Silicon Valley Bank Results Presentation Deck

Robust growth in interest-earning assets as deposit inflows drive

significant securities purchases and elevated cash balances

FY'21 key drivers

• Continue to invest excess on-balance sheet liquidity in high-quality

securities - focused on supporting yields and preserving liquidity

and flexibility

●

●

Q4'20 activity

Purchased $11.4B securities (1.24% weighted average yield, 4.5y

duration) vs. roll-offs of $2.8B at 2.27%

Purchases included agency-issued MBS/CMOS/CMBS and high-quality

munis with attractive risk-adjusted returns

Despite significant purchase activity, exceeded average cash target of

$7-9B due to surge in deposits

●

• $23M net premium amortization expense included $12.7M onetime

benefit (+12 bps impact to portfolio yield) due to change in prepay

assumptions¹

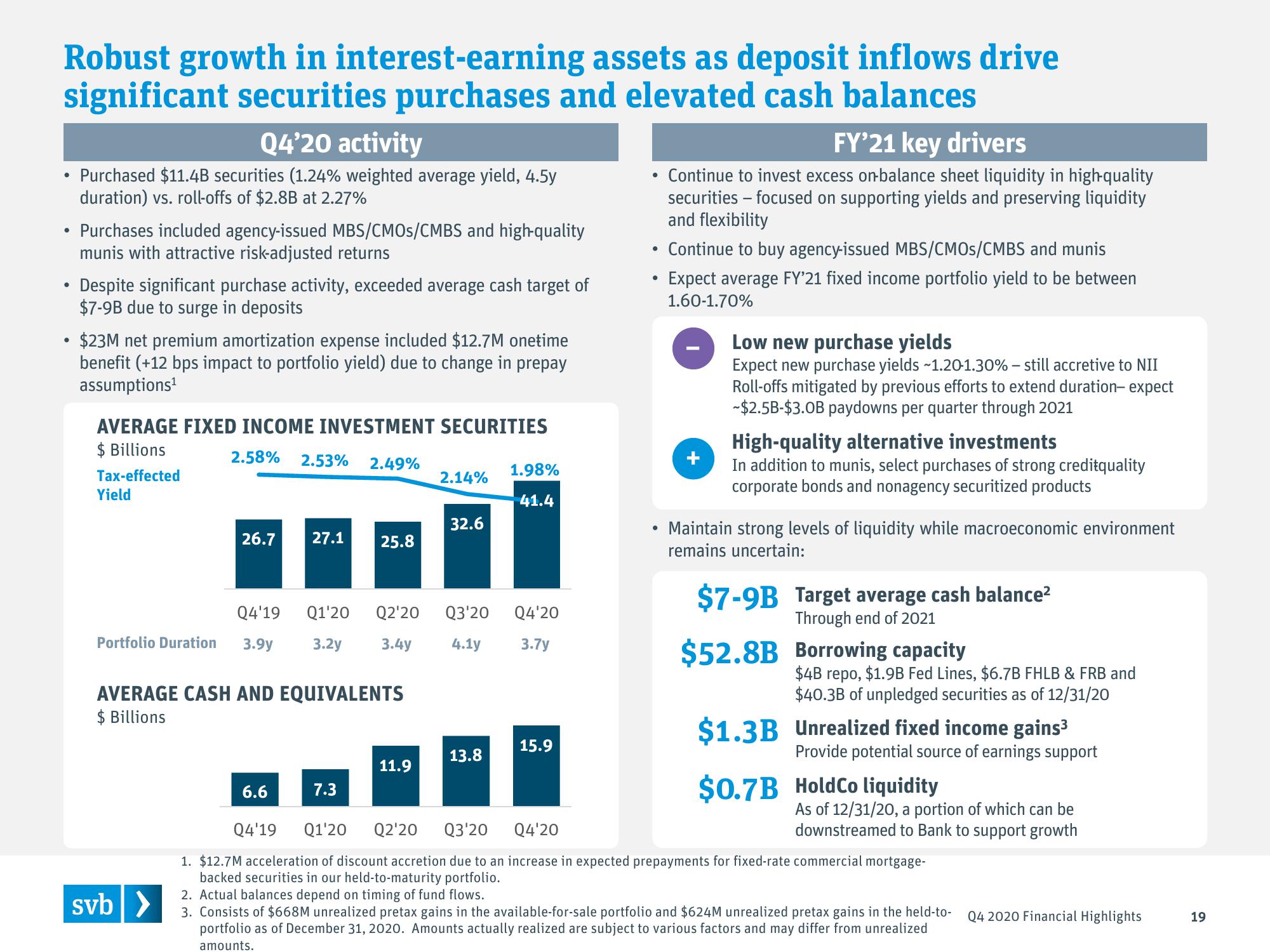

AVERAGE FIXED INCOME INVESTMENT SECURITIES

$ Billions

2.58% 2.53% 2.49%

Tax-effected

Yield

26.7 27.1 25.8

Q4'19

Portfolio Duration 3.9y 3.2y

svb >

AVERAGE CASH AND EQUIVALENTS

$ Billions

6.6

Q1'20 Q2'20 Q3'20 Q4'20

3.4y 4.1y

3.7y

7.3

2.14%

11.9

32.6

1.98%

41.4

13.8

15.9

●

●

●

Continue to buy agency-issued MBS/CMOS/CMBS and munis

Expect average FY'21 fixed income portfolio yield to be between

1.60-1.70%

Low new purchase yields

Expect new purchase yields ~1.20-1.30% - still accretive to NII

Roll-offs mitigated by previous efforts to extend duration-expect

-$2.5B-$3.0B paydowns per quarter through 2021

High-quality alternative investments

In addition to munis, select purchases of strong creditquality

corporate bonds and nonagency securitized products

Maintain strong levels of liquidity while macroeconomic environment

remains uncertain:

$7-9B Target average cash balance²

Through end of 2021

$52.8B Borrowing capacity

$4B repo, $1.9B Fed Lines, $6.7B FHLB & FRB and

$40.3B of unpledged securities as of 12/31/20

$1.3B Unrealized fixed income gains³

Provide potential source of earnings support

$0.7B HoldCo liquidity

As of 12/31/20, a portion of which can be

downstreamed to Bank to support growth

Q4'19 Q1'20 Q2'20 Q3'20 Q4'20

1. $12.7M acceleration of discount accretion due to an increase in expected prepayments for fixed-rate commercial mortgage-

backed securities in our held-to-maturity portfolio.

2. Actual balances depend on timing of fund flows.

3. Consists of $668M unrealized pretax gains in the available-for-sale portfolio and $624M unrealized pretax gains in the held-to-

portfolio as of December 31, 2020. Amounts actually realized are subject to various factors and may differ from unrealized

amounts.

Q4 2020 Financial Highlights

19View entire presentation