Apollo Global Management Investor Day Presentation Deck

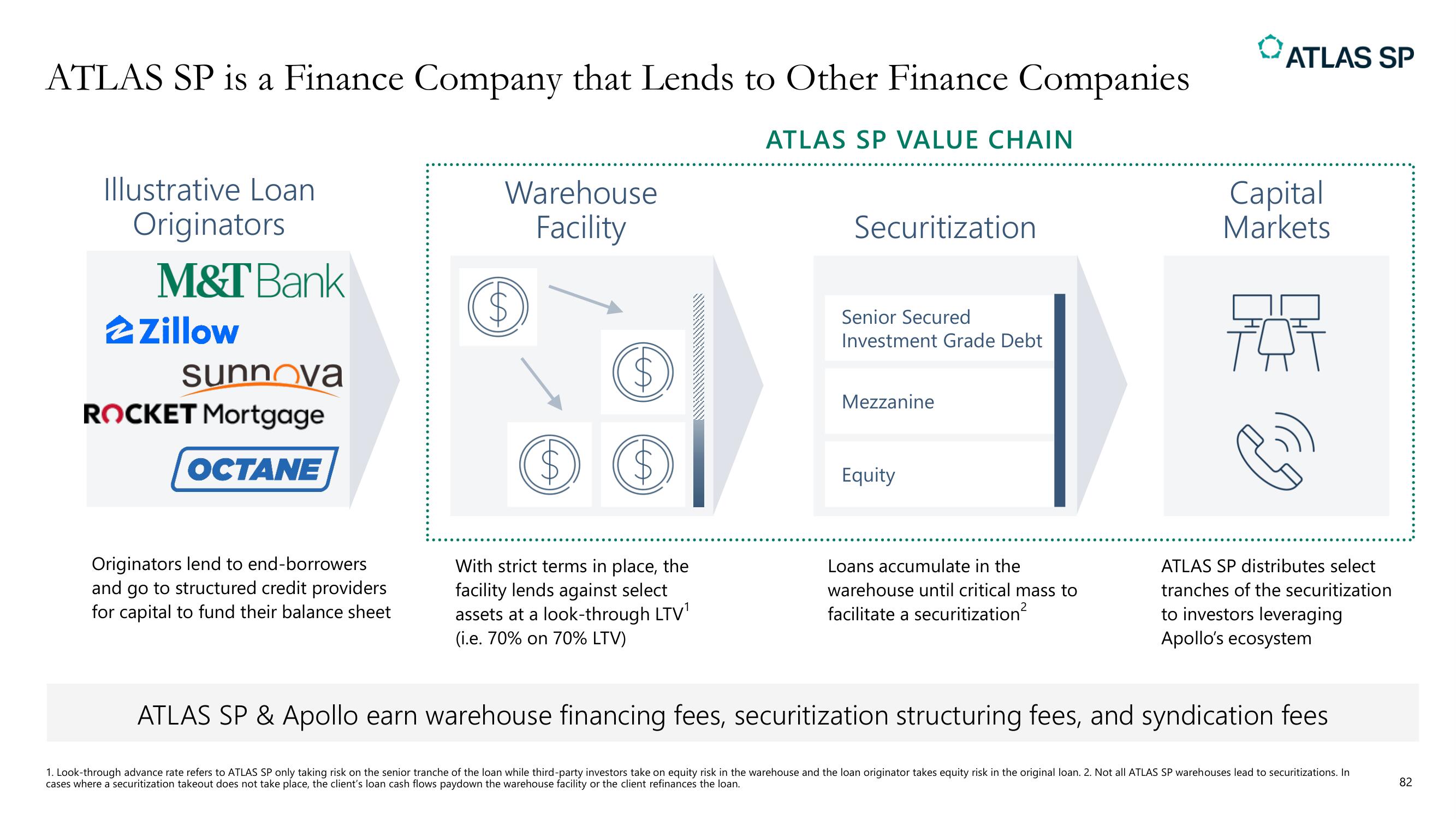

ATLAS SP is a Finance Company that Lends to Other Finance Companies

ATLAS SP VALUE CHAIN

Illustrative Loan

Originators

M&T Bank

Zillow

sunnova

ROCKET Mortgage

OCTANE

Originators lend to end-borrowers

and go to structured credit providers

for capital to fund their balance sheet

Warehouse

Facility

LEA

$

SA

With strict terms in place, the

facility lends against select

assets at a look-through LTV¹

(i.e. 70% on 70% LTV)

Securitization

Senior Secured

Investment Grade Debt

Mezzanine

Equity

Loans accumulate in the

warehouse until critical mass to

facilitate a securitization²

ATLAS SP

Capital

Markets

FR

راحی

ATLAS SP distributes select

tranches of the securitization

to investors leveraging

Apollo's ecosystem

ATLAS SP & Apollo earn warehouse financing fees, securitization structuring fees, and syndication fees

1. Look-through advance rate refers to ATLAS SP only taking risk on the senior tranche of the loan while third-party investors take on equity risk in the warehouse and the loan originator takes equity risk in the original loan. 2. Not all ATLAS SP warehouses lead to securitizations. In

cases where a securitization takeout does not take place, the client's loan cash flows paydown the warehouse facility or the client refinances the loan.

82View entire presentation