Barclays Capital 2010 Global Financial Services Conference

Funding & liquidity - good progress towards targets RBS

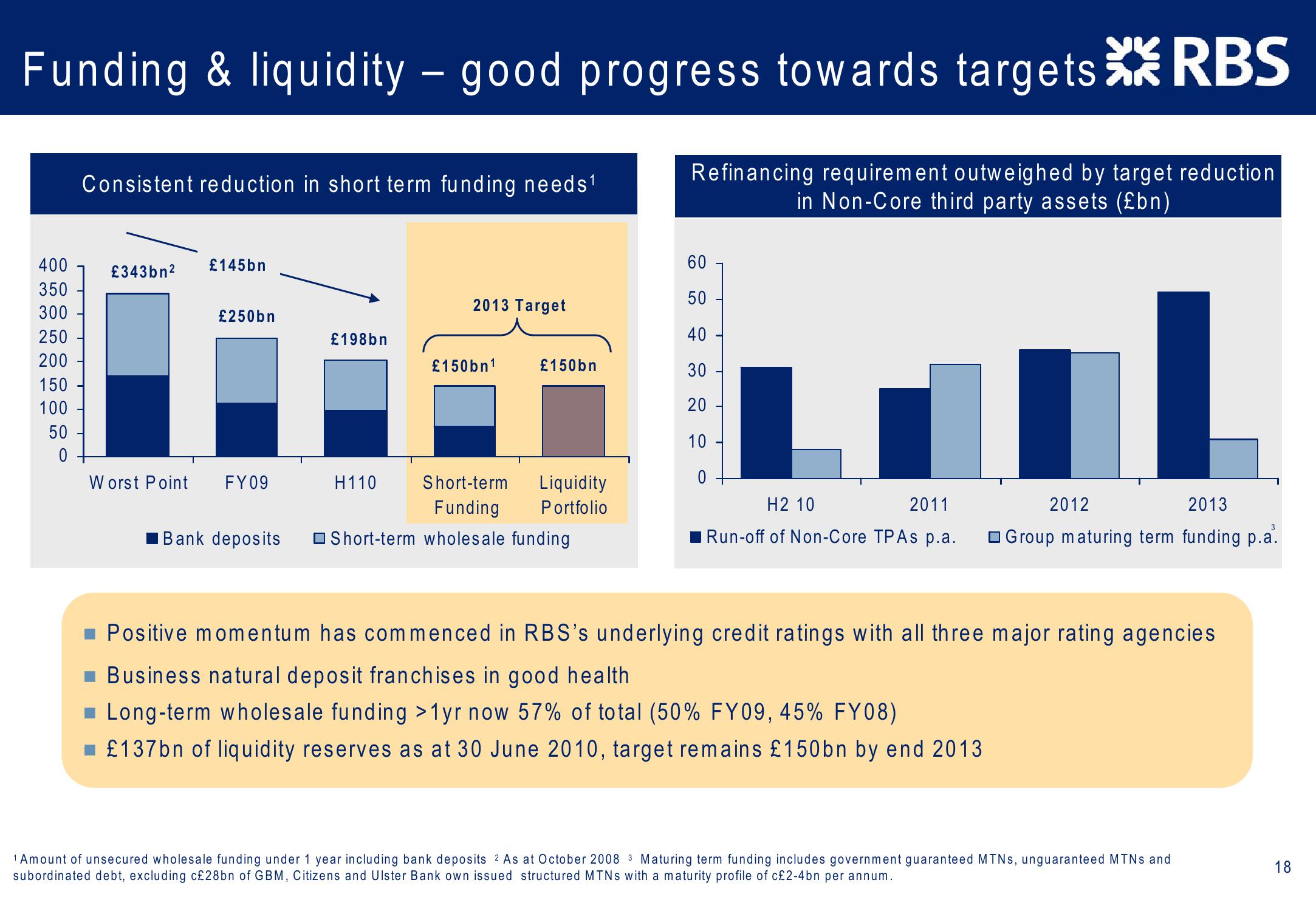

Consistent reduction in short term funding needs¹

Refinancing requirement outweighed by target reduction

in Non-Core third party assets (£bn)

400

£343bn²

£145bn

60

350

2013 Target

90

50

300

£250bn

250

40

£198bn

200

£150bn¹

£150bn

30

150

100

20

50

10

0

Worst Point FY09

H110

Short-term Liquidity

Funding Portfolio

H2 10

2011

2012

2013

3

Bank deposits Short-term wholesale funding

Run-off of Non-Core TPAs p.a.

Group maturing term funding p.a.

Positive momentum has commenced in RBS's underlying credit ratings with all three major rating agencies.

■Business natural deposit franchises in good health

■Long-term wholesale funding >1yr now 57% of total (50% FY09, 45% FY08)

£137bn of liquidity reserves as at 30 June 2010, target remains £150bn by end 2013

1 Amount of unsecured wholesale funding under 1 year including bank deposits 2 As at October 2008 3 Maturing term funding includes government guaranteed MTNs, unguaranteed MTNs and

subordinated debt, excluding c£28bn of GBM, Citizens and Ulster Bank own issued structured MTNS with a maturity profile of c£2-4bn per annum.

18View entire presentation