Olaplex Results Presentation Deck

NON-GAAP RECONCILIATION

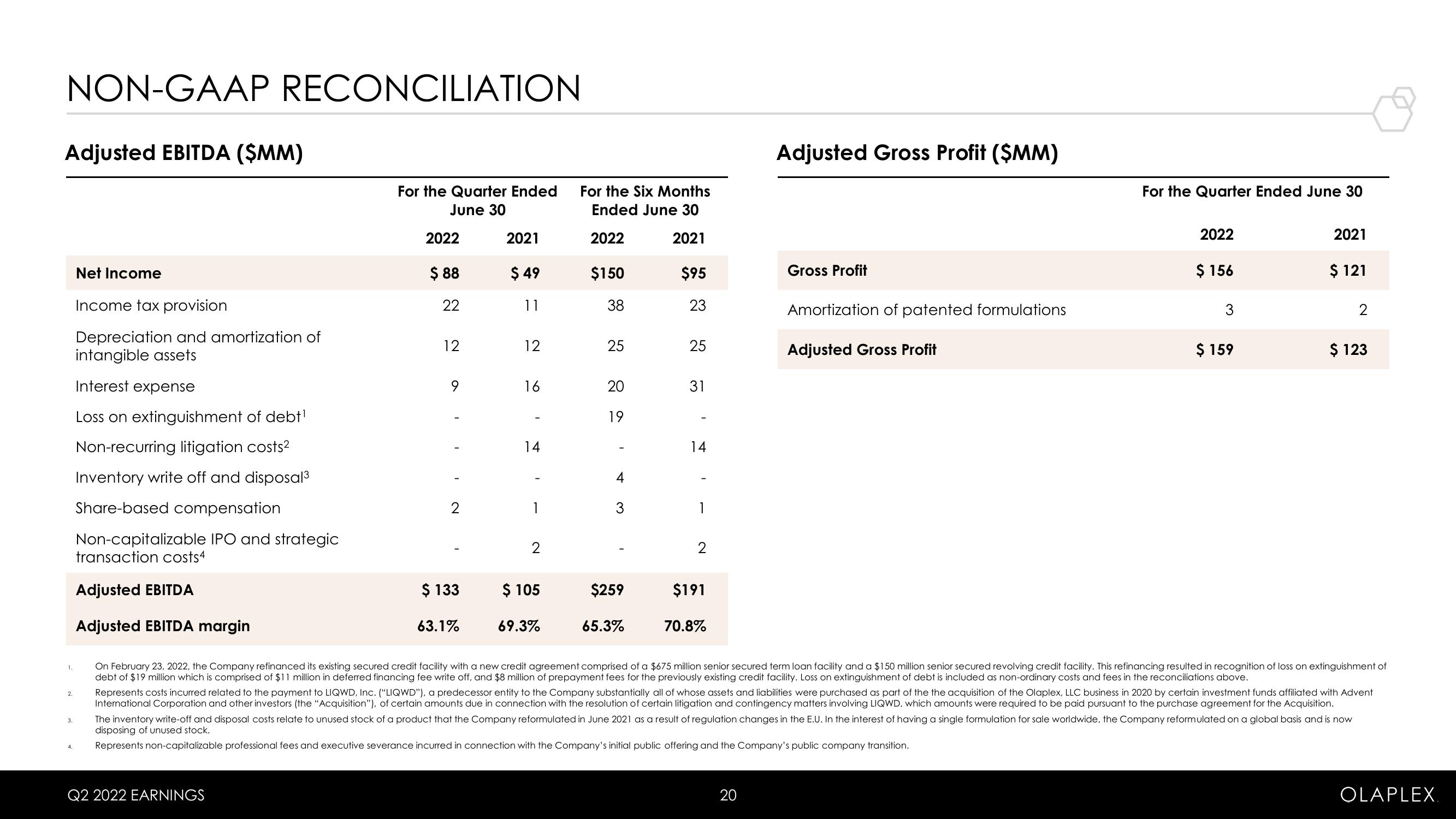

Adjusted EBITDA ($MM)

1.

2.

Net Income

Income tax provision

Depreciation and amortization of

intangible assets

Interest expense

Loss on extinguishment of debt¹

Non-recurring litigation costs²

Inventory write off and disposal ³

Share-based compensation

Non-capitalizable IPO and strategic

transaction costs4

Adjusted EBITDA

Adjusted EBITDA margin

3.

For the Quarter Ended

June 30

2022

$ 88

22

Q2 2022 EARNINGS

12

9

2

$ 133

63.1%

2021

$ 49

11

12

16

14

1

2

$ 105

69.3%

For the Six Months

Ended June 30

2022

2021

$150

38

25

20

19

4

$259

65.3%

$95

23

25

31

14

1

2

$191

70.8%

Adjusted Gross Profit ($MM)

Gross Profit

Amortization of patented formulations

20

Adjusted Gross Profit

For the Quarter Ended June 30

2022

$156

3

$ 159

2021

$ 121

On February 23, 2022, the Company refinanced its existing secured credit facility with a new credit agreement comprised of a $675 million senior secured term loan facility and a $150 million senior secured revolving credit facility. This refinancing resulted in recognition of loss on extinguishment of

debt of $19 million which is comprised of $11 million in deferred financing fee write off, and $8 million of prepayment fees for the previously existing credit facility. Loss on extinguishment of debt is included as non-ordinary costs and fees in the reconciliations above.

The inventory write-off and disposal costs relate to unused stock of a product that the Company reformulated in June 2021 as a result of regulation changes in the E.U. In the interest of having a single formulation for sale worldwide, the Company reformulated on a global basis and is now

disposing of unused stock.

4. Represents non-capitalizable professional fees and executive severance incurred in connection with the Company's initial public offering and the Company's public company transition.

2

$ 123

Represents costs incurred related to the payment to LIQWD, Inc. ("LIQWD"), a predecessor entity to the Company substantially all of whose assets and liabilities were purchased as part of the the acquisition of the Olaplex, LLC business in 2020 by certain investment funds affiliated with Advent

International Corporation and other investors (the "Acquisition"), of certain amounts due in connection with the resolution of certain litigation and contingency matters involving LIQWD, which amounts were required to be paid pursuant to the purchase agreement for the Acquisition.

OLAPLEXView entire presentation