Bausch+Lomb IPO Presentation Deck

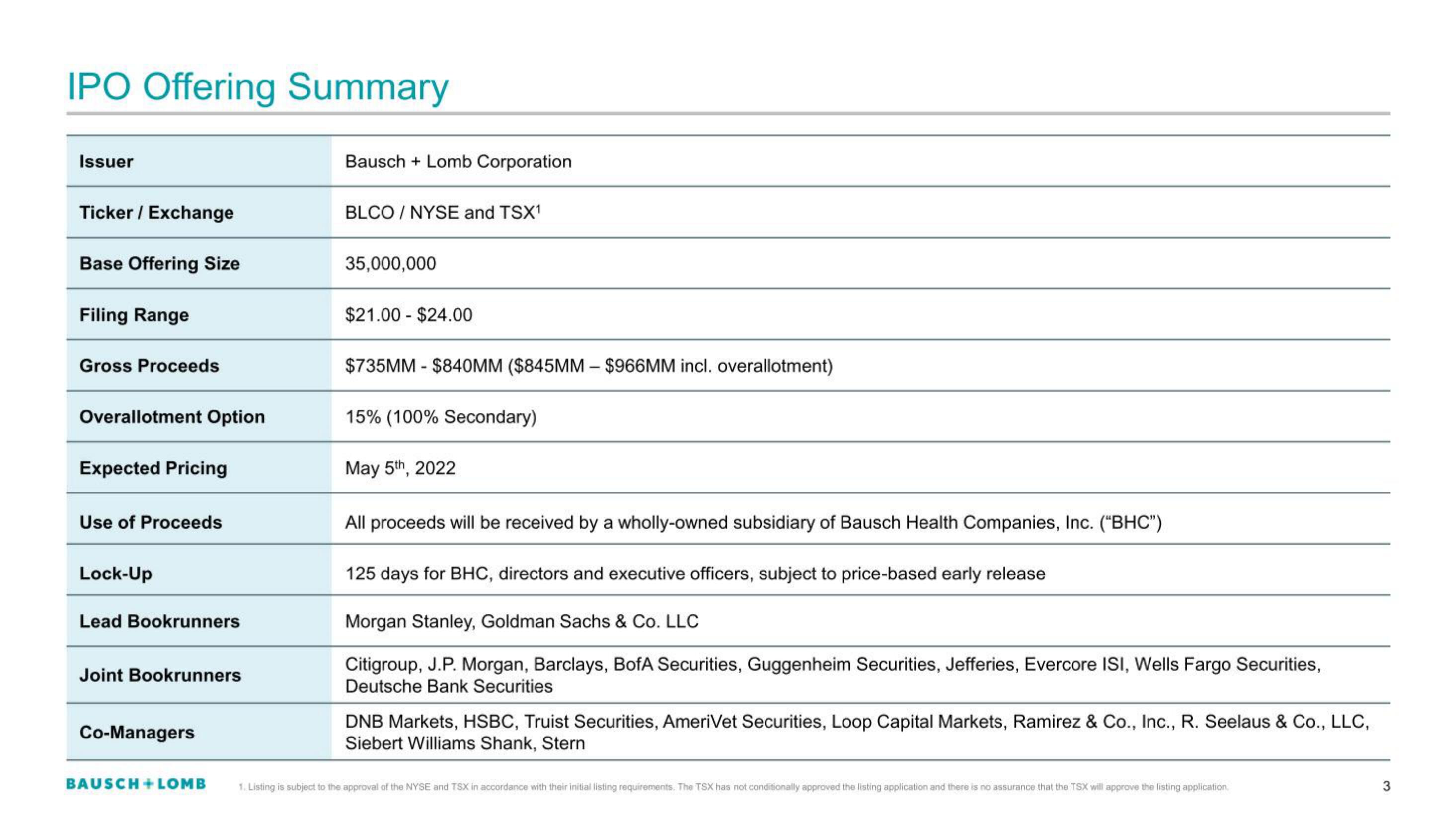

IPO Offering Summary

Issuer

Ticker / Exchange

Base Offering Size

Filing Range

Gross Proceeds

Overallotment Option

Expected Pricing

Use of Proceeds

Lock-Up

Lead Bookrunners

Joint Bookrunners

Co-Managers

BAUSCH + LOMB

Bausch + Lomb Corporation

BLCO/NYSE and TSX¹

35,000,000

$21.00 $24.00

$735MM - $840MM ($845MM - $966MM incl. overallotment)

15% (100% Secondary)

May 5th, 2022

All proceeds will be received by a wholly-owned subsidiary of Bausch Health Companies, Inc. ("BHC")

125 days for BHC, directors and executive officers, subject to price-based early release

Morgan Stanley, Goldman Sachs & Co. LLC

Citigroup, J.P. Morgan, Barclays, BofA Securities, Guggenheim Securities, Jefferies, Evercore ISI, Wells Fargo Securities,

Deutsche Bank Securities

DNB Markets, HSBC, Truist Securities, AmeriVet Securities, Loop Capital Markets, Ramirez & Co., Inc., R. Seelaus & Co., LLC,

Siebert Williams Shank, Stern

1. Listing is subject to the approval of the NYSE and TSX in accordance with their initial listing requirements. The TSX has not conditionally approved the listing application and there is no assurance that the TSX will approve the listing application,

3View entire presentation