HBT Financial Results Presentation Deck

Earnings Overview

($000)

Interest and dividend

income

Interest expense

Net interest income

Provision for credit losses

Net interest income

after provision for credit

losses

Noninterest income

Noninterest expense

Income before income

tax expense

Income tax expense

Net income

3Q23

$59,041

10,762

48,279

480

47,799

9,490

30,671

26,618

6,903

$19,715

Prior Quarter

Non-GAAP Adjusted

Adj.¹ 3Q23¹

1

$59,041

10,762

48,279

480

4.07%

3Q23

790

47,799

226 7,129

$564 $20,279

Current Quarter

4Q23

0.01%

$61,411

14,327

47,084

1,113

10,280

9,205

30,671 30,387

45,971

790 27,408 24,789

6,343

$18,446

0.16%

Non-GAAP Adjusted

Adj. ¹ 4Q23¹

$61,411

14,327

47,084

1,113

1,155

10,360

30,387

1,155 25,944

329 6,672

$826 $19,272

4Q23 NIM Analysis*

45,971

(0.01)%

Nonaccrual Loans² Other

Interest

Recoveries

Earning

Assets

(0.34)%

Deposit

Costs

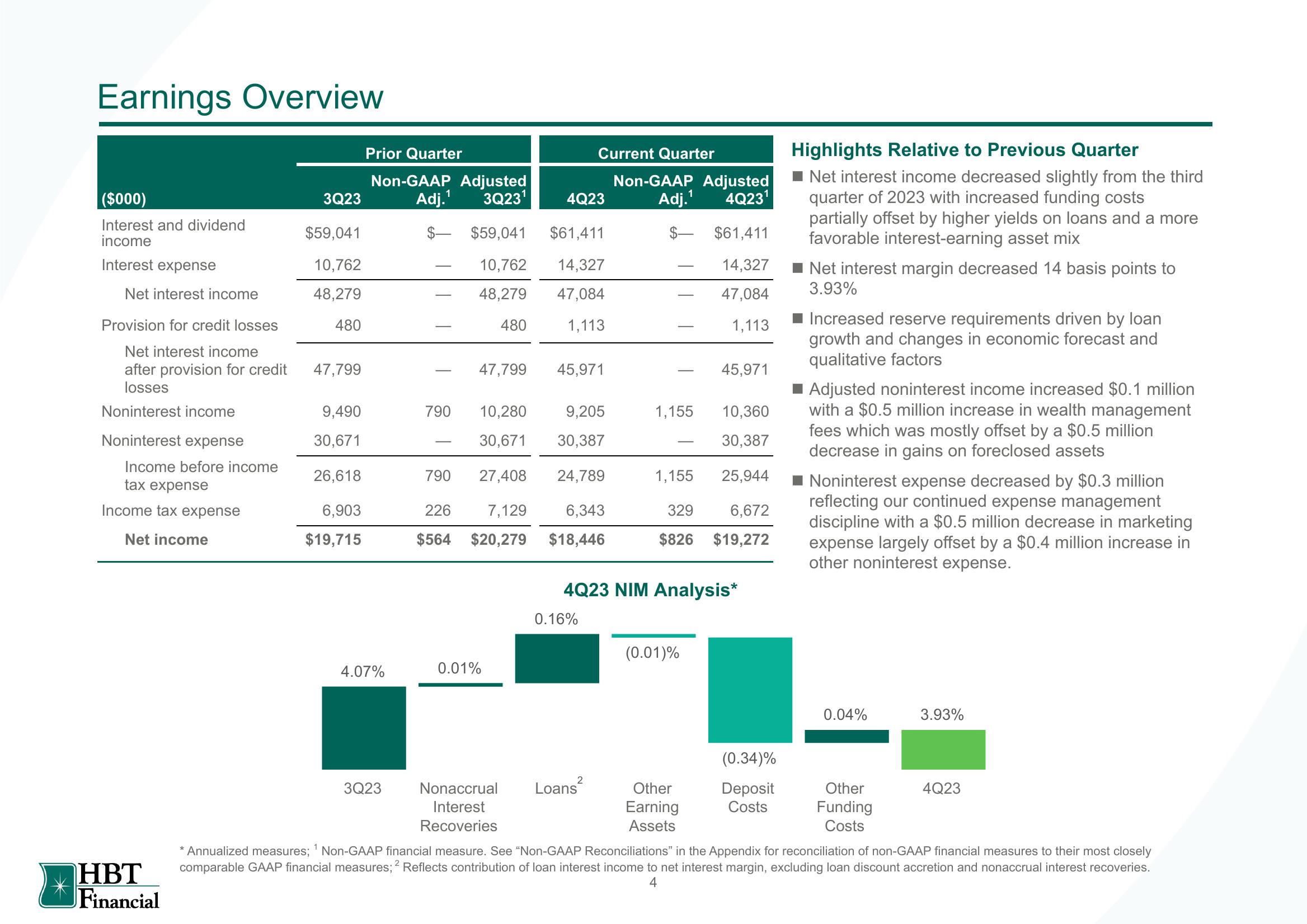

Highlights Relative to Previous Quarter

■ Net interest income decreased slightly from the third

quarter of 2023 with increased funding costs

partially offset by higher yields on loans and a more

favorable interest-earning asset mix

■ Net interest margin decreased 14 basis points to

3.93%

Increased reserve requirements driven by loan

growth and changes in economic forecast and

qualitative factors

Adjusted noninterest income increased $0.1 million

with a $0.5 million increase in wealth management

fees which was mostly offset by a $0.5 million

decrease in gains on foreclosed assets

Noninterest expense decreased by $0.3 million

reflecting our continued expense management

discipline with a $0.5 million decrease in marketing

expense largely offset by a $0.4 million increase in

other noninterest expense.

0.04%

Other

Funding

Costs

3.93%

4Q23

* Annualized measures; Non-GAAP financial measure. See "Non-GAAP Reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely

2

HBT comparable GAAP financial measures; ² Reflects contribution of loan interest income to net interest margin, excluding loan discount accretion and nonaccrual interest recoveries.

Financial

4View entire presentation