Rent The Runway Results Presentation Deck

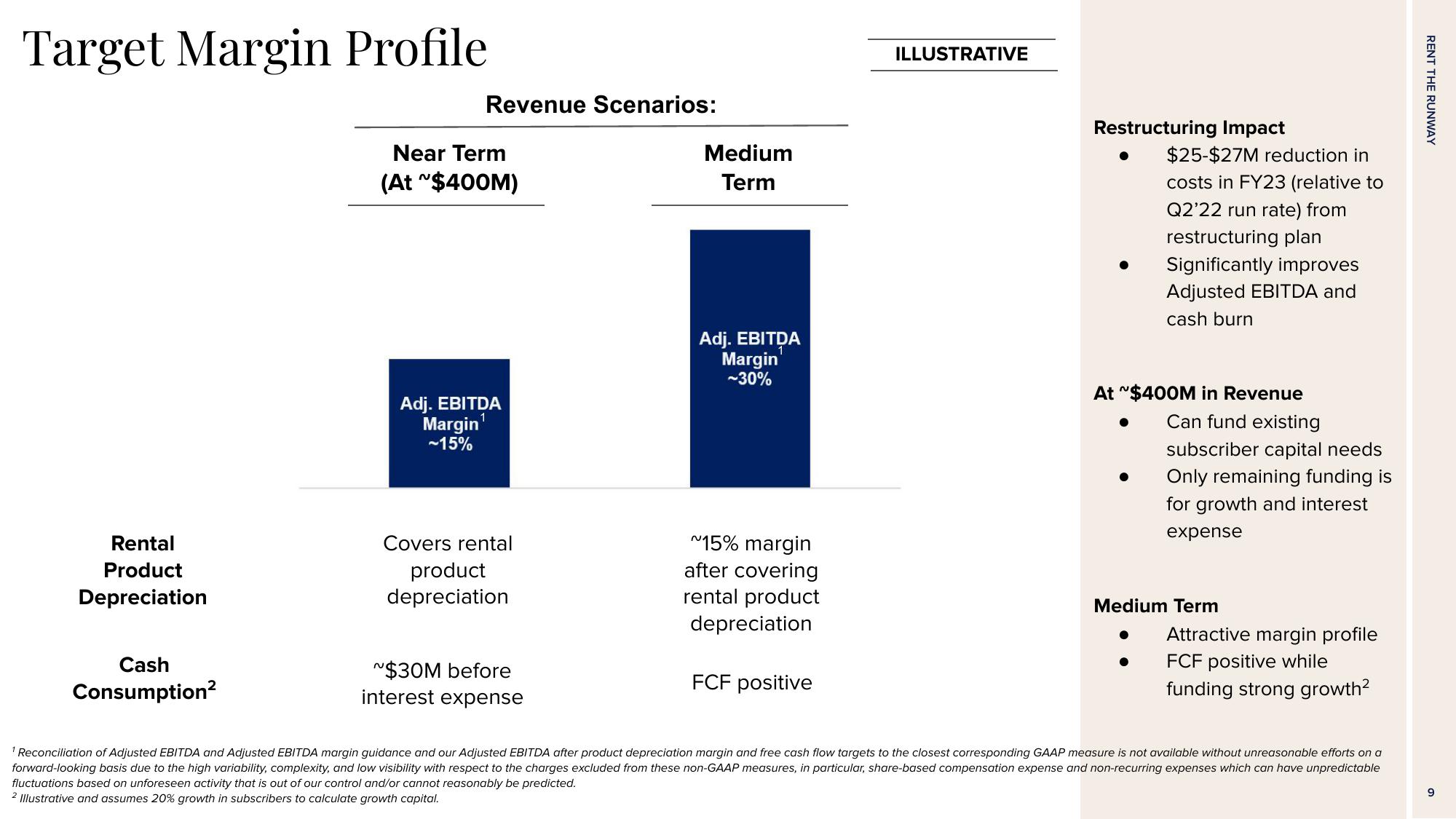

Target Margin Profile

Rental

Product

Depreciation

Cash

Consumption²

Revenue Scenarios:

Near Term

(At ~$400M)

Adj. EBITDA

Margin¹

~15%

Covers rental

product

depreciation

~$30M before

interest expense

Medium

Term

Adj. EBITDA

Margin

-30%

~15% margin

after covering

rental product

depreciation

FCF positive

ILLUSTRATIVE

Restructuring Impact

$25-$27M reduction in

costs in FY23 (relative to

Q2'22 run rate) from

restructuring plan

Significantly improves

Adjusted EBITDA and

cash burn

At ~$400M in Revenue

Can fund existing

subscriber capital needs

Only remaining funding is

for growth and interest

expense

Medium Term

Attractive margin profile

FCF positive while

funding strong growth²

¹ Reconciliation of Adjusted EBITDA and Adjusted EBITDA margin guidance and our Adjusted EBITDA after product depreciation margin and free cash flow targets to the closest corresponding GAAP measure is not available without unreasonable efforts on a

forward-looking basis due to the high variability, complexity, and low visibility with respect to the charges excluded from these non-GAAP measures, in particular, share-based compensation expense and non-recurring expenses which can have unpredictable

fluctuations based on unforeseen activity that is out of our control and/or cannot reasonably be predicted.

2 Illustrative and assumes 20% growth in subscribers to calculate growth capital.

RENT THE RUNWAY

9View entire presentation