Strategically Positioning Truist Insurance Holdings for Long-Term Success

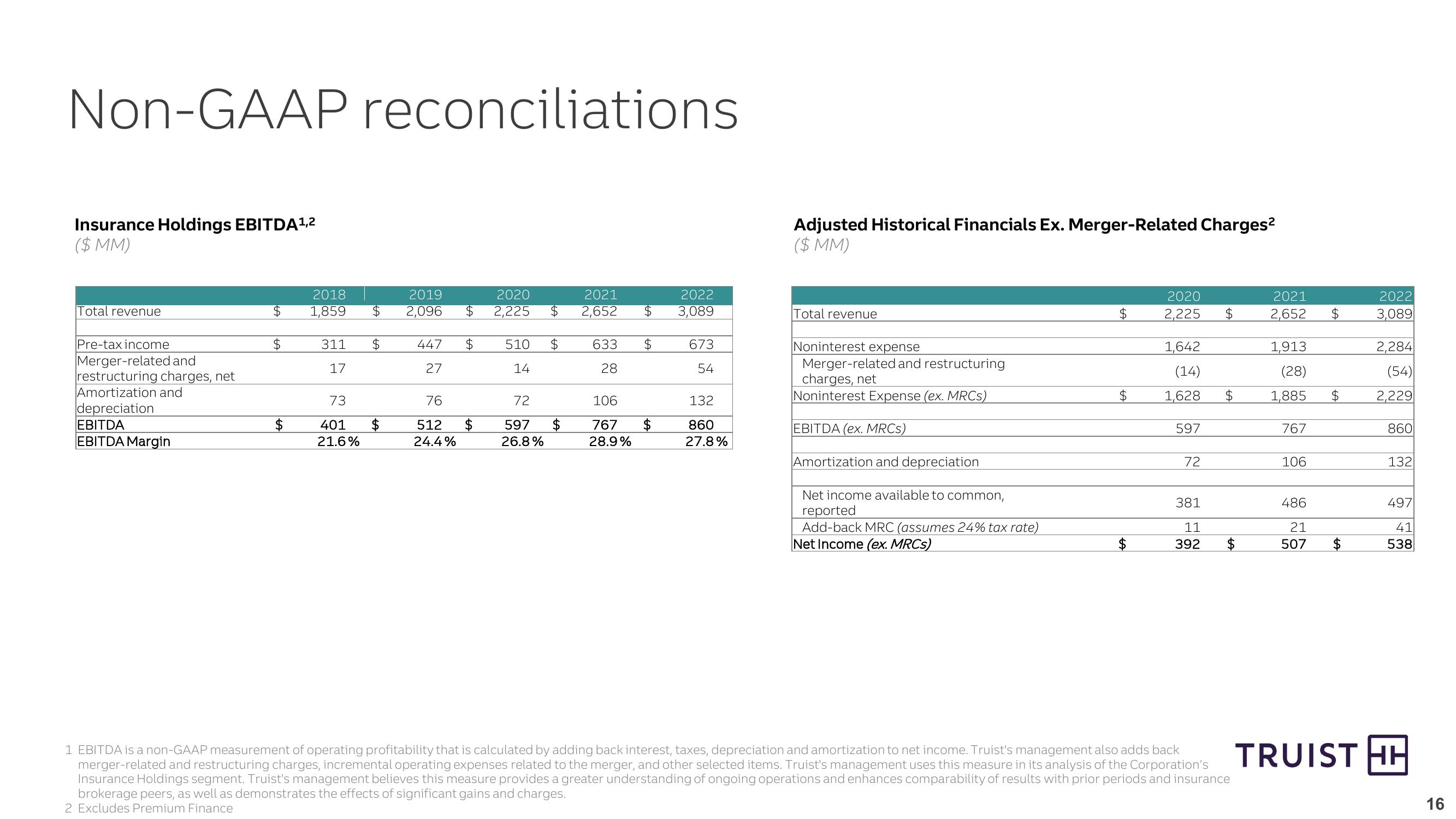

Non-GAAP reconciliations

Insurance Holdings EBITDA 1,2

($ MM)

Adjusted Historical Financials Ex. Merger-Related Charges²

($ MM)

Total revenue

$

SA

2018

1,859

2019

2020

2021

2022

$

2,096 $

A

2,225 $ 2,652

$

3,089

Total revenue

$

2020

2,225 $

2021

2022

2,652 $

3,089

Pre-tax income

$

311

$

447

$

510 $

633

$

673

Noninterest expense

Merger-related and

17

27

14

28

54

restructuring charges, net

Merger-related and restructuring

charges, net

1,642

(14)

1,913

2,284

(28)

(54)

Amortization and

73

76

72

106

132

Noninterest Expense (ex. MRCs)

$

1,628

$

$

1,885

2,229

depreciation

EBITDA

EBITDA Margin

401

21.6%

$

512

24.4%

$

597

26.8%

$

767

28.9%

$

860

EBITDA (ex. MRCS)

597

767

860

27.8%

Amortization and depreciation

72

106

132

Net income available to common,

reported

Add-back MRC (assumes 24% tax rate)

Net Income (ex. MRCs)

381

486

497

11

+A

$

392

$

21

507

41

538

1 EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation and amortization to net income. Truist's management also adds back

merger-related and restructuring charges, incremental operating expenses related to the merger, and other selected items. Truist's management uses this measure in its analysis of the Corporation's

Insurance Holdings segment. Truist's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods and insurance

brokerage peers, as well as demonstrates the effects of significant gains and charges.

2 Excludes Premium Finance

TRUIST HH

16View entire presentation