Ares US Real Estate Opportunity Fund III

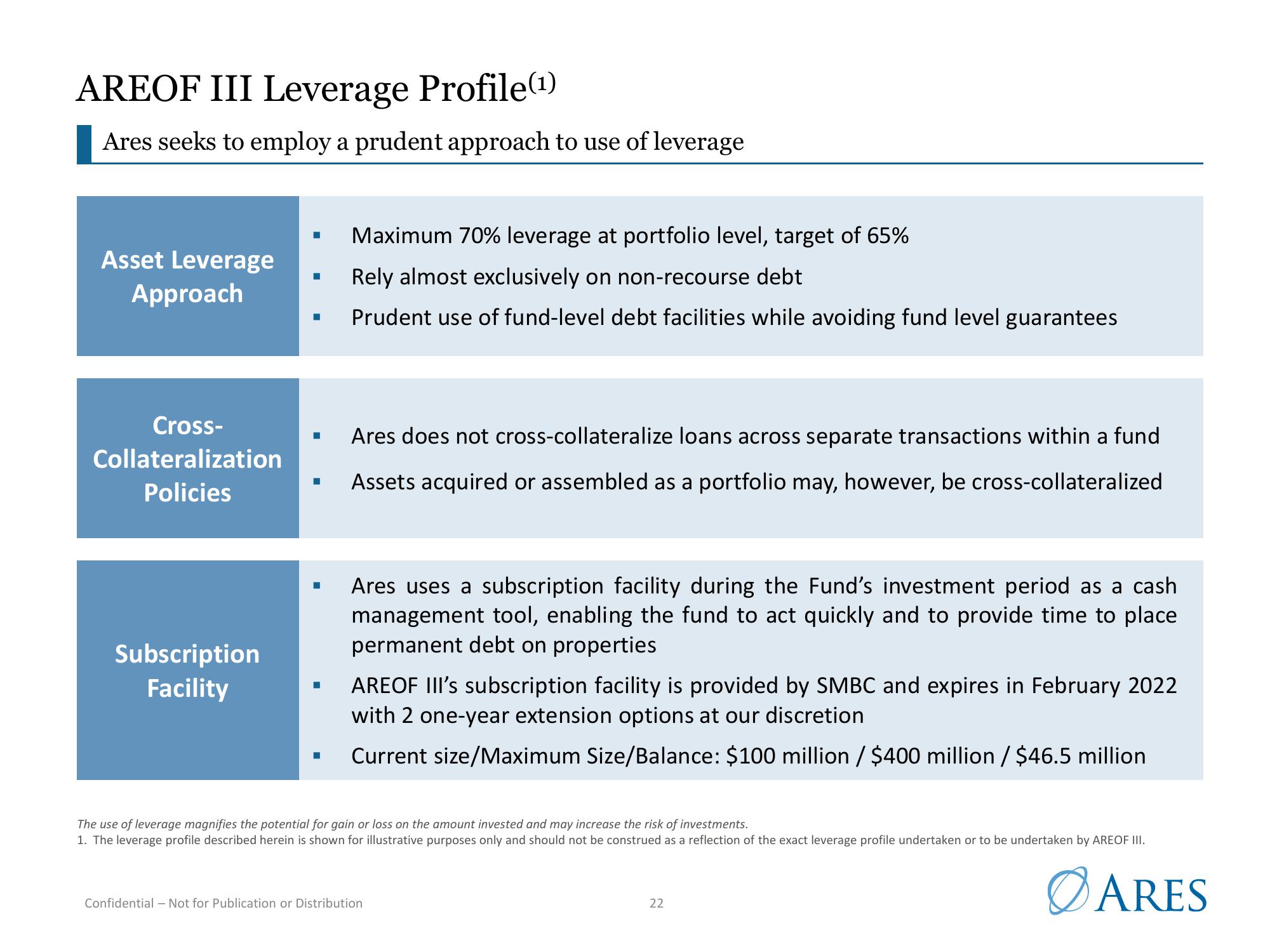

AREOF III Leverage Profile(¹)

Ares seeks to employ a prudent approach to use of leverage

Asset Leverage

Approach

Cross-

Collateralization

Policies

Subscription

Facility

■

I

I

■

■

■

■

■

Maximum 70% leverage at portfolio level, target of 65%

Rely almost exclusively on non-recourse debt

Prudent use of fund-level debt facilities while avoiding fund level guarantees

Ares does not cross-collateralize loans across separate transactions within a fund

Assets acquired or assembled as a portfolio may, however, be cross-collateralized

Ares uses a subscription facility during the Fund's investment period as a cash

management tool, enabling the fund to act quickly and to provide time to place

permanent debt on properties

AREOF III's subscription facility is provided by SMBC and expires in February 2022

with 2 one-year extension options at our discretion

Current size/Maximum Size/Balance: $100 million / $400 million / $46.5 million

The use of leverage magnifies the potential for gain or loss on the amount invested and may increase the risk of investments.

1. The leverage profile described herein is shown for illustrative purposes only and should not be construed as a reflection of the exact leverage profile undertaken or to be undertaken by AREOF III.

Confidential - Not for Publication or Distribution.

22

ARESView entire presentation