First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

5.5%

5.0%

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

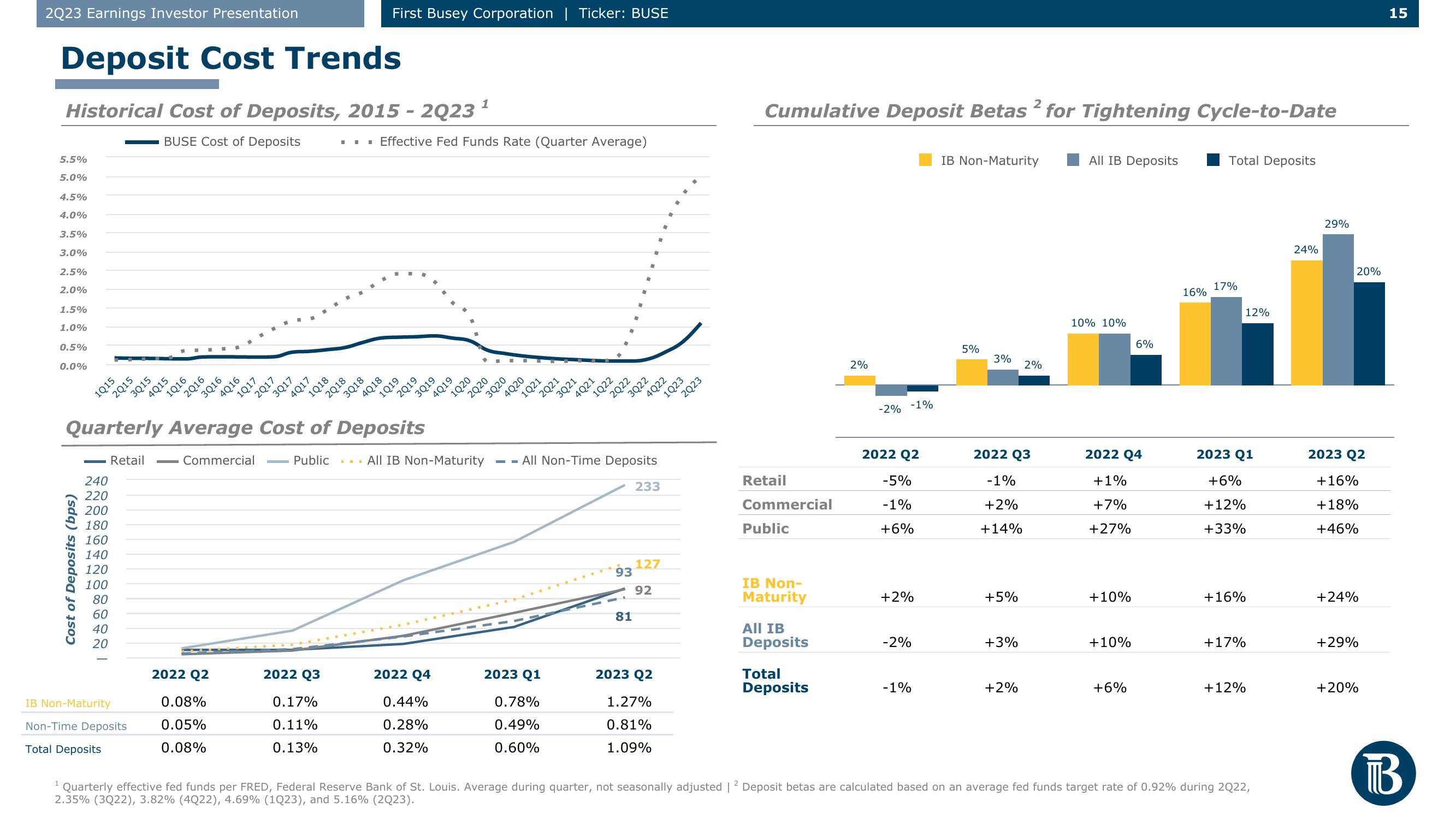

Deposit Cost Trends

1

Historical Cost of Deposits, 2015 - 2023 ¹

BUSE Cost of Deposits

1.5%

1.0%

1

0.5%

0.0%

1Q15

Cost of Deposits (bps)

2015

240

220

200

180

160

140

120

100

80

60

40

20

IB Non-Maturity

Retail

Non-Time Deposits

Total Deposits

3Q15

4Q15

1Q16

2Q16

3Q16

4Q16

2022 Q2

1Q17

Commercial

0.08%

0.05%

0.08%

2Q17

3Q17

4Q17

Quarterly Average Cost of Deposits

1Q18

Public

2022 Q3

0.17%

0.11%

0.13%

▪ ▪ ▪ Effective Fed Funds Rate (Quarter Average)

2018

First Busey Corporation | Ticker: BUSE

3Q18

4018

1Q19

2019

3Q19

2022 Q4

0.44%

0.28%

0.32%

4Q19

1020

3020

2020

4Q20

1Q21

2Q21

2023 Q1

0.78%

0.49%

0.60%

3Q21

4Q21

1Q22

2022

93

"

"

All IB Non-Maturity --All Non-Time Deposits

81

M

3Q22

-

.

.

233

127

92

2023 Q2

1.27%

0.81%

1.09%

4Q22

1Q23

2Q23

Cumulative Deposit Betas 2 for Tightening Cycle-to-Date

Retail

Commercial

Public

IB Non-

Maturity

All IB

Deposits

Total

Deposits

2%

-2%

2022 Q2

-5%

-1%

+6%

-1%

+2%

-2%

-1%

IB Non-Maturity

5%

3%

2022 Q3

-1%

+2%

+14%

+5%

+3%

2%

+2%

All IB Deposits

10% 10%

2022 Q4

+1%

+7%

+27%

+10%

+10%

6%

+6%

16%

Total Deposits

17%

2023 Q1

+6%

+12%

+33%

+16%

+17%

12%

+12%

Quarterly effective fed funds per FRED, Federal Reserve Bank of St. Louis. Average during quarter, not seasonally adjusted | 2 Deposit betas are calculated based on an average fed funds target rate of 0.92% during 2Q22,

2.35% (3Q22), 3.82% (4Q22), 4.69% (1Q23), and 5.16% (2Q23).

24%

29%

2023 Q2

+16%

+18%

+46%

+24%

20%

+29%

+20%

15

ТВView entire presentation