Markforged SPAC Presentation Deck

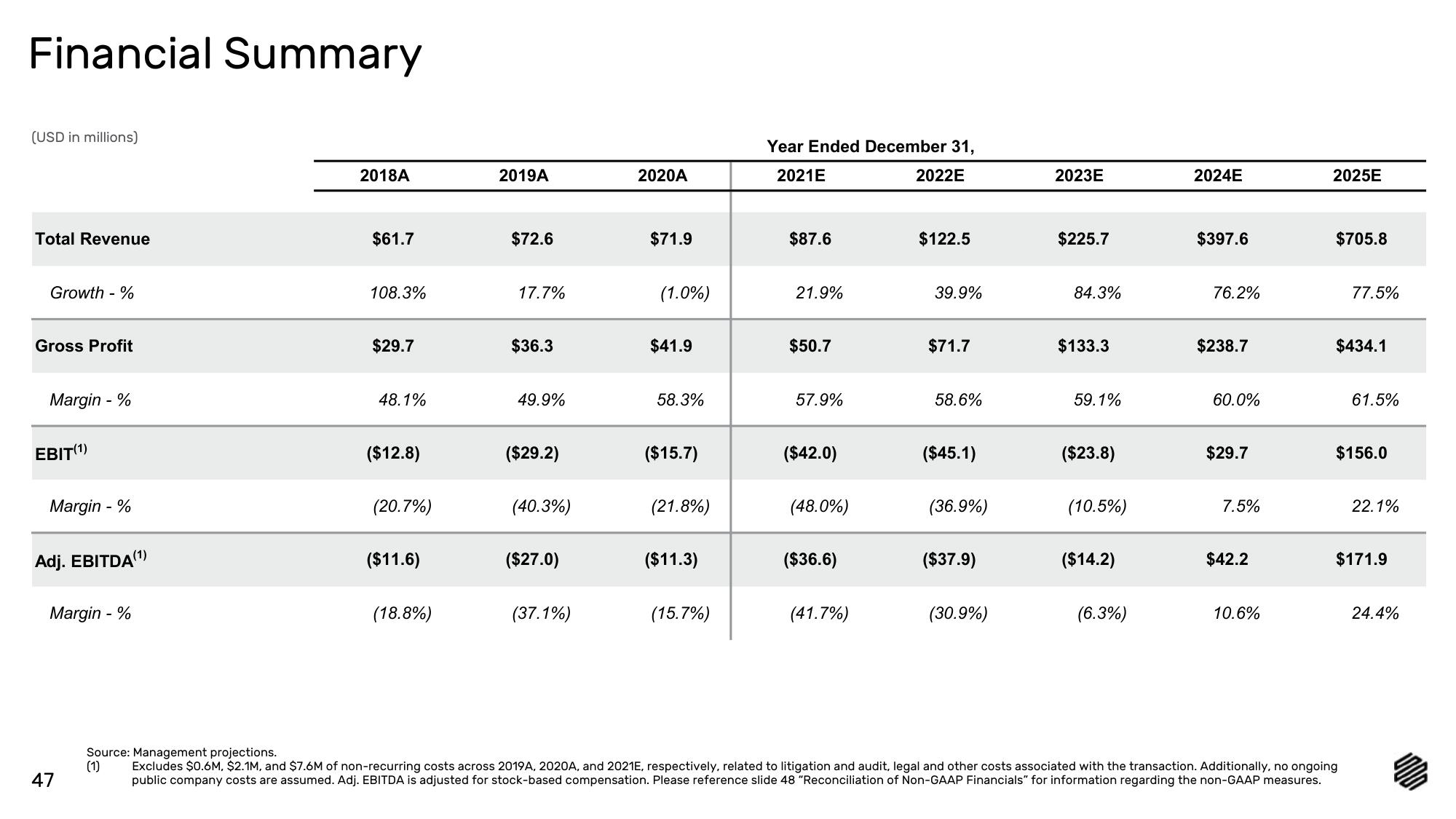

Financial Summary

(USD in millions)

Total Revenue

Growth - %

Gross Profit

Margin - %

EBIT(1¹)

Margin - %

Adj. EBITDA (1)

Margin - %

47

2018A

$61.7

108.3%

$29.7

48.1%

($12.8)

(20.7%)

($11.6)

(18.8%)

2019A

$72.6

17.7%

$36.3

49.9%

($29.2)

(40.3%)

($27.0)

(37.1%)

2020A

$71.9

(1.0%)

$41.9

58.3%

($15.7)

(21.8%)

($11.3)

(15.7%)

Year Ended December 31,

2021E

2022E

$87.6

21.9%

$50.7

57.9%

($42.0)

(48.0%)

($36.6)

(41.7%)

$122.5

39.9%

$71.7

58.6%

($45.1)

(36.9%)

($37.9)

(30.9%)

2023E

$225.7

84.3%

$133.3

59.1%

($23.8)

(10.5%)

($14.2)

(6.3%)

2024E

$397.6

76.2%

$238.7

60.0%

$29.7

7.5%

$42.2

10.6%

2025E

$705.8

77.5%

$434.1

61.5%

$156.0

Source: Management projections.

(1)

Excludes $0.6M, $2.1M, and $7.6M of non-recurring costs across 2019A, 2020A, and 2021E, respectively, related to litigation and audit, legal and other costs associated with the transaction. Additionally, no ongoing

public company costs are assumed. Adj. EBITDA is adjusted for stock-based compensation. Please reference slide 48 "Reconciliation of Non-GAAP Financials" for information regarding the non-GAAP measures.

22.1%

$171.9

24.4%View entire presentation