Aptiv Overview

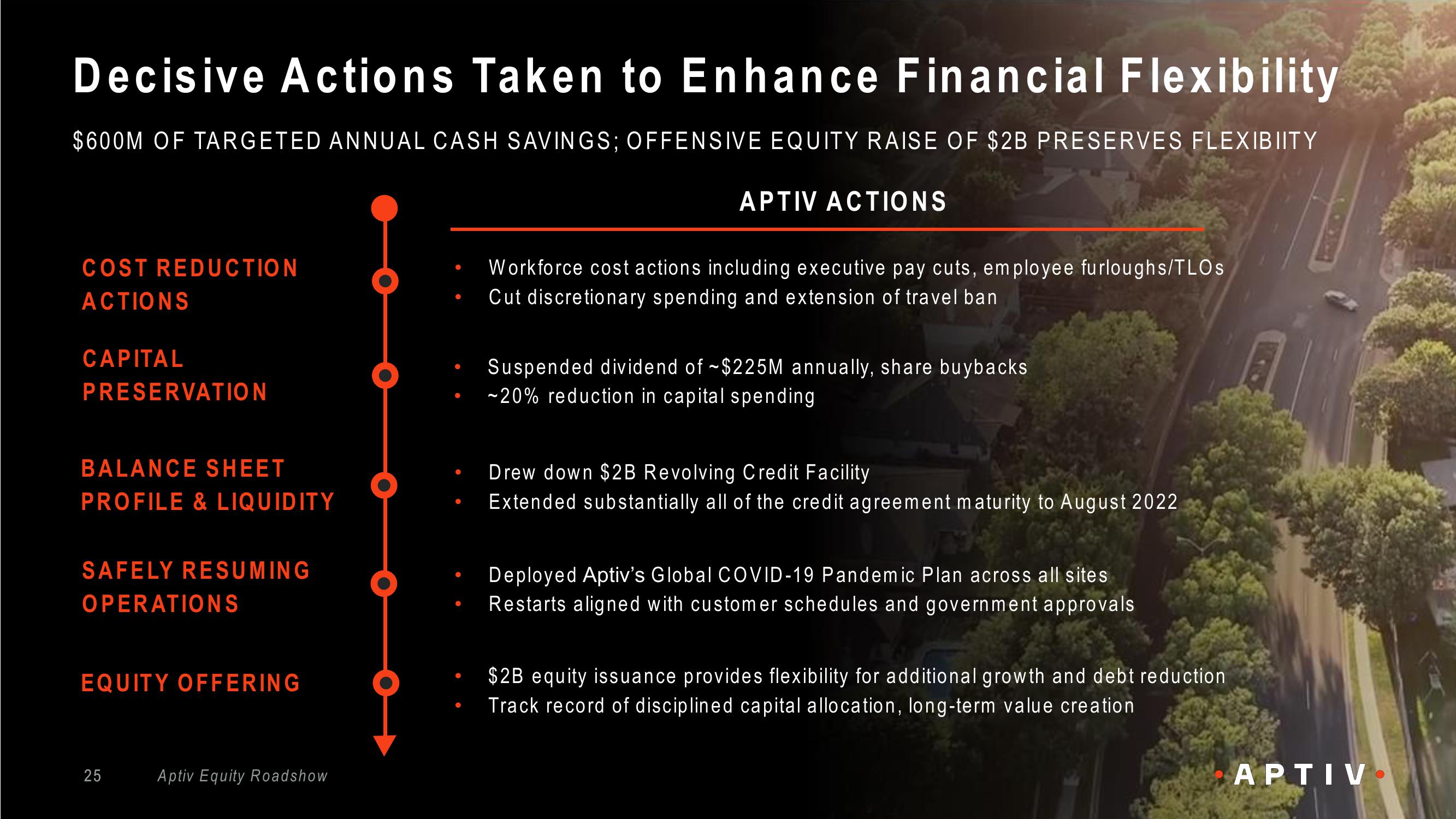

Decisive Actions Taken to Enhance Financial Flexibility

$600M OF TARGETED ANNUAL CASH SAVINGS; OFFENSIVE EQUITY RAISE OF $2B PRESERVES FLEXIBIITY

COST REDUCTION

ACTIONS

CAPITAL

PRESERVATION

BALANCE SHEET

PROFILE & LIQUIDITY

SAFELY RESUMING

OPERATIONS

EQUITY OFFERING

25

Aptiv Equity Roadshow

APTIV ACTIONS

Workforce cost actions including executive pay cuts, employee furloughs/TLOs

Cut discretionary spending and extension of travel ban

Suspended dividend of ~$225M annually, share buybacks

-20% reduction in capital spending

Drew down $2B Revolving Credit Facility

Extended substantially all of the credit agreement maturity to August 2022

Deployed Aptiv's Global COVID-19 Pandemic Plan across all sites

Restarts aligned with customer schedules and government approvals

$2B equity issuance provides flexibility for additional growth and debt reduction

Track record of disciplined capital allocation, long-term value creation.

APTIV.View entire presentation