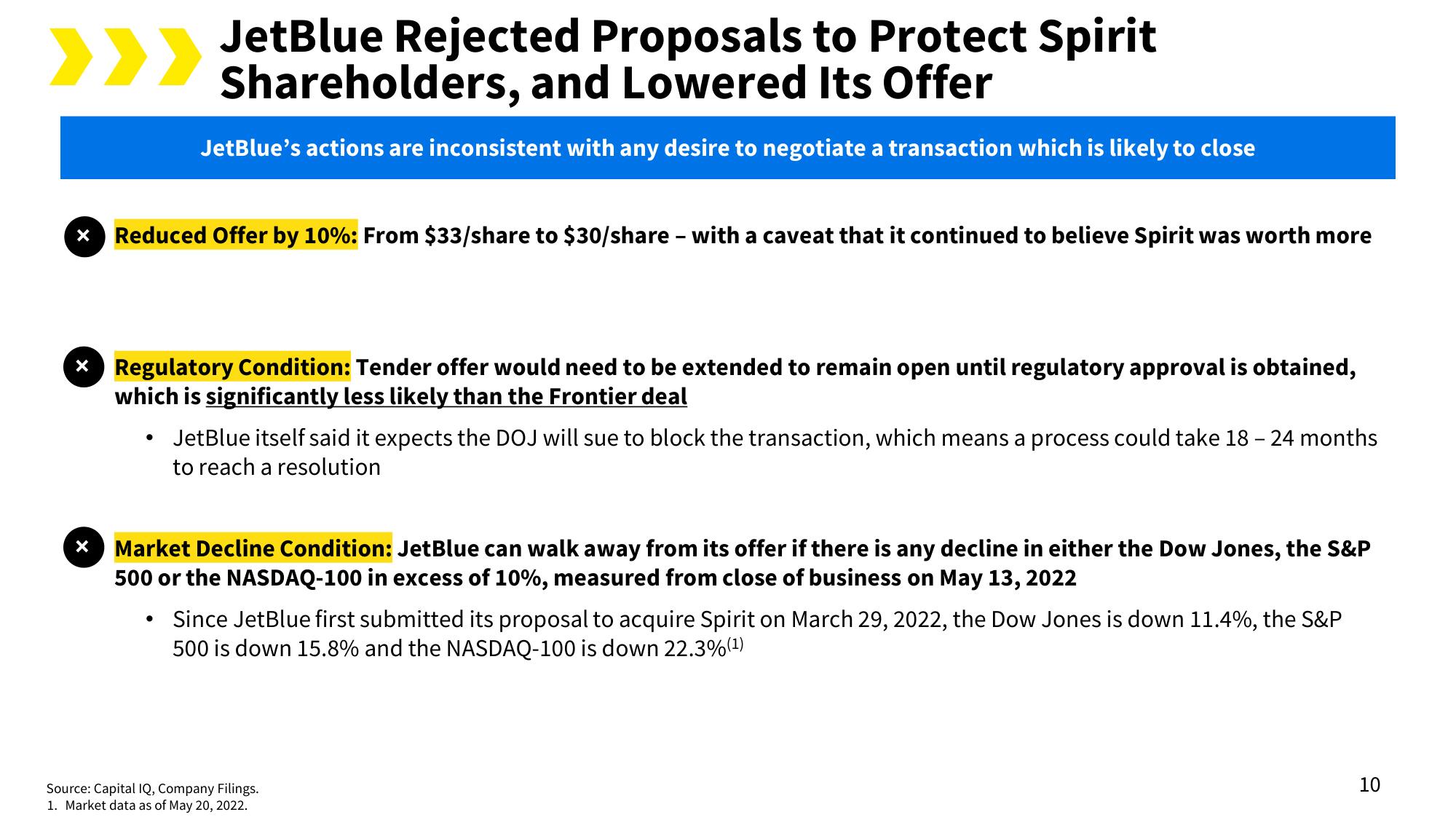

>>> JetBlue Rejected Proposals to Protect Spirit

Shareholders, and Lowered Its Offer

JetBlue's actions are inconsistent with any desire to negotiate a transaction which is likely to close

x Reduced Offer by 10%: From $33/share to $30/share with a caveat that it continued to believe Spirit was worth more

* Regulatory Condition: Tender offer would need to be extended to remain open until regulatory approval is obtained,

which is significantly less likely than the Frontier deal

X

●

—

●

JetBlue itself said it expects the DOJ will sue to block the transaction, which means a process could take 18 - 24 months

to reach a resolution

Market Decline Condition: JetBlue can walk away from its offer if there is any decline in either the Dow Jones, the S&P

500 or the NASDAQ-100 in excess of 10%, measured from close of business on May 13, 2022

Since JetBlue first submitted its proposal to acquire Spirit on March 29, 2022, the Dow Jones is down 11.4%, the S&P

500 is down 15.8% and the NASDAQ-100 is down 22.3% (¹)

Source: Capital IQ, Company Filings.

1. Market data as of May 20, 2022.

10View entire presentation