Benson Hill SPAC Presentation Deck

BENSON HILL

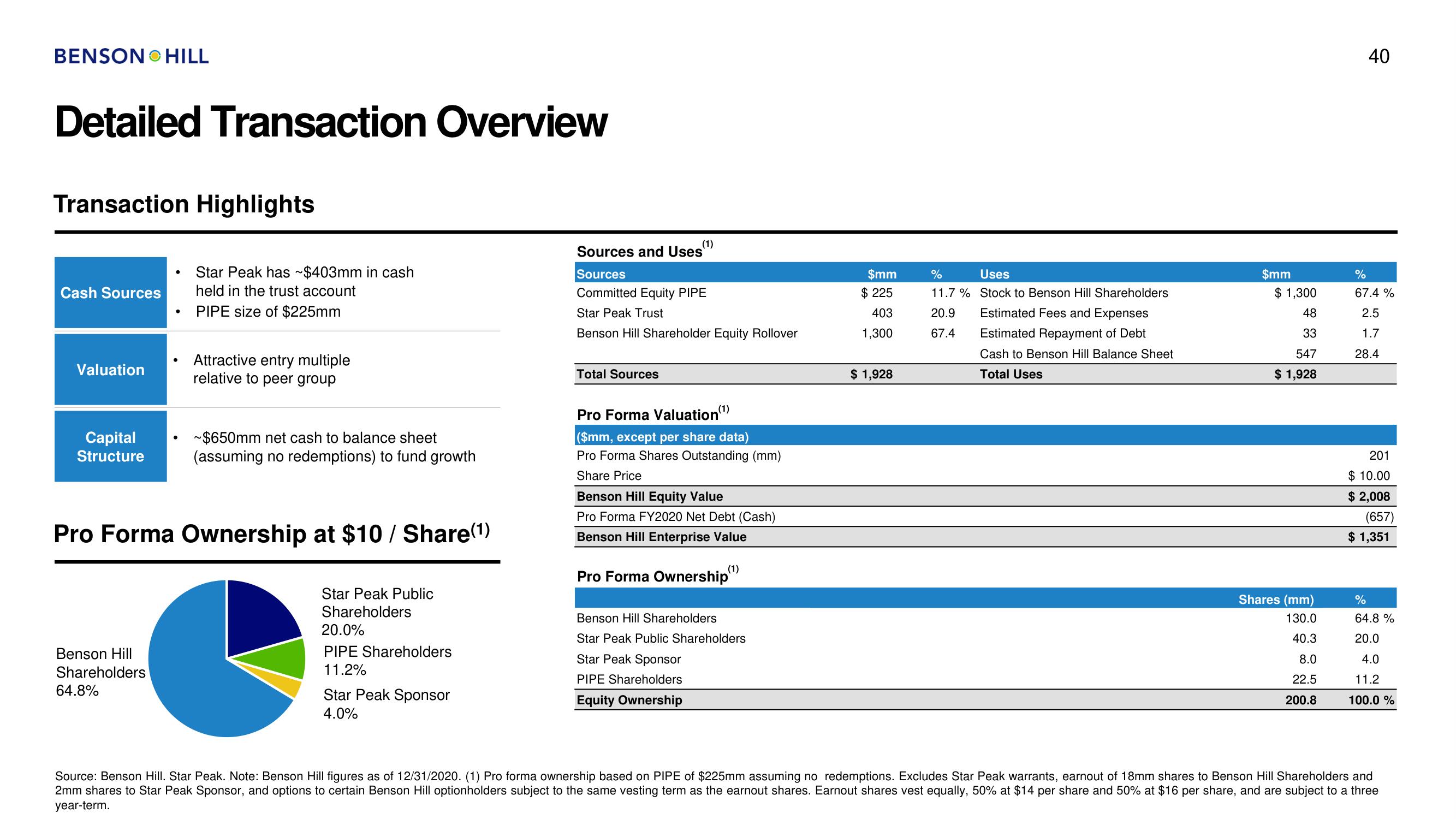

Detailed Transaction Overview

Transaction Highlights

Cash Sources

Valuation

Capital

Structure

●

Benson Hill

Shareholders

64.8%

●

Star Peak has ~$403mm in cash

held in the trust account

PIPE size of $225mm

Attractive entry multiple

relative to peer group

~$650mm net cash to balance sheet

(assuming no redemptions) to fund growth

Pro Forma Ownership at $10 / Share (¹)

Star Peak Public

Shareholders

20.0%

PIPE Shareholders

11.2%

Star Peak Sponsor

4.0%

(1)

Sources and Uses

Sources

Committed Equity PIPE

Star Peak Trust

Benson Hill Shareholder Equity Rollover

Total Sources

Pro Forma Valuation (¹)

($mm, except per share data)

Pro Forma Shares Outstanding (mm)

Share Price

Benson Hill Equity Value

Pro Forma FY2020 Net Debt (Cash)

Benson Hill Enterprise Value

Pro Forma Ownership

Benson Hill Shareholders

Star Peak Public Shareholders

Star Peak Sponsor

PIPE Shareholders

Equity Ownership

$mm

$225

403

1,300

$ 1,928

Uses

%

11.7% Stock to Benson Hill Shareholders

Estimated Fees and Expenses

20.9

67.4

Estimated Repayment of Debt

Cash to Benson Hill Balance Sheet

Total Uses

$mm

$ 1,300

48

33

547

$ 1,928

Shares (mm)

130.0

40.3

8.0

22.5

200.8

40

%

67.4 %

2.5

1.7

28.4

201

$10.00

$ 2,008

(657)

$ 1,351

%

64.8 %

20.0

4.0

11.2

100.0 %

Source: Benson Hill. Star Peak. Note: Benson Hill figures as of 12/31/2020. (1) Pro forma ownership based on PIPE of $225mm assuming no redemptions. Excludes Star Peak warrants, earnout of 18mm shares to Benson Hill Shareholders and

2mm shares to Star Peak Sponsor, and options to certain Benson Hill optionholders subject to the same vesting term as the earnout shares. Earnout shares vest equally, 50% at $14 per share and 50% at $16 per share, and are subject to a three

year-term.View entire presentation