Carlyle Investor Conference Presentation Deck

Reconciliation for Total Segment Information, continued

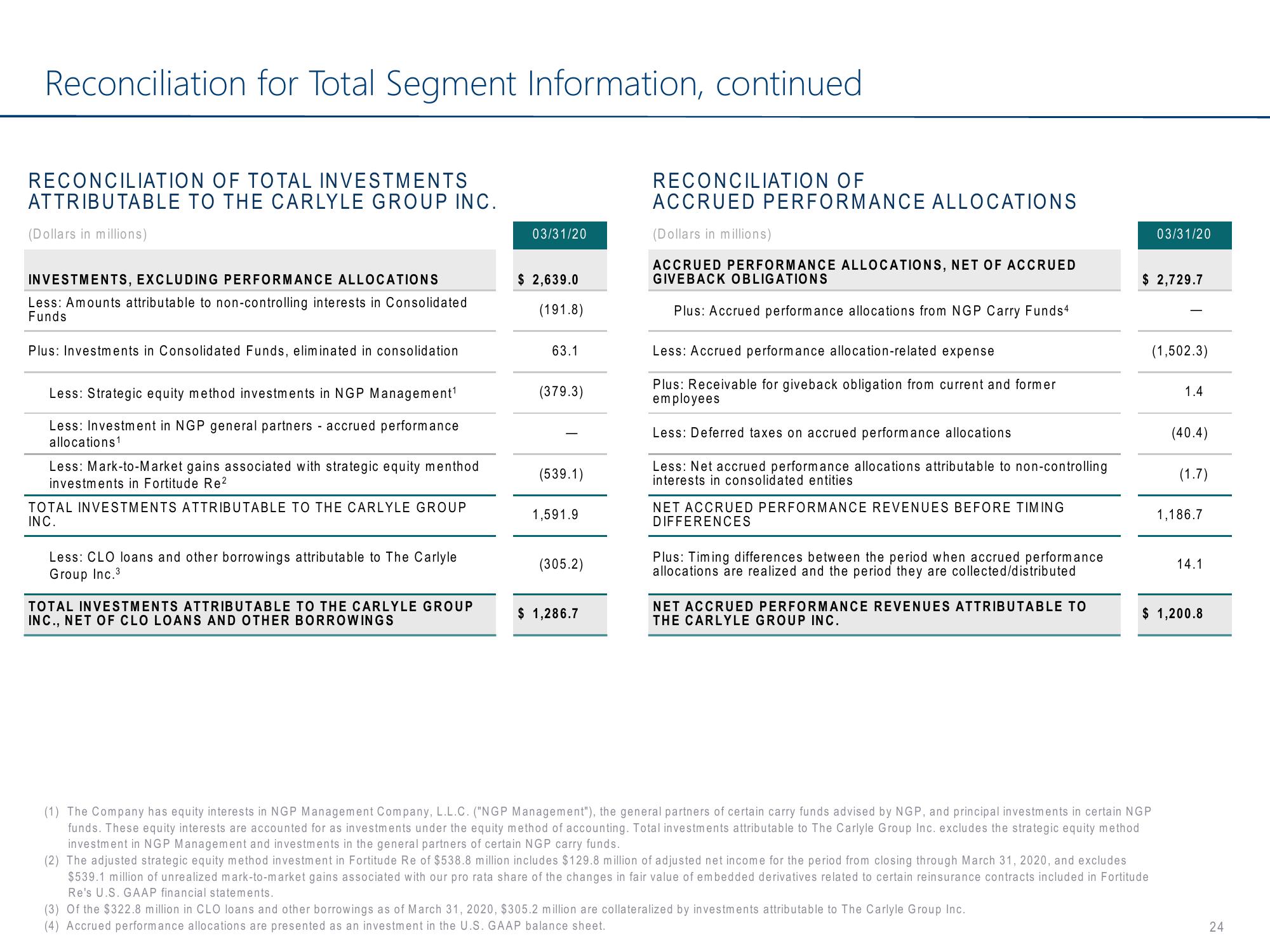

RECONCILIATION OF TOTAL INVESTMENTS

ATTRIBUTABLE TO THE CARLYLE GROUP INC.

(Dollars in millions)

INVESTMENTS, EXCLUDING PERFORMANCE ALLOCATIONS

Less: Amounts attributable to non-controlling interests in Consolidated

Funds

Plus: Investments in Consolidated Funds, eliminated in consolidation.

Less: Strategic equity method investments in NGP Management¹

Less: Investment in NGP general partners accrued performance

allocations 1

Less: Mark-to-Market gains associated with strategic equity menthod

investments in Fortitude Re²

TOTAL INVESTMENTS ATTRIBUTABLE TO THE CARLYLE GROUP

INC.

Less: CLO loans and other borrowings attributable to The Carlyle

Group Inc. 3

TOTAL INVESTMENTS ATTRIBUTABLE TO THE CARLYLE GROUP

INC., NET OF CLO LOANS AND OTHER BORROWINGS

03/31/20

$ 2,639.0

(191.8)

63.1

(379.3)

(539.1)

1,591.9

(305.2)

$ 1,286.7

RECONCILIATION OF

ACCRUED PERFORMANCE ALLOCATIONS

(Dollars in millions)

ACCRUED PERFORMANCE ALLOCATIONS, NET OF ACCRUED

GIVEBACK OBLIGATIONS

Plus: Accrued performance allocations from NGP Carry Funds4

Less: Accrued performance allocation-related expense

Plus: Receivable for giveback obligation from current and former

employees

Less: Deferred taxes on accrued performance allocations

Less: Net accrued performance allocations attributable to non-controlling

interests in consolidated entities

NET ACCRUED PERFORMANCE REVENUES BEFORE TIMING

DIFFERENCES

Plus: Timing differences between the period when accrued performance

allocations are realized and the period they are collected/distributed

NET ACCRUED PERFORMANCE REVENUES ATTRIBUTABLE TO

THE CARLYLE GROUP INC.

(3) Of the $322.8 million in CLO loans and other borrowings as of March 31, 2020, $305.2 million are collateralized by investments attributable to The Carlyle Group Inc.

(4) Accrued performance allocations are presented as an investment in the U.S. GAAP balance sheet.

03/31/20

$ 2,729.7

(1) The Company has equity interests in NGP Management Company, L.L.C. ("NGP Management"), the general partners of certain carry funds advised by NGP, and principal investments in certain NGP

funds. These equity interests are accounted for as investments under the equity method of accounting. Total investments attributable to The Carlyle Group Inc. excludes the strategic equity method

investment in NGP Management and investments in the general partners of certain NGP carry funds.

(2) The adjusted strategic equity method investment in Fortitude Re of $538.8 million includes $129.8 million of adjusted net income for the period from closing through March 31, 2020, and excludes

$539.1 million of unrealized mark-to-market gains associated with our pro rata share of the changes in fair value of embedded derivatives related to certain reinsurance contracts included in Fortitude

Re's U.S. GAAP financial statements.

(1,502.3)

1.4

(40.4)

(1.7)

1,186.7

14.1

$ 1,200.8

24View entire presentation