WeWork SPAC Presentation Deck

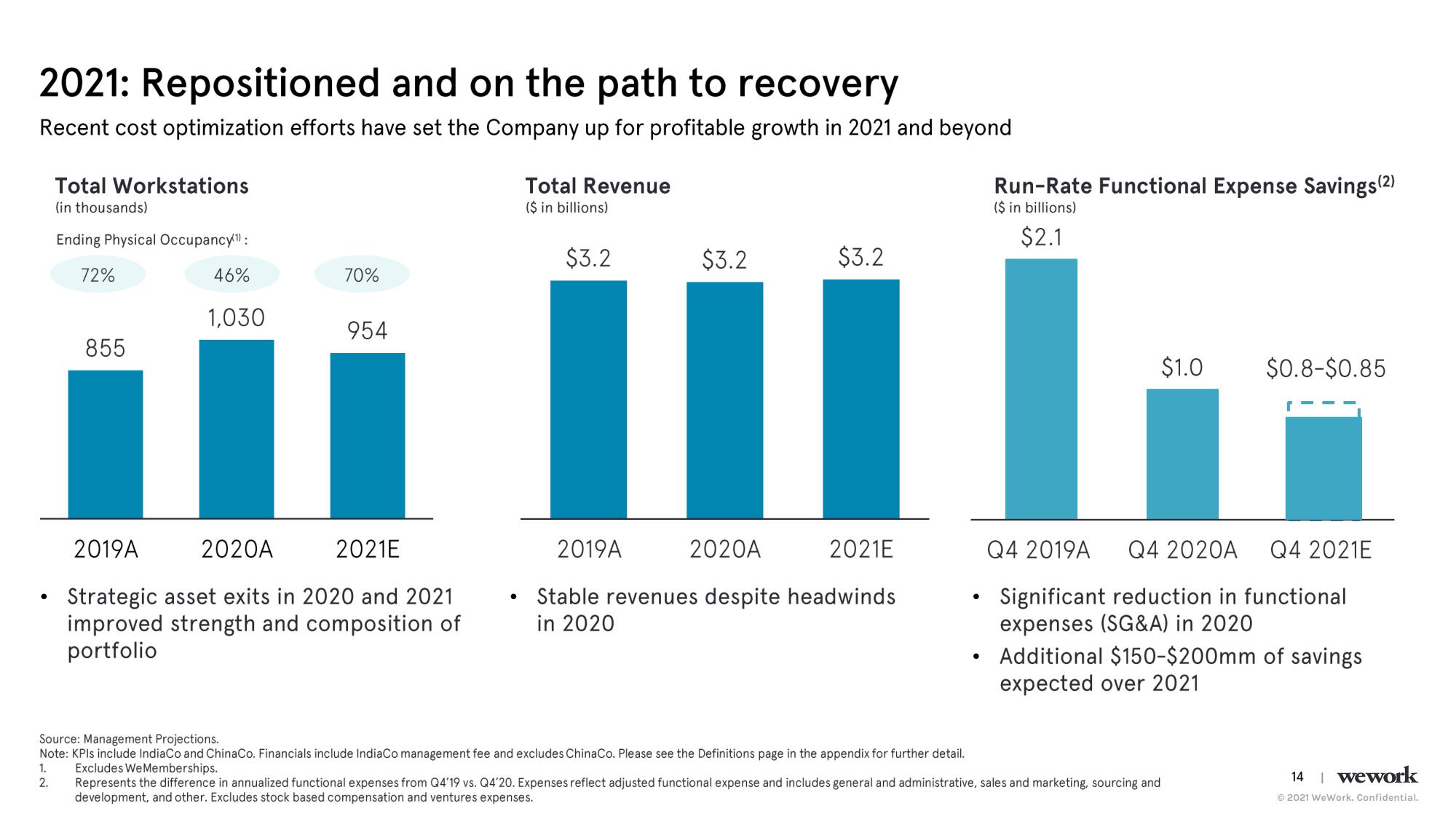

2021: Repositioned and on the path to recovery

Recent cost optimization efforts have set the Company up for profitable growth in 2021 and beyond

Total Workstations

(in thousands)

1.

2.

Ending Physical Occupancy(¹):

72%

855

46%

1,030

70%

954

2019A

2020A

2021E

Strategic asset exits in 2020 and 2021

improved strength and composition of

portfolio

●

Total Revenue

($ in billions)

$3.2

$3.2

$3.2

2019A

2020A

2021E

Stable revenues despite headwinds

in 2020

●

Run-Rate Functional Expense Savings (2)

($ in billions)

$2.1

$1.0

Source: Management Projections.

Note: KPIs include IndiaCo and ChinaCo. Financials include IndiaCo management fee and excludes ChinaCo. Please see the Definitions page in the appendix for further detail.

Excludes We Memberships.

Represents the difference in annualized functional expenses from Q4'19 vs. Q4'20. Expenses reflect adjusted functional expense and includes general and administrative, sales and marketing, sourcing and

development, and other. Excludes stock based compensation and ventures expenses.

$0.8-$0.85

Q4 2019A

Q4 2020A Q4 2021E

Significant reduction in functional

expenses (SG&A) in 2020

Additional $150-$200mm of savings

expected over 2021

14 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation