TPG Results Presentation Deck

Fee-Related Earnings

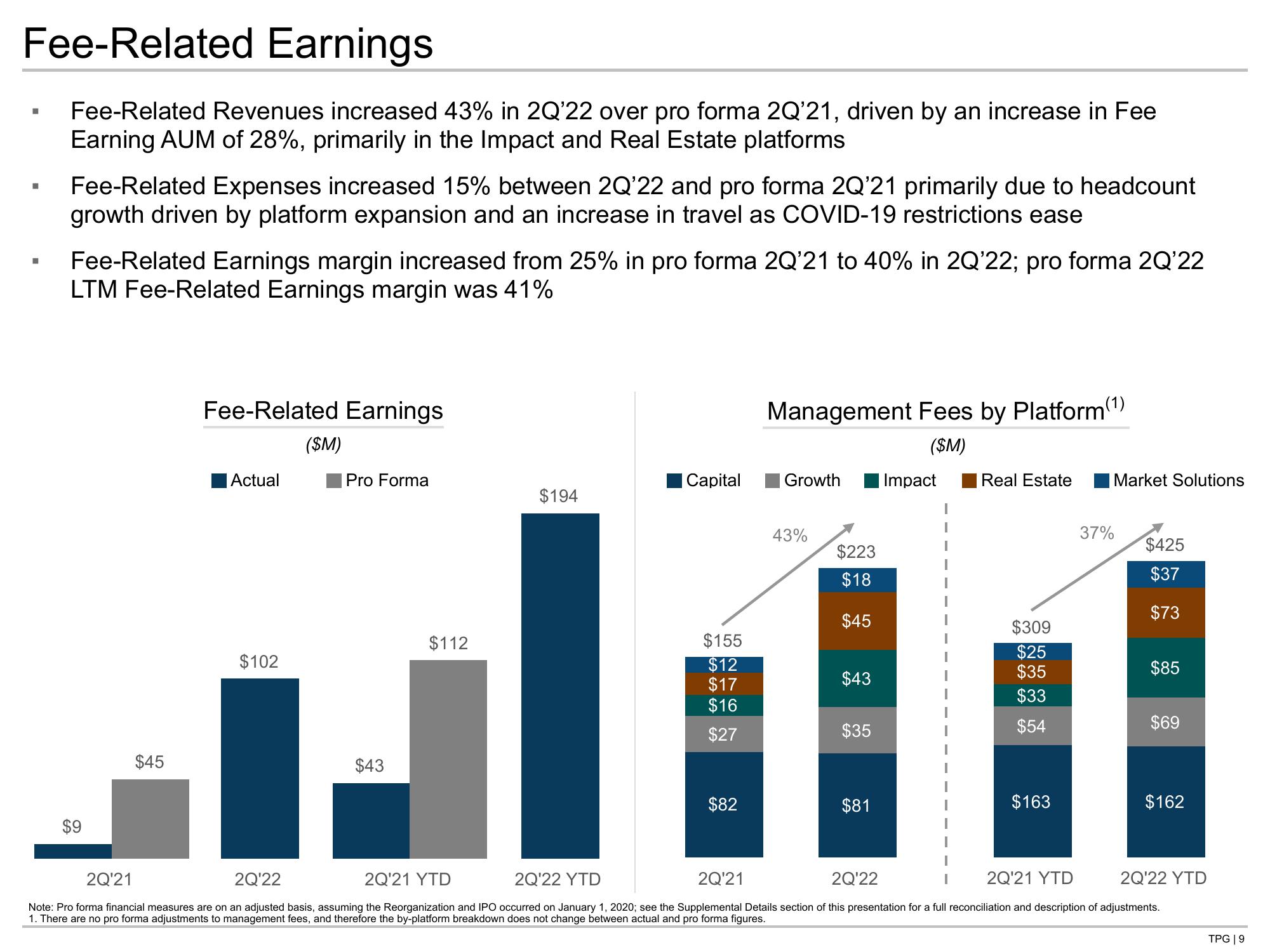

Fee-Related Revenues increased 43% in 2Q'22 over pro forma 2Q'21, driven by an increase in Fee

Earning AUM of 28%, primarily in the Impact and Real Estate platforms

H

■

■

Fee-Related Expenses increased 15% between 2Q'22 and pro forma 2Q'21 primarily due to headcount

growth driven by platform expansion and an increase in travel as COVID-19 restrictions ease

Fee-Related Earnings margin increased from 25% in pro forma 2Q'21 to 40% in 2Q'22; pro forma 2Q'22

LTM Fee-Related Earnings margin was 41%

$9

$45

Fee-Related Earnings

Actual

$102

($M)

Pro Forma

$43

$112

$194

Capital

$155

$12

$17

$16

$27

$82

Management Fees by Platform(1)

($M)

Growth Impact Real Estate

43%

$223

$18

$45

$43

$35

$81

$309

$25

$35

$33

$54

$163

37%

Market Solutions

$425

$37

$73

$85

$69

$162

2Q'22

2Q'21 YTD

2Q'22 YTD

2Q'21

2Q'22

2Q'21 YTD

2Q'22 YTD

2Q¹21

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Supplemental Details section of this presentation for a full reconciliation and description of adjustments.

1. There are no pro forma adjustments to management fees, and therefore the by-platform breakdown does not change between actual and pro forma figures.

TPG | 9View entire presentation