J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

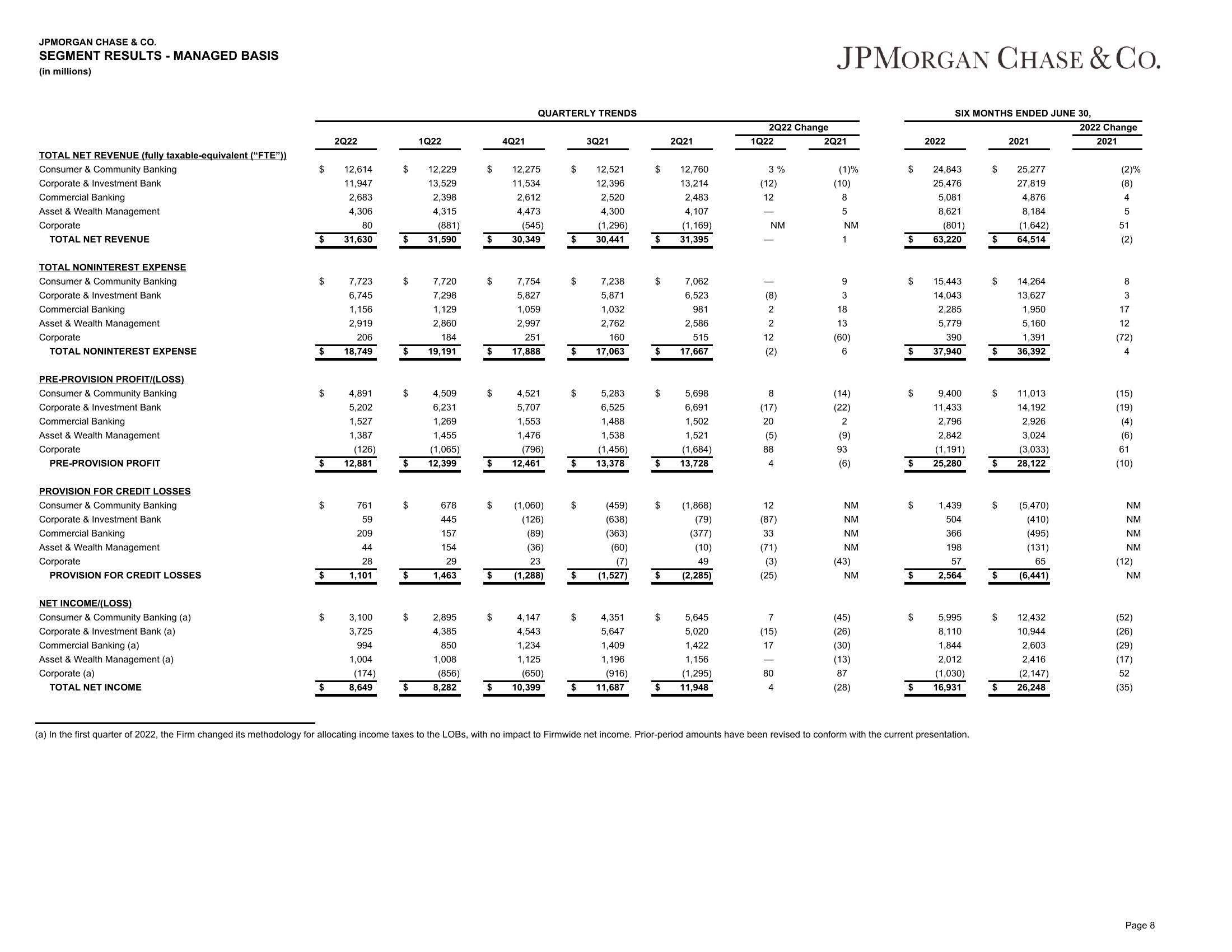

SEGMENT RESULTS - MANAGED BASIS

(in millions)

TOTAL NET REVENUE (fully taxable-equivalent ("FTE"))

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

TOTAL NONINTEREST EXPENSE

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NONINTEREST EXPENSE

PRE-PROVISION PROFIT/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PRE-PROVISION PROFIT

PROVISION FOR CREDIT LOSSES

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

PROVISION FOR CREDIT LOSSES

NET INCOME/(LOSS)

Consumer & Community Banking (a)

Corporate & Investment Bank (a)

Commercial Banking (a)

Asset & Wealth Management (a)

Corporate (a)

TOTAL NET INCOME

$

$

$

$

$

$

$

$

2Q22

(126)

$ 12,881

$

12,614

11,947

2,683

4,306

80

31,630

7,723

6,745

1,156

2,919

206

18,749

4,891

5,202

1,527

1,387

761

59

209

44

28

1,101

3,100

3,725

994

1,004

(174)

8,649

$

$

$

$

7,720

7,298

1,129

2,860

184

$ 19,191

$

$

$

1Q22

$

12,229

13,529

2,398

4,315

(881)

31,590

4,509

6,231

1,269

1,455

(1,065)

12,399

678

445

157

154

29

1,463

2,895

4,385

850

1,008

(856)

8,282

$

$

$

$

$

4Q21

$

QUARTERLY TRENDS

12,275

11,534

2,612

4,473

(545)

30,349

7,754

5,827

1,059

2,997

251

17,888

4,521

5,707

(796)

$ 12,461

1,553

1,476

(1,060)

(126)

(89)

(36)

23

(1,288)

4,147

4,543

1,234

1,125

(650)

$ 10,399

$

$

$

$

$

$

3Q21

5,283

6,525

1,488

1,538

(1,456)

$ 13,378

$

12,521

12,396

2,520

4,300

(1,296)

30,441

7,238

5,871

1,032

2,762

160

17,063

(459)

(638)

(363)

(60)

(7)

(1,527)

4,351

5,647

1,409

1,196

(916)

$ 11,687

$

$

$

$

$

$

$ 5,698

6,691

1,502

1,521

(1,684)

13,728

$

$

2Q21

$

12,760

13,214

2,483

4,107

(1,169)

31,395

7,062

6,523

981

2,586

515

17,667

(1,868)

(79)

(377)

(10)

49

(2,285)

5,645

5,020

1,422

1,156

(1,295)

11,948

2Q22 Change

1Q22

3%

(12)

12

NM

(8)

2

2

12

(2)

8

(17)

20

(5)

88

4

12

(87)

33

(71)

(3)

(25)

7

(15)

17

80

4

JPMORGAN CHASE & Co.

2Q21

(1)%

(10)

8

5

NM

1

9

3

18

13

(60)

6

(14)

(22)

2

(9)

93

(6)

NM

NM

NM

NM

(43)

NM

(45)

(26)

(30)

(13)

87

(28)

$

$

$

$

$

$

$

9,400

11,433

2,796

2,842

(1,191)

$ 25,280

$

2022

$

SIX MONTHS ENDED JUNE 30,

24,843

25,476

5,081

8,621

(801)

63,220

15,443

14,043

2,285

5,779

390

37,940

1,439

504

366

198

57

2,564

5,995

8,110

1,844

2,012

(1,030)

16,931

(a) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

$

25,277

27,819

4,876

8,184

(1,642)

$ 64,514

$

$

$

$

$

$

2021

$

14,264

13,627

1,950

5,160

1,391

36,392

11,013

14,192

2,926

3,024

(3,033)

28,122

(5,470)

(410)

(495)

(131)

65

(6,441)

12,432

10,944

2,603

2,416

(2,147)

26,248

2022 Change

2021

(2)%

(8)

4

5

51

(2)

N N w o

(72)

(15)

(19)

(4)

(6)

61

(10)

NM

NM

NM

NM

(12)

NM

(52)

(26)

(29)

(17)

52

(35)

Page 8View entire presentation