Avantor Results Presentation Deck

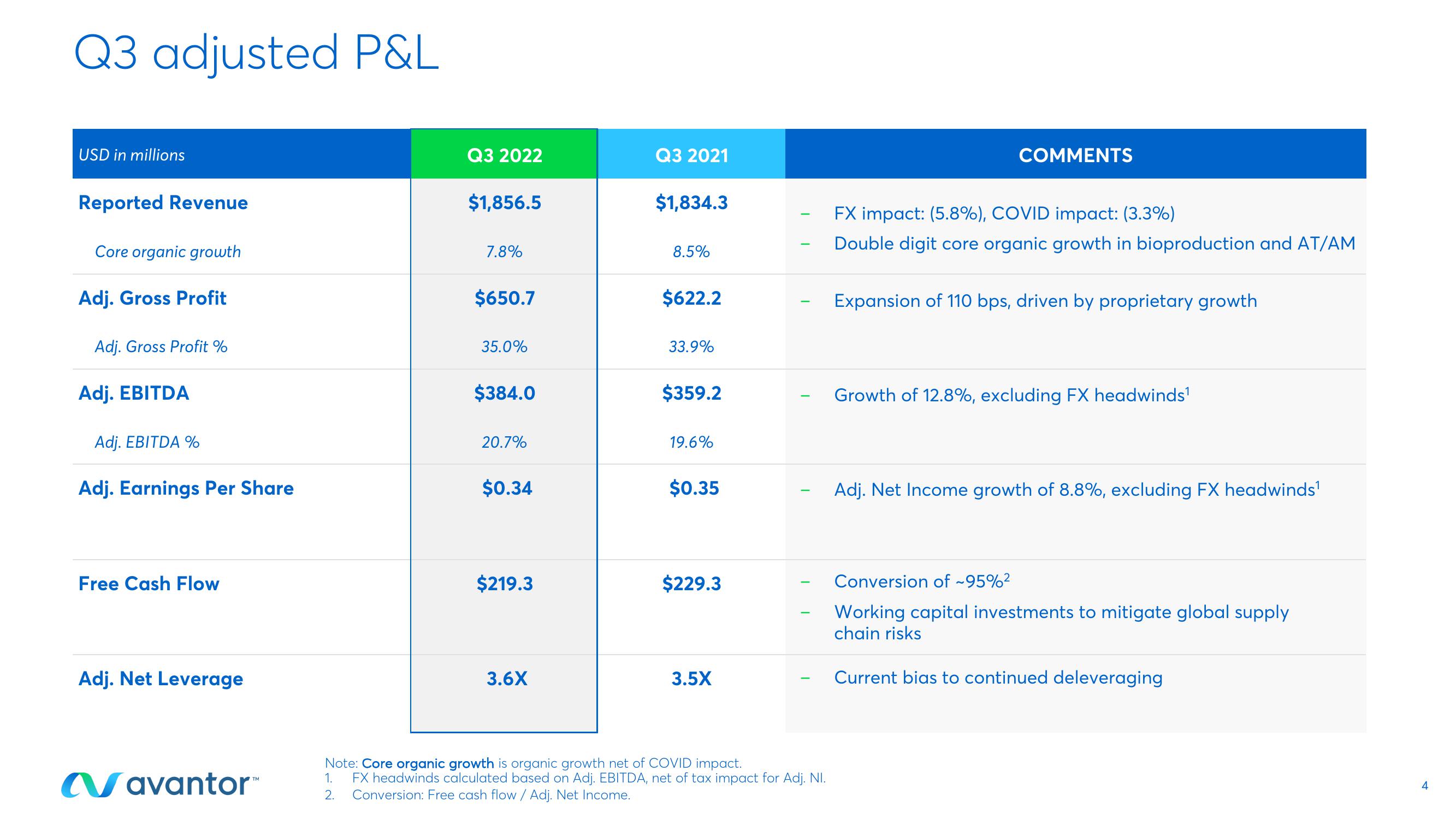

Q3 adjusted P&L

USD in millions

Reported Revenue

Core organic growth

Adj. Gross Profit

Adj. Gross Profit %

Adj. EBITDA

Adj. EBITDA %

Adj. Earnings Per Share

Free Cash Flow

Adj. Net Leverage

Navantor™

Q3 2022

$1,856.5

7.8%

$650.7

35.0%

$384.0

20.7%

$0.34

$219.3

3.6X

Q3 2021

$1,834.3

8.5%

$622.2

33.9%

$359.2

19.6%

$0.35

$229.3

3.5X

-

-

Note: Core organic growth is organic growth net of COVID impact.

1.

FX headwinds calculated based on Adj. EBITDA, net of tax impact for Adj. NI.

2. Conversion: Free cash flow / Adj. Net Income.

COMMENTS

FX impact: (5.8%), COVID impact: (3.3%)

Double digit core organic growth in bioproduction and AT/AM

Expansion of 110 bps, driven by proprietary growth

Growth of 12.8%, excluding FX headwinds¹

Adj. Net Income growth of 8.8%, excluding FX headwinds¹

Conversion of ~95%²

Working capital investments to mitigate global supply

chain risks

Current bias to continued deleveraging

4View entire presentation