First Busey Results Presentation Deck

1.

2.

4Q23 Earnings Investor Presentation

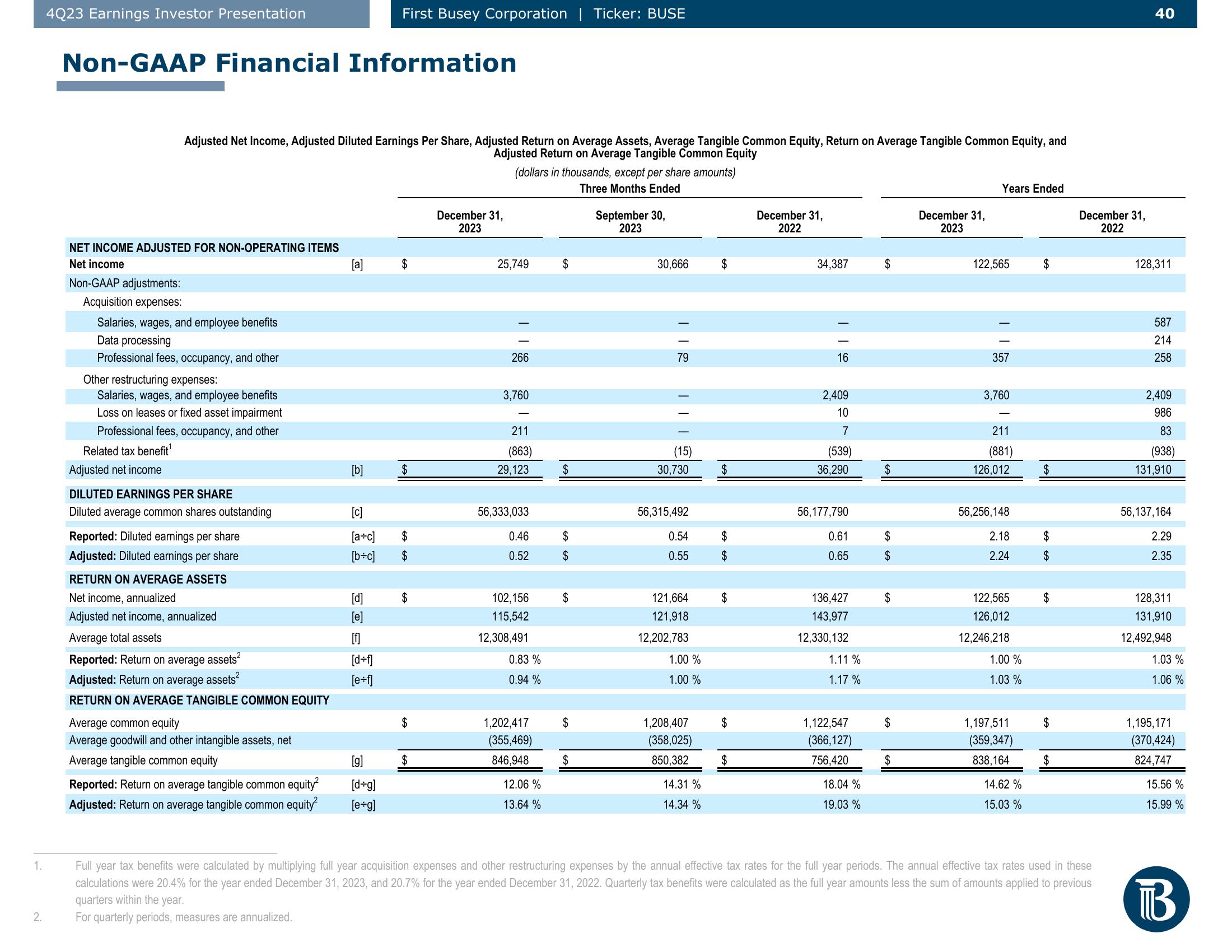

Non-GAAP Financial Information

Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted Return on Average Assets, Average Tangible Common Equity, Return on Average Tangible Common Equity, and

Adjusted Return on Average Tangible Common Equity

NET INCOME ADJUSTED FOR NON-OPERATING ITEMS

Net income

Non-GAAP adjustments:

Acquisition expenses:

Salaries, wages, and employee benefits

Data processing

Professional fees, occupancy, and other

Other restructuring expenses:

Salaries, wages, and employee benefits

Loss on leases or fixed asset impairment

Professional fees, occupancy, and other

Related tax benefit¹

Adjusted net income

DILUTED EARNINGS PER SHARE

Diluted average common shares outstanding

Reported: Diluted earnings per share

Adjusted: Diluted earnings per share

RETURN ON AVERAGE ASSETS

Net income, annualized

Adjusted net income, annualized

Average total assets

Reported: Return on average assets²

Adjusted: Return on average assets

RETURN ON AVERAGE TANGIBLE COMMON EQUITY

Average common equity

Average goodwill and other intangible assets, net

Average tangible common equity

Reported: Return on average tangible common equity²

Adjusted: Return on average tangible common equity²

[a]

[b]

[c]

[a+c]

[b+c]

First Busey Corporation | Ticker: BUSE

[d]

[e]

[f]

[d+f]

[e+f]

[g]

[d+g]

[e+g]

$

$

GA GA

$

$

$

$

$

December 31,

2023

(dollars in thousands, except per share amounts)

Three Months Ended

25,749

266

3,760

211

(863)

29,123

56,333,033

0.46

0.52

102,156

115,542

12,308,491

0.83%

0.94%

1,202,417

(355,469)

846,948

12.06%

13.64%

$

$

$

$

$

$

$

September 30,

2023

30,666

79

(15)

30,730

56,315,492

0.54

0.55

121,664

121,918

12,202,783

1.00 %

1.00%

1,208,407

(358,025)

850,382

14.31%

14.34 %

$

$

LA GA

$

$

$

$

December 31,

2022

34,387

||

16

2,409

10

7

(539)

36,290

56,177,790

0.61

0.65

136,427

143,977

12,330,132

1.11%

1.17%

1,122,547

(366,127)

756,420

18.04%

19.03 %

$

$

$

$

$

$

$

December 31,

2023

Years Ended

122,565

357

3,760

211

(881)

126,012

56,256,148

2.18

2.24

122,565

126,012

12,246,218

1.00%

1.03 %

1,197,511

(359,347)

838,164

14.62 %

15.03 %

$

$

LA L

$

$

$

$

$

December 31,

2022

40

128,311

587

214

258

2,409

986

83

(938)

131,910

56,137,164

2.29

2.35

128,311

131,910

12,492,948

1.03 %

1.06 %

1,195,171

(370,424)

824,747

15.56 %

15.99 %

Full year tax benefits were calculated by multiplying full year acquisition expenses and other restructuring expenses by the annual effective tax rates for the full year periods. The annual effective tax rates used in these

calculations were 20.4% for the year ended December 31, 2023, and 20.7% for the year ended December 31, 2022. Quarterly tax benefits were calculated as the full year amounts less the sum of amounts applied to previous

quarters within the year.

B

For quarterly periods, measures are annualized.View entire presentation