Deutsche Bank Fixed Income Presentation Deck

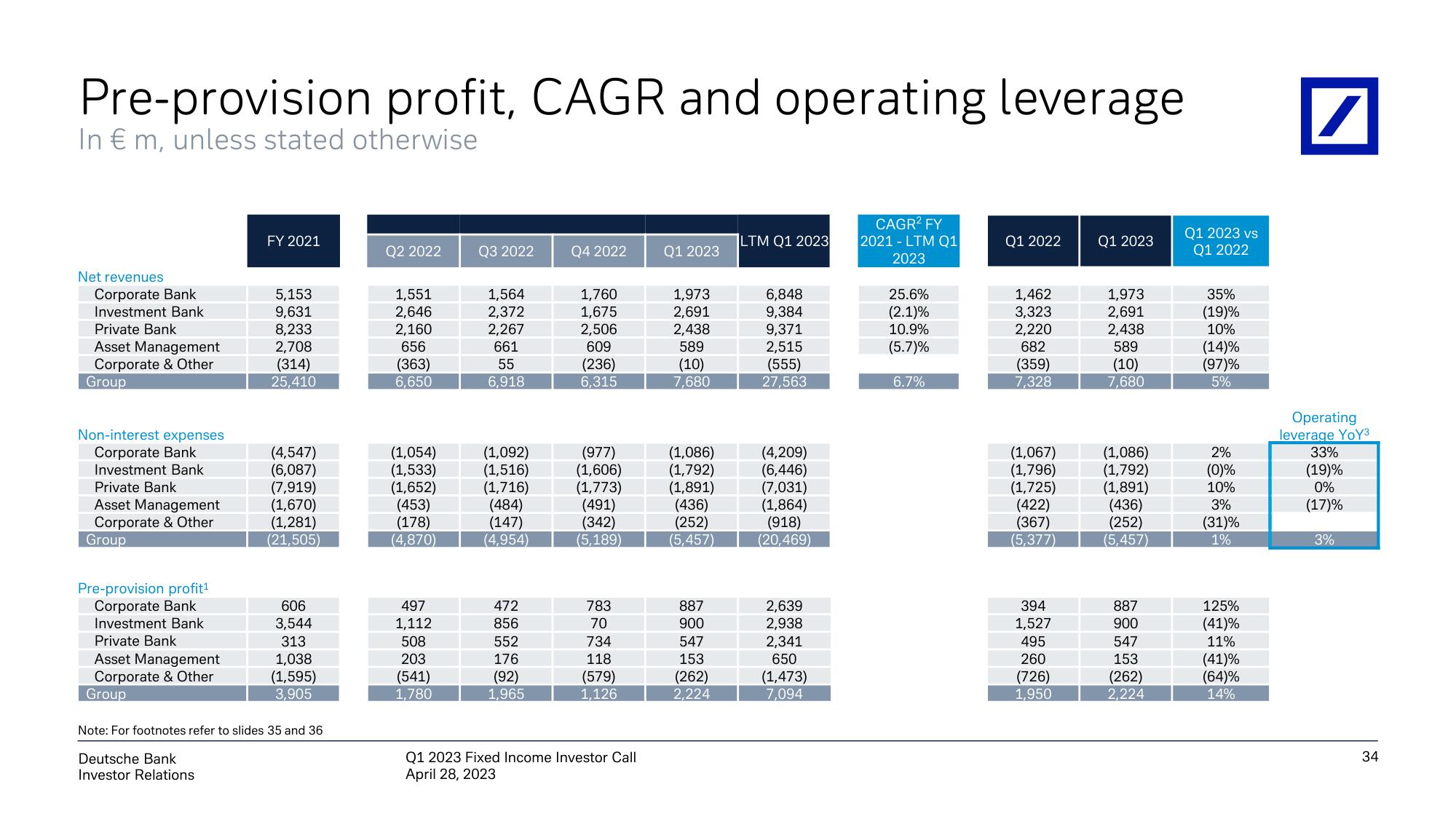

Pre-provision profit, CAGR and operating leverage

In € m, unless stated otherwise

Net revenues

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

Group

Non-interest expenses

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

Group

Pre-provision profit¹

Corporate Bank

Investment Bank

Private Bank

Asset Management

Corporate & Other

Group

FY 2021

5,153

9,631

8,233

2,708

(314)

25,410

(4,547)

(6,087)

(7,919)

(1,670)

(1,281)

(21,505)

606

3,544

313

1,038

(1,595)

3,905

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

Q2 2022

1,551

2,646

2,160

656

(363)

6,650

(1,054)

(1,533)

(1,652)

(453)

(178)

(4,870)

497

1,112

508

203

(541)

1,780

Q3 2022

1,564

2,372

2,267

661

55

6,918

(1,092)

(1,516)

(1,716)

(484)

(147)

(4,954)

472

856

552

176

(92)

1,965

Q4 2022

1,760

1,675

2,506

609

(236)

6,315

(977)

(1,606)

(1,773)

(491)

(342)

(5,189)

783

70

734

118

(579)

1,126

Q1 2023 Fixed Income Investor Call

April 28, 2023

Q1 2023

1,973

2,691

2,438

589

(10)

7,680

(1,086)

(1,792)

(1,891)

(436)

(252)

(5,457)

887

900

547

153

(262)

2,224

LTM Q1 2023

6,848

9,384

9,371

2,515

(555)

27,563

(4,209)

(6,446)

(7,031)

(1,864)

(918)

(20,469)

2,639

2,938

2,341

650

(1,473)

7,094

CAGR² FY

2021-LTM Q1

2023

25.6%

(2.1)%

10.9%

(5.7)%

6.7%

Q1 2022

1,462

3,323

2,220

682

(359)

7,328

(1,067)

(1,796)

(1,725)

(422)

(367)

(5,377)

394

1,527

495

260

(726)

1,950

Q1 2023

1,973

2,691

2,438

589

(10)

7,680

(1,086)

(1,792)

(1,891)

(436)

(252)

(5,457)

887

900

547

153

(262)

2,224

Q1 2023 vs

Q1 2022

35%

(19)%

10%

(14)%

(97)%

5%

2%

(0)%

10%

3%

(31)%

1%

125%

(41)%

11%

(41)%

(64)%

14%

/

Operating

leverage YoY³

33%

(19)%

0%

(17)%

3%

34View entire presentation