Melrose Results Presentation Deck

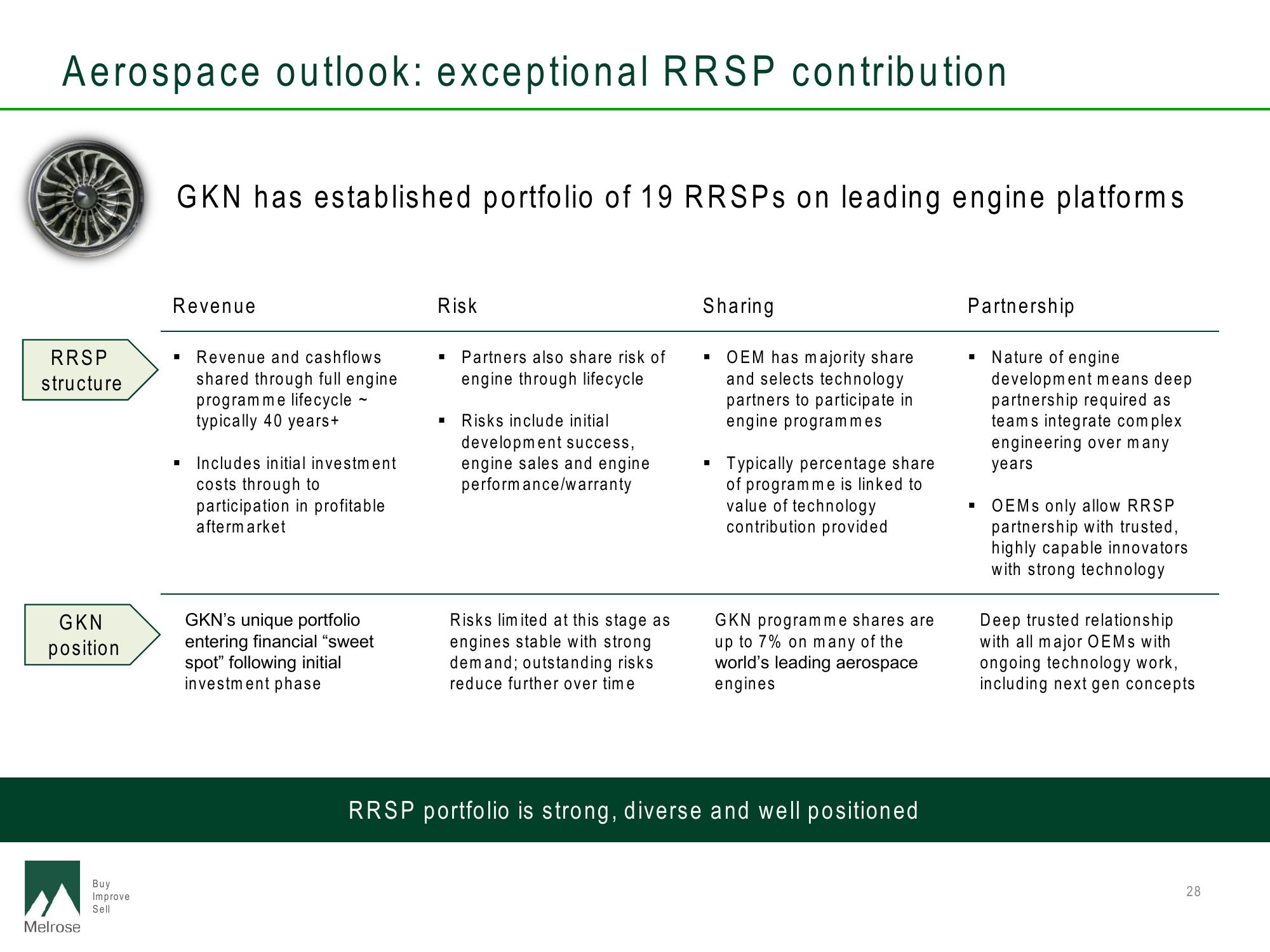

Aerospace outlook: exceptional RRSP contribution

RRSP

structure

GKN

position

Melrose

Buy

Improve

Sell

GKN has established portfolio of 19 RRSPs on leading engine platforms.

Revenue

■ Revenue and cashflows

shared through full engine

programme life cycle ~

typically 40 years+

Includes initial investment

costs through to

participation in profitable

aftermarket

GKN's unique portfolio

entering financial "sweet

spot" following initial

investment phase

Risk

Partners also share risk of

engine through lifecycle

Risks include initial

development success,

engine sales and engine

performance/warranty

Risks limited at this stage as

engines stable with strong

demand; outstanding risks

reduce further over time

Sharing

I

OEM has majority share

and selects technology

partners to participate in

engine programmes

Typically percentage share

of programme is linked to

value of technology

contribution provided

GKN program me shares are

up to 7% on many of the

world's leading aerospace

engines

RRSP portfolio is strong, diverse and well positioned

Partnership

I Nature of engine

development means deep

partnership required as

teams integrate complex

engineering over many

years

■

OEMs only allow RRSP

partnership with trusted,

highly capable innovators

with strong technology

Deep trusted relationship

with all major OEMs with

ongoing technology work,

including next gen concepts

28View entire presentation